Gold Holds Above $3340 as Dollar Drops and Fed Uncertainty Rises

GOLD OVERVIEW

Gold Holds Gains as Dollar Weakens and Fed Uncertainty Grows

Gold climbed above $3,340 per ounce on Thursday, supported by a sharp decline in the U.S. dollar amid growing dovish expectations from the Federal Reserve.

Adding to market speculation, U.S. President Donald Trump hinted he may announce a new Fed Chair as early as September or October, potentially reducing Jerome Powell’s influence before his term ends in June and boosting expectations for a more accommodative policy stance.

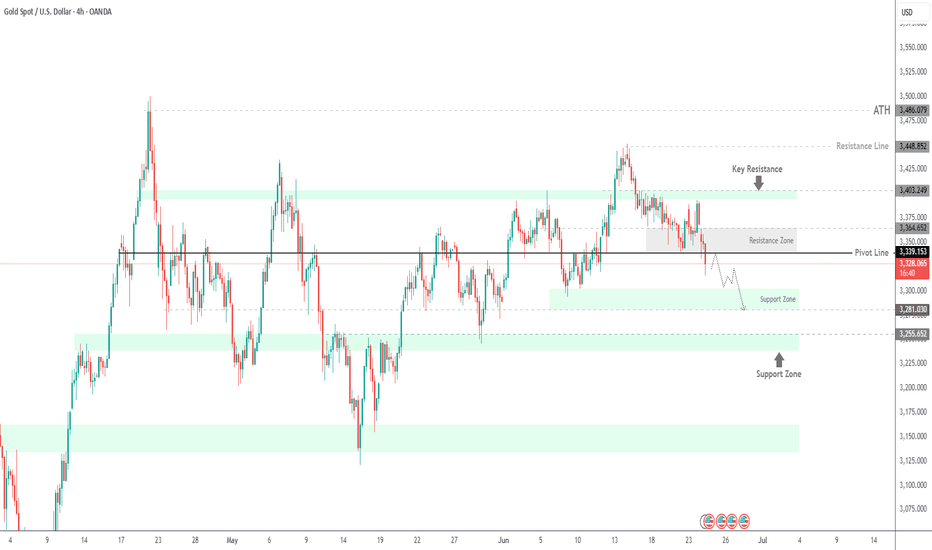

TECHNICAL OUTLOOK – XAU/USD

Gold shows bearish potential if the price can stabilize below the pivot level at 3,341.

However, while trading above 3,341, a short-term correction toward 3,364–3,365 is likely before any renewed selling pressure.

Today’s U.S. GDP release may add further volatility and direction to the market.

Key Levels

Pivot Line: 3,341

Resistance: 3,364 → 3,373

Support: 3,320 → 3,302

previous idea:

Gold Holds Gains as Dollar Weakens and Fed Uncertainty Grows

Gold climbed above $3,340 per ounce on Thursday, supported by a sharp decline in the U.S. dollar amid growing dovish expectations from the Federal Reserve.

Adding to market speculation, U.S. President Donald Trump hinted he may announce a new Fed Chair as early as September or October, potentially reducing Jerome Powell’s influence before his term ends in June and boosting expectations for a more accommodative policy stance.

TECHNICAL OUTLOOK – XAU/USD

Gold shows bearish potential if the price can stabilize below the pivot level at 3,341.

However, while trading above 3,341, a short-term correction toward 3,364–3,365 is likely before any renewed selling pressure.

Today’s U.S. GDP release may add further volatility and direction to the market.

Key Levels

Pivot Line: 3,341

Resistance: 3,364 → 3,373

Support: 3,320 → 3,302

previous idea:

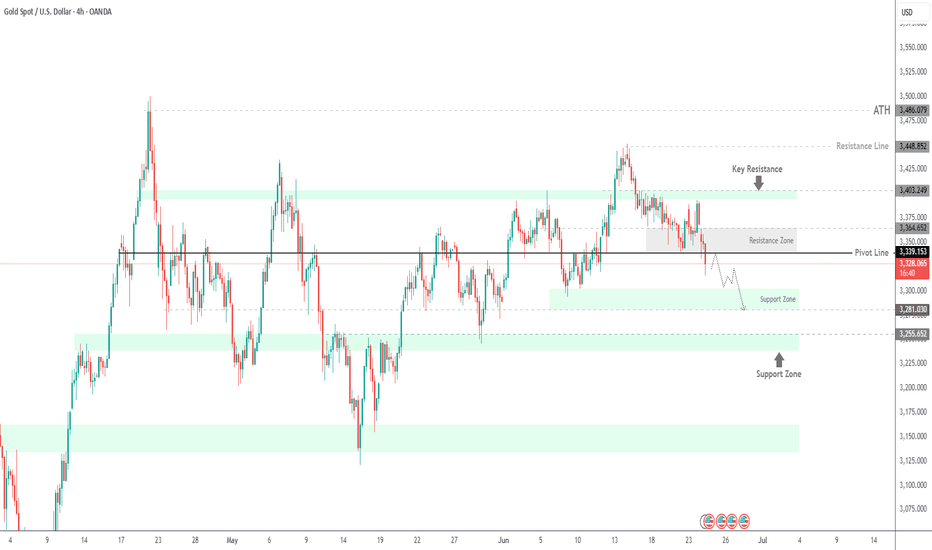

Trade active

GOLD | UPDATEGold has dropped approximately $70 and continues to show strong bearish momentum, with price action targeting 3255.

As long as it remains below the pivot level at 3281.

A 1H candle close below 3281 will confirm continuation toward 3255 and 3239

A 1H close above 3282 may lead to short-term consolidation between 3282 and 3302

Key Levels

Pivot: 3281

Resistance: 3302 → 3320

Support: 3255 → 3239

Technical analyst focused on gold, indices, and forex.

Providing regular updates with structure, entry/exit clarity, and real-time outlooks.

More at: sroshmayi.com/

Providing regular updates with structure, entry/exit clarity, and real-time outlooks.

More at: sroshmayi.com/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Technical analyst focused on gold, indices, and forex.

Providing regular updates with structure, entry/exit clarity, and real-time outlooks.

More at: sroshmayi.com/

Providing regular updates with structure, entry/exit clarity, and real-time outlooks.

More at: sroshmayi.com/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.