Today (Friday), the US Bureau of Labor Statistics will release the highly anticipated non-farm payroll data for May. The market expects 130,000 new jobs and the unemployment rate to remain unchanged at 4.2%.

On Wednesday, the ADP jobs report, also known as the “mini-non-farm,” showed the smallest number of jobs created by the U.S. private sector in two years. The report could be a precursor to a negative non-farm payrolls report.

Payroll processor ADP reported on Wednesday that private sector payrolls increased by just 37,000 in May, down from a revised 60,000 in April and below the Dow Jones forecast of 110,000. It was the smallest monthly job gain since March 2023, according to ADP.

The U.S. Department of Labor reported on Thursday that initial jobless claims unexpectedly rose last week as concerns about the labor market mounted. The data showed initial jobless claims hit 247,000 in the week ended May 31, up 8,000 from the previous week and above the 236,000 expected in a Dow Jones survey.

If non-farm payrolls data released today is much worse than expected, it could weigh on the U.S. dollar and send gold prices soaring.

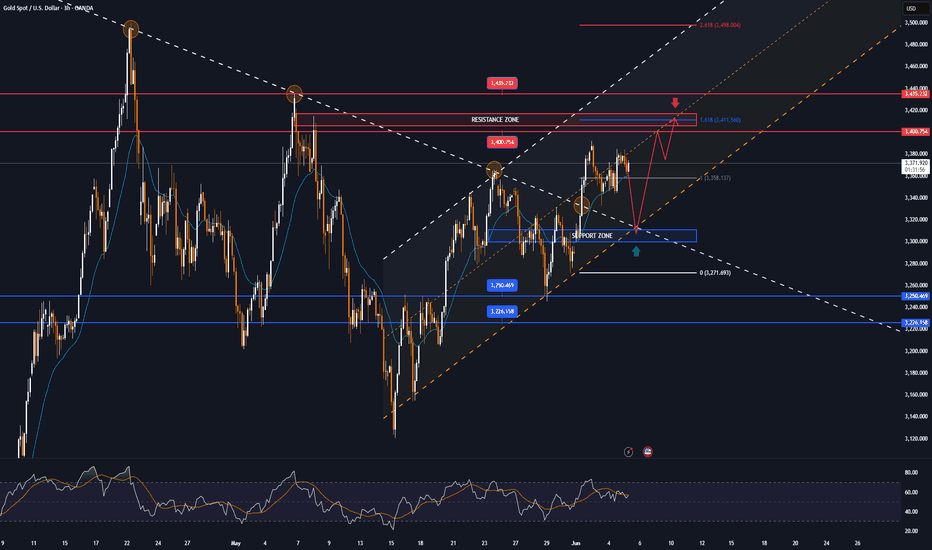

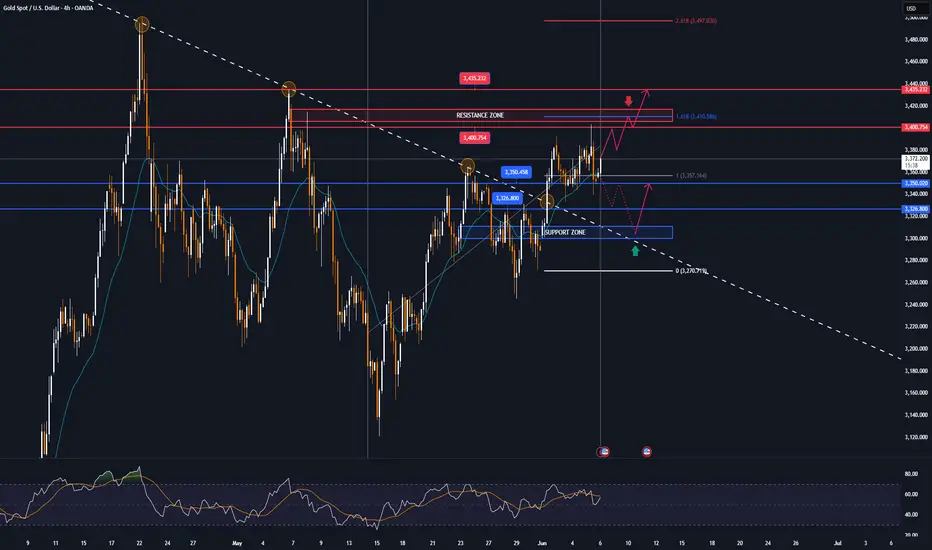

Technical Outlook Analysis

On the daily chart, after making a fresh weekly high and correcting lower yesterday, gold has recovered to reach its initial target at $3,371, the price point of the 0.236% Fibonacci retracement.

Following the uptrend, gold is likely to head towards the full price point of $3,400 in the short term, rather than $3,435.

Currently, the technical structure has not changed much with the uptrend completely dominating the technical chart. And the notable price points will also be listed as follows.

Support: 3,350 – 3,326 – 3,300USD

Resistance: 3,400 – 3,435USD

SELL XAUUSD PRICE 3412 - 3410⚡️

↠↠ Stop Loss 3416

→Take Profit 1 3404

↨

→Take Profit 2 3398

BUY XAUUSD PRICE 3301 - 3303⚡️

↠↠ Stop Loss 3297

→Take Profit 1 3309

↨

→Take Profit 2 3315

Note

🔴Spot gold prices fell below $3,300/ounce, down 0.35% on the day.Note

▫️Spot gold price reached 3330 USD/ounce, up 0.22% on the day.Note

On June 12, spot gold prices in Asia rose to a weekly high of $3,373.25 an ounce. The increase was supported by lower-than-expected US CPI data in May.Note

Next week is shaping up to be a rollercoaster for markets, with interest rate announcements from central banks, monetary policy updates, and a slew of central bank governors speaking throughout the week.Note

▫️Spot gold erased intraday gains, with the latest quote at $3,435/ounce.Note

Faced with concerns about the developments of the war between Iran and Israel, this morning, the price of gold increased sharply, surpassing 3430 to establish a secondary peak. Immediately after that, the price of gold began to reverse and decrease to around 3410.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

![GOLD MARKET ANALYSIS AND COMMENTARY - [Jun 09 - Jun 13]](https://tradingview.sweetlogin.com/proxy-s3/j/JGVeDZl3_mid.png)