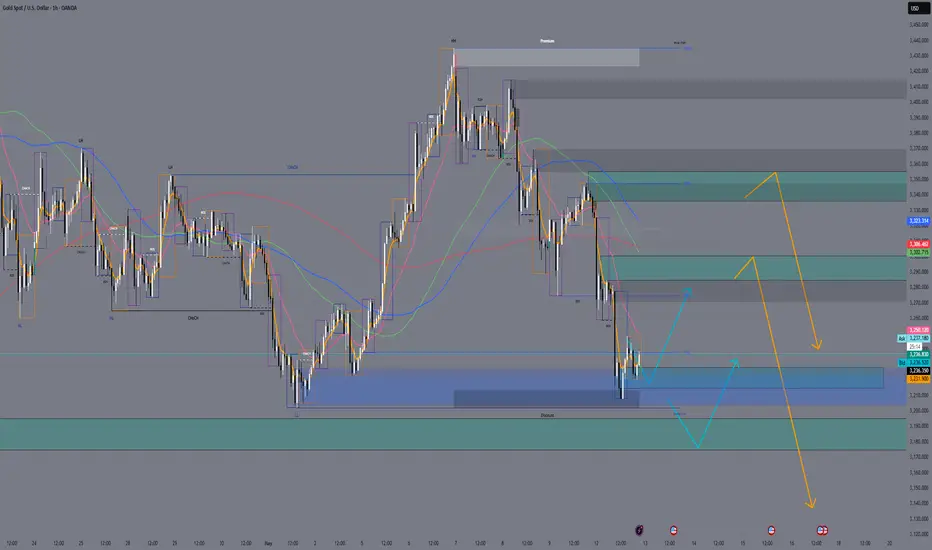

🔹 Bias: Intraday bullish (HL forming)

🔹 Context: Price is reacting from the 3215–3228 zone (OB + discount) after confirming CHoCH at 3284.

We’re in a retracement phase — next move could target 3240–3280 if structure holds.

🔵 BUY ZONES (reaction areas, not sniper):

3215–3228

✅ Confirmed H4 OB

✅ Discount zone + EMA200 confluence on H1

✅ HL structure still valid

📌 If price retests with bullish confirmation → long toward 3240+ remains valid

3175–3195

🔵 Strong H4 demand zone

📌 Only if 3215 fails — last area to defend the bullish bias

Wait for structure to hold — don’t panic buy into weakness

🔴 SELL ZONES (broad reaction areas):

3285–3300

🔺 Previous high + unfilled FVG

🔺 Potential inducement zone before rejection

📌 If price rallies fast, watch for rejection — solid area for short pullbacks

3340–3355

🔺 Strong H4/D1 supply

🔺 Untested premium OB

📌 Only valid if price breaks above 3300 — aggressive short if NY overextends

🧠 Summary:

We’re in a bullish retracement.

If 3215 holds → price may push toward 3280+.

If that fails → 3175–3195 is the final defense zone before larger structure shifts.

Sell zones are reactive — wait for signals, don’t jump in early.

💬 Stay calm, stay patient. Don’t trade the zones — trade the reaction.

🔔 Final Thoughts for Tuesday

The levels are marked. The structure is clear.

Now it’s up to you to stay calm and let price do the talking.

We don’t chase moves — we let the market knock on our zones.

📍 Whether you're buying from discount or selling from premium — let logic lead, not FOMO.

And remember: structure doesn’t lie... but your emotions might.

💬 Got questions? Drop them — this is a team effort.

Let’s stay sharp, focused, and prepared.

See you on the charts,

— GoldFxMinds 🧠⚔️

🔹 Context: Price is reacting from the 3215–3228 zone (OB + discount) after confirming CHoCH at 3284.

We’re in a retracement phase — next move could target 3240–3280 if structure holds.

🔵 BUY ZONES (reaction areas, not sniper):

3215–3228

✅ Confirmed H4 OB

✅ Discount zone + EMA200 confluence on H1

✅ HL structure still valid

📌 If price retests with bullish confirmation → long toward 3240+ remains valid

3175–3195

🔵 Strong H4 demand zone

📌 Only if 3215 fails — last area to defend the bullish bias

Wait for structure to hold — don’t panic buy into weakness

🔴 SELL ZONES (broad reaction areas):

3285–3300

🔺 Previous high + unfilled FVG

🔺 Potential inducement zone before rejection

📌 If price rallies fast, watch for rejection — solid area for short pullbacks

3340–3355

🔺 Strong H4/D1 supply

🔺 Untested premium OB

📌 Only valid if price breaks above 3300 — aggressive short if NY overextends

🧠 Summary:

We’re in a bullish retracement.

If 3215 holds → price may push toward 3280+.

If that fails → 3175–3195 is the final defense zone before larger structure shifts.

Sell zones are reactive — wait for signals, don’t jump in early.

💬 Stay calm, stay patient. Don’t trade the zones — trade the reaction.

🔔 Final Thoughts for Tuesday

The levels are marked. The structure is clear.

Now it’s up to you to stay calm and let price do the talking.

We don’t chase moves — we let the market knock on our zones.

📍 Whether you're buying from discount or selling from premium — let logic lead, not FOMO.

And remember: structure doesn’t lie... but your emotions might.

💬 Got questions? Drop them — this is a team effort.

Let’s stay sharp, focused, and prepared.

See you on the charts,

— GoldFxMinds 🧠⚔️

Trade active

🟡 GOLD (XAUUSD) – NY Session Market Update – May 13, 2025🔹 Bias: Bullish retracement holding

🔹 Current Price: ~3247

🔹 Session: New York active – post-CPI digestion in progress

🧠 Context:

Price bounced perfectly from 3215–3228, aligning with:

🔸 H4 Order Block (OB)

🔸 EMA200 (H4) confluence

🔸 Discount zone reaction

This confirms bullish retracement flow is still valid, with a higher low forming.

🔵 Valid BUY ZONES:

1. 3215–3228 ✅

→ Held perfectly during CPI drop + EMA200 confluence on H4

→ Confirmed HL (higher low) and solid reaction.

📌 If we revisit this zone with bullish M5–M15 confirmation → reentry is valid.

2. 3175–3195

→ Still valid as deep H4 demand zone

→ Use only if the 3215 zone fails. This is the final defense for bullish structure.

🔴 SELL ZONES (broad reactive zones):

1. 3285–3300

→ Previous H1-H4 structure high

→ Potential inducement area + low-volume gap

📌 Watch for price stalling or rejecting aggressively here, especially if news impact fades.

2. 3340–3355

→ Premium untested OB on H4/D1

→ Only valid if price extends above 3300

📌 Reactive sell only if NY session breaks aggressively toward premium.

📈 Technical Confluence Recap:

EMA200 H4 = perfect bounce at 3225

FVGs above still act as magnets (3260 / 3285)

Structure: HL forming – as long as 3215 holds, the bullish leg remains active

Liquidity: Buy-side above 3285–3300 → may be swept before reversal

🔁 What to Expect Next:

📌 Bullish scenario:

→ If price holds 3230–3240 zone → short-term targets: 3265 → 3285

→ Momentum may continue toward premium sell zones only if flow remains clean.

📌 Bearish scenario:

→ If price breaks back below 3215 → expect retest of 3175–3195

→ Breaking below this = structure shift toward bearish control.

🧠 Summary:

✅ 3215–3228 held beautifully – EMA200 H4 + OB = sniper combo

⚠️ Don’t rush into new trades — premium zones above are reactive

🧨 NY might still trigger fakeouts or liquidity sweeps — wait for PA confirmation

⚔️ Final Thoughts:

Let the zones work. Let the market come to us.

We saw the reaction, we mapped it, we didn’t chase it — and that’s exactly how sniper trading should look.

Structure doesn’t lie. Your FOMO does.

💬 Questions? Drop them below.

Stay sharp. Stay ready. Let’s hunt smarter, not harder.

— GoldFxMinds

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD ⭐

Telegram: t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD ⭐

Telegram: t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD ⭐

Telegram: t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD ⭐

Telegram: t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.