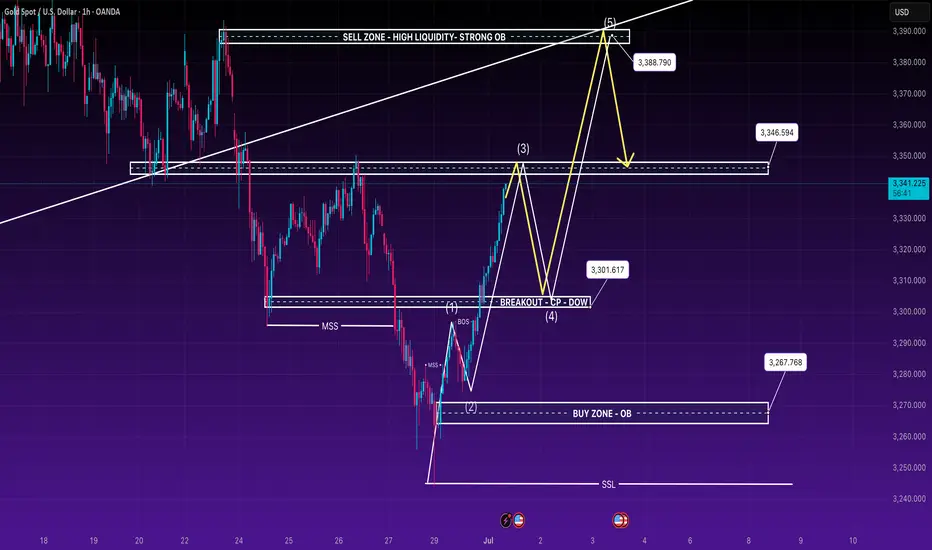

🔹 Macro Structure:

Gold has successfully broken structure (BOS) after forming a bullish shift in market structure (MSS) around the 326x – 327x zone.

Current price action is respecting internal bullish order flow, with higher highs and higher lows being maintained.

Breakout above 3300 psychological level + recent BOS confirms bullish intent.

🔹 Liquidity Map:

Buy-side liquidity is still resting above 3350 and into the strong OB at 3388, where a potential sell-side reaction could occur.

Sell-side liquidity below 3267 has not been swept recently, meaning deeper retracements may still occur after internal liquidity is cleared.

🔹 Expectation:

Current wave is likely in impulse phase (Wave 3 → Wave 5) aiming for 3388 OB.

A retracement into the discount zone (3301 – 3303 OB) is ideal for a continuation trade.

Watch for bearish signs near 3388 – this zone aligns with high liquidity, strong OB, and trendline confluence.

🔵 BUY SETUP (Retracement entry – continuation)

Buy Zone: 3301 – 3303 OB

Entry Trigger: Bullish engulfing / FVG fill

Stop Loss: Below 3297 (below recent swing low)

Targets: 3306 – 3310 – 3315 – 3320 – 3330 – 3346 – 3388

🔴 SELL SETUP (Reversal entry – premium zone)

Sell Zone: 3348 – 3350 (mitigation area)

Entry Trigger: CHoCH + bearish rejection wick

Stop Loss: Above 3354

Targets: 3344 – 3340 – 3335 – 3325 – 3310 – 3300

✅ Alternative Entry (Low sweep)

Buy Limit: 3270 – 3267 (deep OB + SSL zone)

SL: 3262

TP: 3280 – 3290 – 3300 – 3315+

⏳ Wait for price to confirm intention via structure + liquidity reaction before entering trades.

🧠 SMC traders: focus on manipulation zones, OBs, and internal BOS for precision entries.

Gold has successfully broken structure (BOS) after forming a bullish shift in market structure (MSS) around the 326x – 327x zone.

Current price action is respecting internal bullish order flow, with higher highs and higher lows being maintained.

Breakout above 3300 psychological level + recent BOS confirms bullish intent.

🔹 Liquidity Map:

Buy-side liquidity is still resting above 3350 and into the strong OB at 3388, where a potential sell-side reaction could occur.

Sell-side liquidity below 3267 has not been swept recently, meaning deeper retracements may still occur after internal liquidity is cleared.

🔹 Expectation:

Current wave is likely in impulse phase (Wave 3 → Wave 5) aiming for 3388 OB.

A retracement into the discount zone (3301 – 3303 OB) is ideal for a continuation trade.

Watch for bearish signs near 3388 – this zone aligns with high liquidity, strong OB, and trendline confluence.

🔵 BUY SETUP (Retracement entry – continuation)

Buy Zone: 3301 – 3303 OB

Entry Trigger: Bullish engulfing / FVG fill

Stop Loss: Below 3297 (below recent swing low)

Targets: 3306 – 3310 – 3315 – 3320 – 3330 – 3346 – 3388

🔴 SELL SETUP (Reversal entry – premium zone)

Sell Zone: 3348 – 3350 (mitigation area)

Entry Trigger: CHoCH + bearish rejection wick

Stop Loss: Above 3354

Targets: 3344 – 3340 – 3335 – 3325 – 3310 – 3300

✅ Alternative Entry (Low sweep)

Buy Limit: 3270 – 3267 (deep OB + SSL zone)

SL: 3262

TP: 3280 – 3290 – 3300 – 3315+

⏳ Wait for price to confirm intention via structure + liquidity reaction before entering trades.

🧠 SMC traders: focus on manipulation zones, OBs, and internal BOS for precision entries.

Note

🟣 Why Elise Re-Entered a SELL at 3356 and Took 120 Pips

1️⃣ Macro Reason – USD Strengthens Slightly After JOLTS & ISM Data

Despite softer expectations, the US JOLTS Job Openings came in stronger than forecast (7.77M vs 7.32M), indicating a still-resilient labour market. Meanwhile, the ISM Manufacturing PMI rebounded to 49.0, reflecting a potential bottoming in manufacturing sentiment.

This provided mild support to the USD, triggering a short-term reversal in XAUUSD after a strong bullish impulse.

As a result, gold struggled to sustain above the 3355–3360 zone and showed signs of exhaustion.

2️⃣ Technical Reason #1 – Liquidity Grab + Weak High Rejection

On the H1 chart:

Price engineered liquidity above previous highs (3355–3360).

A clear reaction from the Weak High zone confirms it was a liquidity sweep rather than a breakout.

This setup aligns with a "Buy to Sell" Smart Money Concept, where price grabs liquidity before reversing into premium short zones.

3️⃣ Technical Reason #2 – Entry Confirmation at Small Block Reaction Zone

After liquidity was taken, price returned to a small block reaction zone below the trendline.

The structure break and retest (CHoCH + BOS) confirm a bearish shift in order flow.

Elise re-entered confidently at 3356, with TP based on the liquidity void towards 323x, capturing 120+ pips.

✅ Summary

This was a textbook SMC + fundamental alignment setup:

USD slightly strengthened after US data

Gold hit a clear liquidity grab zone

Confirmed rejection + block reaction provided high-RR re-entry for the short

🔱 Trade with Smart Money – ICT Concepts & Price Action

🔱 Latest Daily Plan – Updated with 4–6 Free Gold Signals Daily

Join now: t.me/+BT9z8lt4yJ01OGVl

🔱 Latest Daily Plan – Updated with 4–6 Free Gold Signals Daily

Join now: t.me/+BT9z8lt4yJ01OGVl

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔱 Trade with Smart Money – ICT Concepts & Price Action

🔱 Latest Daily Plan – Updated with 4–6 Free Gold Signals Daily

Join now: t.me/+BT9z8lt4yJ01OGVl

🔱 Latest Daily Plan – Updated with 4–6 Free Gold Signals Daily

Join now: t.me/+BT9z8lt4yJ01OGVl

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.