Gold defends 50-day SMA ahead of US PPI inflation data

Gold price attempts a tepid bounce early Wednesday as focus shifts to trade updates and US PPI data. The US Dollar retreats alongside Treasury bond yields even as risk-off flows persist. Gold price needs to crack the 50-day SMA support at $3,323; daily RSI reclaims midline.

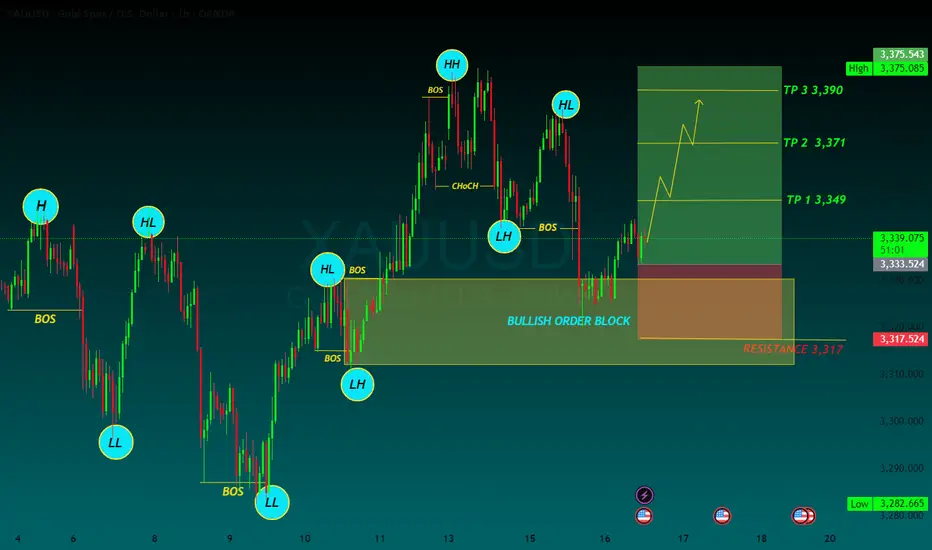

As observed on the daily chart, Gold price is stuck between two key barriers, with the 21-day Simple Moving Average (SMA) support-turned-resistance at $3,335 checking the upside.

On the other hand, the 50-day SMA at $3,323 cushions the downside.

The 14-day Relative Strength Index (RSI) is sitting just above the midline, currently near 50.50, suggesting that buyers could retain control.

Acceptance above the 21-day SMA is critical to sustaining the renewed upside, above which the 23.6% Fibonacci Retracement (Fibo) level of the April record rally at $3377 will be put to the test once again.

Further north, the $3,400 round level will challenge bearish commitments.

In contrast, rejection at the 21-day SMA could attack the 50-day SMA support.

Sellers must find a strong foothold below the 50-day SMA on daily closing basis.

The next healthy support levels are located at the 38.2% Fibo level of the same rally at $3,297 and the July low of $3,283.

TP 1 3,349

TP 2 3,371

TP 3 3,390

RESISTANCE 3,317

Gold price attempts a tepid bounce early Wednesday as focus shifts to trade updates and US PPI data. The US Dollar retreats alongside Treasury bond yields even as risk-off flows persist. Gold price needs to crack the 50-day SMA support at $3,323; daily RSI reclaims midline.

As observed on the daily chart, Gold price is stuck between two key barriers, with the 21-day Simple Moving Average (SMA) support-turned-resistance at $3,335 checking the upside.

On the other hand, the 50-day SMA at $3,323 cushions the downside.

The 14-day Relative Strength Index (RSI) is sitting just above the midline, currently near 50.50, suggesting that buyers could retain control.

Acceptance above the 21-day SMA is critical to sustaining the renewed upside, above which the 23.6% Fibonacci Retracement (Fibo) level of the April record rally at $3377 will be put to the test once again.

Further north, the $3,400 round level will challenge bearish commitments.

In contrast, rejection at the 21-day SMA could attack the 50-day SMA support.

Sellers must find a strong foothold below the 50-day SMA on daily closing basis.

The next healthy support levels are located at the 38.2% Fibo level of the same rally at $3,297 and the July low of $3,283.

TP 1 3,349

TP 2 3,371

TP 3 3,390

RESISTANCE 3,317

Gold free signale

t.me/GoldsignalMark804

My Channel link

t.me/GoldsignalMark804

Check my performance

t.me/GoldsignalMark804

My Channel link

t.me/GoldsignalMark804

Check my performance

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Gold free signale

t.me/GoldsignalMark804

My Channel link

t.me/GoldsignalMark804

Check my performance

t.me/GoldsignalMark804

My Channel link

t.me/GoldsignalMark804

Check my performance

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.