On Monday (August 18), according to Reuters, US President Donald Trump told Ukrainian President Volodymyr Zelenskiy that the United States would support Ukraine's security in any deal to end Russia's war in Ukraine. However, Reuters said the level of support was still unclear.

XAUUSD reacted quite mildly as no real message of sufficient weight was released, and market sentiment remained very hesitant, currently spot gold is trading around $3,335/oz, equivalent to an increase of about $2 on the day.

XAUUSD reacted quite mildly as no real message of sufficient weight was released, and market sentiment remained very hesitant, currently spot gold is trading around $3,335/oz, equivalent to an increase of about $2 on the day.

Tracking the progress of the Ukraine ceasefire talks

Trump made the pledge at a special summit at the White House, where he hosted Zelenskiy and a group of European allies. The pledge came days after meeting with Russian President Vladimir Putin in Alaska.

The comments came months after Trump and Vice President J.D. Vance had a disastrous meeting in the Oval Office, in which he publicly criticized Ukrainian leader Volodymyr Zelensky.

However, Reuters notes that a peace deal appears far from certain. Just before the talks began, the Russian Foreign Ministry ruled out the possibility of deploying NATO troops to help broker a peace deal, further complicating Trump’s proposal.

Both Trump and Zelenskiy have said they hope Monday’s meeting will eventually lead to three-way talks with Putin.

The Kremlin has not publicly endorsed such talks, and it remains unclear whether Putin, whose forces are advancing into eastern Ukraine, is willing to sit down with Zelenskiy or make meaningful concessions.

Trump tweeted late Monday that he had called Putin and was beginning to arrange a meeting between Putin and Zelensky, followed by a three-way summit between the three presidents.

Meanwhile, European leaders have arrived in Washington to support Ukraine and urge Trump to get Putin to agree to a ceasefire before any talks can begin.

Trump had previously supported the proposal but reversed course after meeting with Putin on Friday, agreeing with Moscow’s stance that any peace deal must be comprehensive.

Speaking to reporters in the Oval Office on Monday, Trump said he liked the concept of a ceasefire, but the two sides could negotiate a peace deal while fighting continued.

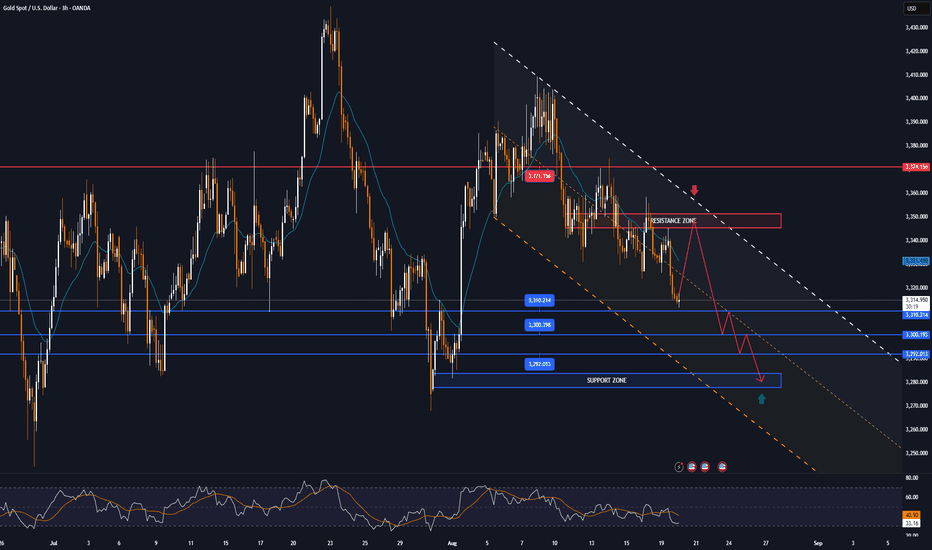

Technical Outlook Analysis XAUUSD

XAUUSD

On the daily chart, gold weakened after failing to break above the EMA21 line, which was the near resistance that readers noticed in the previous issue. Gold has also shown signs of a possible short-term decline, but the trend is still not really clear and solid.

Specifically, the Relative Strength Index has fallen below 50, but the slope is insignificant, indicating that the bearish momentum is not strong. This is followed by price action below the EMA21 but not far from this moving average, while still remaining above the psychologically important $3,300 price mark.

If gold does not sell below $3,300, it is likely to have clear conditions for a short-term downtrend, which is generally sideways.

The content of the Trump multilateral meeting, with Ukraine and Europe, will impact market sentiment, and the catalyst is strong enough to break the current structure and hesitation to create a technical trend in the short to medium term.

During the day, with the current position, the gold price still has a technical outlook of sideways accumulation and notable positions will be listed as follows.

Support: 3,310 - 3,300 - 3,292 USD

Resistance: 3,350 - 3,371 - 3,400 USD

SELL XAUUSD PRICE 3376 - 3374⚡️

↠↠ Stop Loss 3380

→Take Profit 1 3368

↨

→Take Profit 2 3362

BUY XAUUSD PRICE 3299 - 3301⚡️

↠↠ Stop Loss 3295

→Take Profit 1 3307

↨

→Take Profit 2 3313

Tracking the progress of the Ukraine ceasefire talks

Trump made the pledge at a special summit at the White House, where he hosted Zelenskiy and a group of European allies. The pledge came days after meeting with Russian President Vladimir Putin in Alaska.

The comments came months after Trump and Vice President J.D. Vance had a disastrous meeting in the Oval Office, in which he publicly criticized Ukrainian leader Volodymyr Zelensky.

However, Reuters notes that a peace deal appears far from certain. Just before the talks began, the Russian Foreign Ministry ruled out the possibility of deploying NATO troops to help broker a peace deal, further complicating Trump’s proposal.

Both Trump and Zelenskiy have said they hope Monday’s meeting will eventually lead to three-way talks with Putin.

The Kremlin has not publicly endorsed such talks, and it remains unclear whether Putin, whose forces are advancing into eastern Ukraine, is willing to sit down with Zelenskiy or make meaningful concessions.

Trump tweeted late Monday that he had called Putin and was beginning to arrange a meeting between Putin and Zelensky, followed by a three-way summit between the three presidents.

Meanwhile, European leaders have arrived in Washington to support Ukraine and urge Trump to get Putin to agree to a ceasefire before any talks can begin.

Trump had previously supported the proposal but reversed course after meeting with Putin on Friday, agreeing with Moscow’s stance that any peace deal must be comprehensive.

Speaking to reporters in the Oval Office on Monday, Trump said he liked the concept of a ceasefire, but the two sides could negotiate a peace deal while fighting continued.

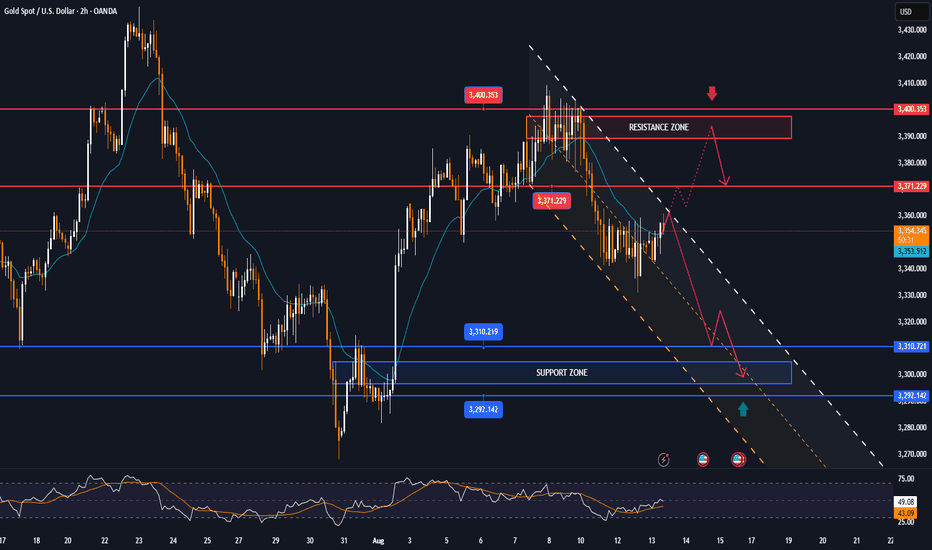

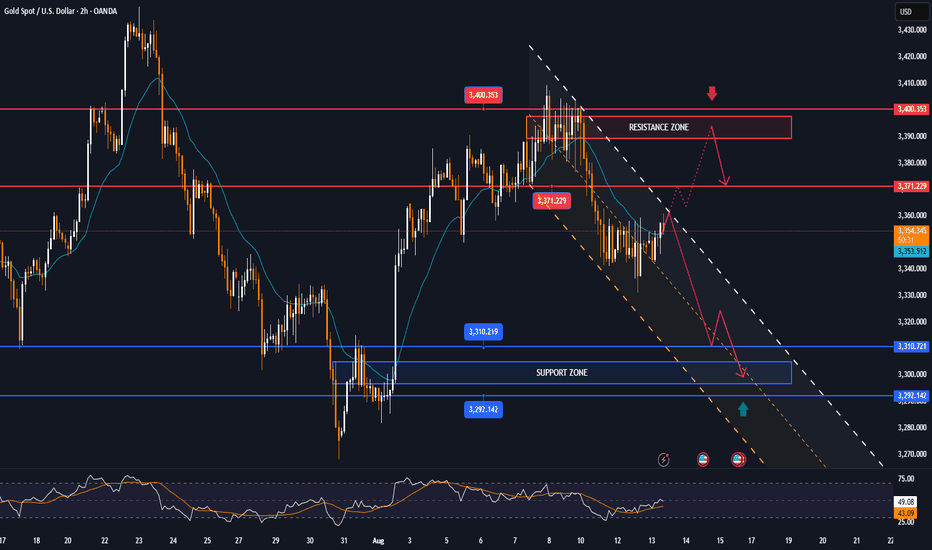

Technical Outlook Analysis

On the daily chart, gold weakened after failing to break above the EMA21 line, which was the near resistance that readers noticed in the previous issue. Gold has also shown signs of a possible short-term decline, but the trend is still not really clear and solid.

Specifically, the Relative Strength Index has fallen below 50, but the slope is insignificant, indicating that the bearish momentum is not strong. This is followed by price action below the EMA21 but not far from this moving average, while still remaining above the psychologically important $3,300 price mark.

If gold does not sell below $3,300, it is likely to have clear conditions for a short-term downtrend, which is generally sideways.

The content of the Trump multilateral meeting, with Ukraine and Europe, will impact market sentiment, and the catalyst is strong enough to break the current structure and hesitation to create a technical trend in the short to medium term.

During the day, with the current position, the gold price still has a technical outlook of sideways accumulation and notable positions will be listed as follows.

Support: 3,310 - 3,300 - 3,292 USD

Resistance: 3,350 - 3,371 - 3,400 USD

SELL XAUUSD PRICE 3376 - 3374⚡️

↠↠ Stop Loss 3380

→Take Profit 1 3368

↨

→Take Profit 2 3362

BUY XAUUSD PRICE 3299 - 3301⚡️

↠↠ Stop Loss 3295

→Take Profit 1 3307

↨

→Take Profit 2 3313

Note

Spot gold is hovering below 3340, with multiple candlesticks now appearing on the hourly chart.Note

Gold prices fell 0.5% to around $3,313/oz, close to the 100-day moving average support, due to a stronger USD and concerns that the Fed will maintain a "hawkish" stance.Note

The world's largest gold ETF, SPDR Gold Trust, fell 3.16 tonnes.Note

Gold prices on August 20 jumped nearly $40, reaching a high of $3,350 and closing at $3,348.20/oz after holding 100-day support, thanks to bottom-fishing buying and a weakening USD.Note

Gold prices edged lower as the dollar rose to a two-week high, as investors focused on Federal Reserve Chairman Powell's speech at the Jackson Hole conference.Note

The world's largest gold ETF, SPDR Gold Trust, kept its holdings unchanged.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.