Hello everyone! I hope you enjoy my very first analysis published on TradingView Indonesia!

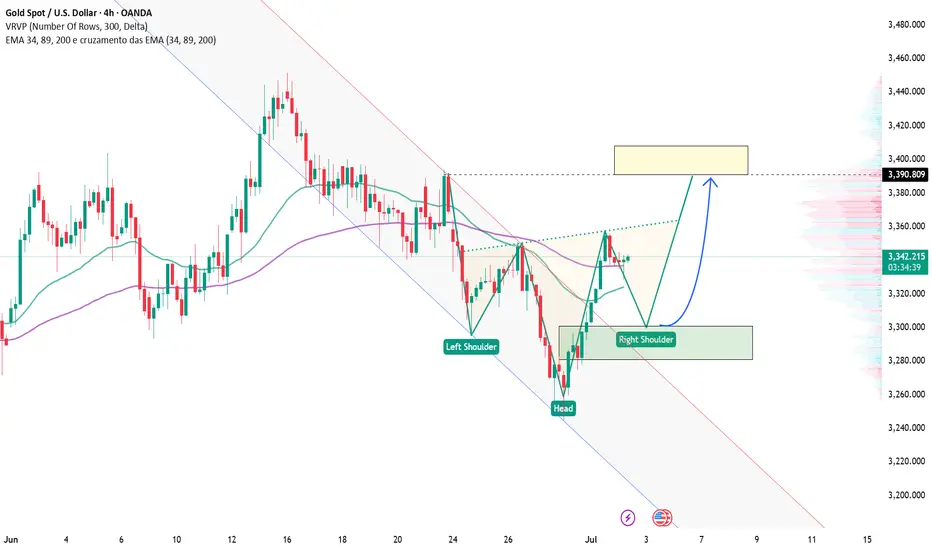

After a convincing breakout from the descending channel, gold is now firmly holding its ground around the $3,280 support zone – considered a strategic anchor for the ongoing short-term bullish trend. Notably, an Inverse Head and Shoulders pattern is clearly forming on the H4 chart, reinforcing expectations that $3,390 could be the next key level the market aims to conquer.

On the news front, gold is receiving support from both a weakening U.S. dollar and declining U.S. Treasury yields. Specifically, the latest U.S. ISM Manufacturing Index came in at 48.7 – below expectations – indicating a slowdown in industrial activity. Meanwhile, the yield on the 10-year Treasury note has dipped to 4.15%, prompting investors to turn to gold as a safer store of value during this volatile period.

All eyes are now on the upcoming U.S. labor market report at the end of the week, along with any signals from the Federal Reserve regarding a potential interest rate cut roadmap for Q3. If upcoming data continues to support a monetary easing narrative, gold may not only break through $3,390 but also head toward the next target at $3,420.

My personal strategy is to prioritize a “Buy on Dip” approach around the $3,280 level, especially if price action confirms a clear rebound from this support zone.

Are you ready for the next bullish wave?

After a convincing breakout from the descending channel, gold is now firmly holding its ground around the $3,280 support zone – considered a strategic anchor for the ongoing short-term bullish trend. Notably, an Inverse Head and Shoulders pattern is clearly forming on the H4 chart, reinforcing expectations that $3,390 could be the next key level the market aims to conquer.

On the news front, gold is receiving support from both a weakening U.S. dollar and declining U.S. Treasury yields. Specifically, the latest U.S. ISM Manufacturing Index came in at 48.7 – below expectations – indicating a slowdown in industrial activity. Meanwhile, the yield on the 10-year Treasury note has dipped to 4.15%, prompting investors to turn to gold as a safer store of value during this volatile period.

All eyes are now on the upcoming U.S. labor market report at the end of the week, along with any signals from the Federal Reserve regarding a potential interest rate cut roadmap for Q3. If upcoming data continues to support a monetary easing narrative, gold may not only break through $3,390 but also head toward the next target at $3,420.

My personal strategy is to prioritize a “Buy on Dip” approach around the $3,280 level, especially if price action confirms a clear rebound from this support zone.

Are you ready for the next bullish wave?

Trade active

✅ Get 7–10 high-quality trading signals daily (Forex, Gold, Bitcoin)

✅ Real-time updates – precise and timely alerts

✅ Perfect for both beginners and seasoned traders

👉 Click the link to join now: t.me/+xo3AwHaKIcZhZDg9

✅ Real-time updates – precise and timely alerts

✅ Perfect for both beginners and seasoned traders

👉 Click the link to join now: t.me/+xo3AwHaKIcZhZDg9

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅ Get 7–10 high-quality trading signals daily (Forex, Gold, Bitcoin)

✅ Real-time updates – precise and timely alerts

✅ Perfect for both beginners and seasoned traders

👉 Click the link to join now: t.me/+xo3AwHaKIcZhZDg9

✅ Real-time updates – precise and timely alerts

✅ Perfect for both beginners and seasoned traders

👉 Click the link to join now: t.me/+xo3AwHaKIcZhZDg9

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.