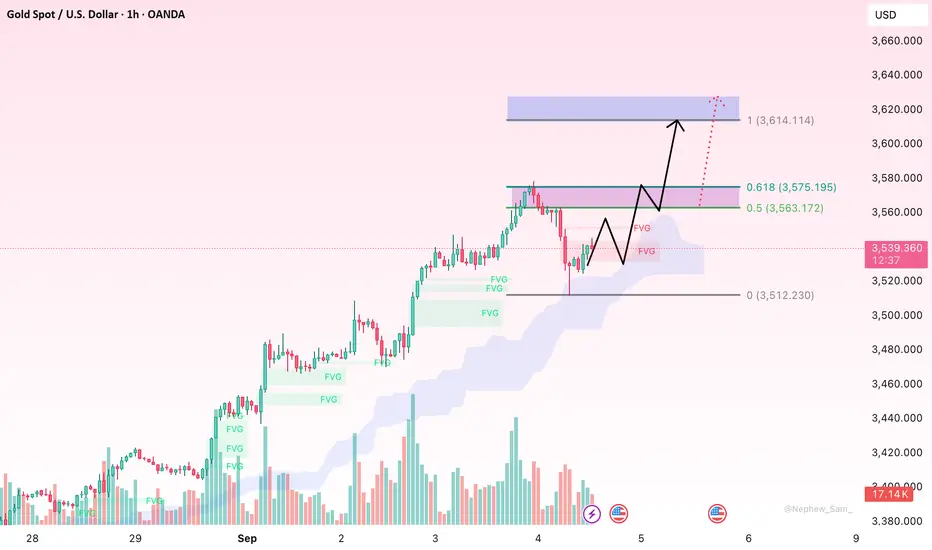

Hello everyone, last week gold staged a strong rally, consistently building new steps upward, gaining around 50–60 USD from the 3,520 zone. On the H1 chart, the structure remains very clean: price is holding above the upward-sloping Ichimoku cloud, with layered FVG blocks beneath – clear signs that buying flow is still maintaining momentum. The recent dip only tested the edge of the cloud before bouncing back, leaving the trend intact.

The immediate key lies in the 3,563–3,575 cluster (a confluence of the 0.5–0.618 Fib and recent highs). A decisive H1 close above this area could open the path to 3,595–3,600, and further to 3,610–3,620. On the downside, nearby supports sit at 3,538–3,532, followed by 3,520–3,525. Structure would only turn weaker if price closes below 3,512 – in which case risks shift towards a broader consolidation phase.

In short, I still favour the scenario of a shallow pullback before continuation, as long as price holds above the cloud and the FVG floors.

What do you think – will 3,563–3,575 have the strength to unlock 3,600+? Feel free to share your view.

The immediate key lies in the 3,563–3,575 cluster (a confluence of the 0.5–0.618 Fib and recent highs). A decisive H1 close above this area could open the path to 3,595–3,600, and further to 3,610–3,620. On the downside, nearby supports sit at 3,538–3,532, followed by 3,520–3,525. Structure would only turn weaker if price closes below 3,512 – in which case risks shift towards a broader consolidation phase.

In short, I still favour the scenario of a shallow pullback before continuation, as long as price holds above the cloud and the FVG floors.

What do you think – will 3,563–3,575 have the strength to unlock 3,600+? Feel free to share your view.

Trade active

Trade like you mean it – because every second matters.

📊 Instant insights.

📬 Precision signals.

👨🏫 Real coaching. Real results.

👉🏻Join here: t.me/+jBAj1Jdf4vY1NzM1

📊 Instant insights.

📬 Precision signals.

👨🏫 Real coaching. Real results.

👉🏻Join here: t.me/+jBAj1Jdf4vY1NzM1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Trade like you mean it – because every second matters.

📊 Instant insights.

📬 Precision signals.

👨🏫 Real coaching. Real results.

👉🏻Join here: t.me/+jBAj1Jdf4vY1NzM1

📊 Instant insights.

📬 Precision signals.

👨🏫 Real coaching. Real results.

👉🏻Join here: t.me/+jBAj1Jdf4vY1NzM1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.