The Federal Reserve is likely to cut interest rates by 50 basis points in September

According to the CME's "Fed Watch" tool, the probability of the Fed keeping interest rates unchanged in September is 0, the probability of cutting interest rates by 25 basis points is 88.3%, and the probability of cutting interest rates by 50 basis points is 11.7% (the probability was 0 before the release of non-farm payrolls data).

Gold itself does not generate interest, but it does well in low- or high-uncertainty environments, making it a safe haven for investors’ money.

The outlook for gold is positive as the Federal Reserve’s independence is under threat following Trump’s attempt to fire Fed Governor Tim Cook, weakening the dollar and boosting investor appetite for the precious metal. Gold traders are focused on next week’s US Consumer Price Index (CPI) data. If inflation continues to decline, that would strengthen the case for a rate cut at the September 16-17 meeting.

![GOLD MARKET ANALYSIS AND COMMENTARY - [Sep 08 - Sep 12]](https://tradingview.sweetlogin.com/proxy-s3/p/P2GgsvtS_mid.png)

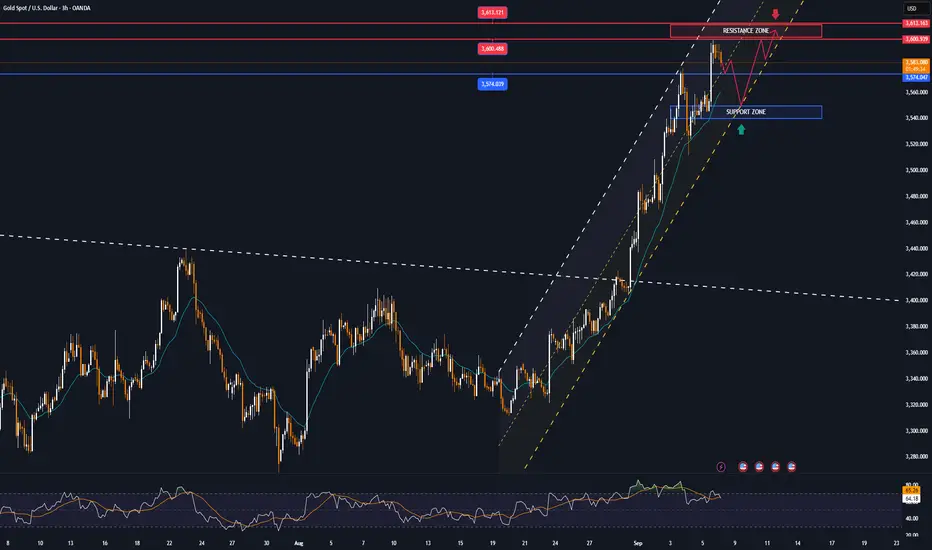

Technical Outlook Analysis

First, gold has achieved the $3,600 price target and a new all-time high.

Currently, the technical conditions and technical positions are all bullish, with a short-term directional bullish channel and major support from the EMA21. Meanwhile, the Relative Strength Index (RSI) has not provided any signals of a possible correction in momentum, even though it has been operating in the overbought zone (80 to 100) for some time.

In the short term, gold may retest the all-time high, then target around $3,613 in the short term, which is the price point of the 0.382% Fibonacci extension. And the nearest support is noted at $3,574, which is the price point of the 0.236% Fibonacci extension.

As long as gold remains above $3,550, it is not in a position to correct lower, and any dips due to profit-taking should be considered as a short-term move rather than a trend.

Finally, the overall trend of gold is bullish, and the notable points will also be listed as follows.

Support: $3,574 – $3,550

Resistance: $3,600 – $3,613

SELL XAUUSD PRICE 3607 - 3605⚡️

↠↠ Stop Loss 3611

→Take Profit 1 3599

↨

→Take Profit 2 3593

BUY XAUUSD PRICE 3548 - 3550⚡️

↠↠ Stop Loss 3544

→Take Profit 1 3556

↨

→Take Profit 2 3562

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.