Hey Everyone,

Daily Chart Update

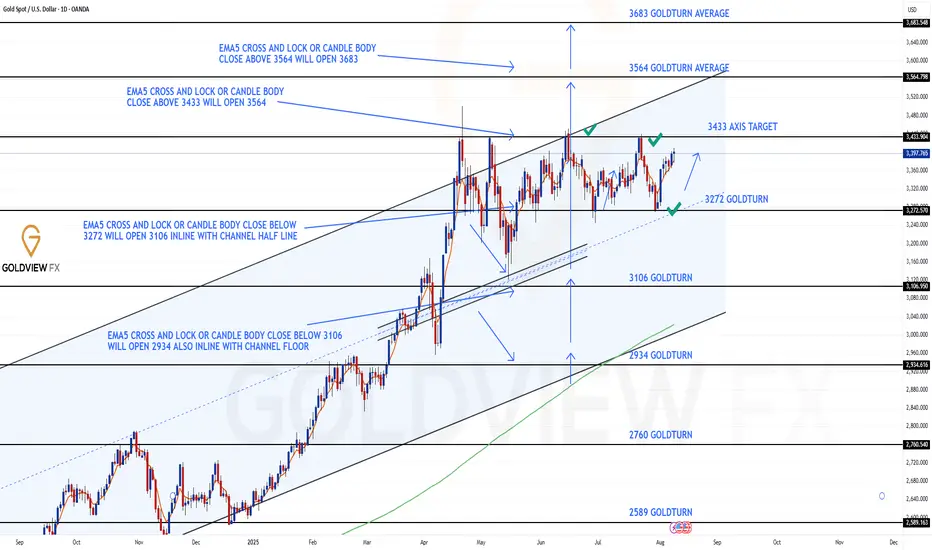

Another Clean Rejection: Structure Still Dominates

Following up on the recent price action last week, the 3372 support level continued to provide support aligned perfectly with the channel half-line, giving us the bounce that continued all the way up to 3409, just short of the 3433 resistance, which once again remains open for a potential test.

We remain in the same structured range, with price still rotating between 3272 and 3433, a 170+ pip zone that continues to deliver high-probability trade setups.

Here’s where we are now:

🔹 Range Still Active

Price is respecting the 3272–3433 boundaries with precision. Until we get a decisive break and hold outside this range, range bound strategies remain in play.

🔹 No Breakout = Clean Rejection

The failure to sustain above 3433 confirms resistance is still valid. We're watching EMA5 for potential breakout confirmation, until then, the bias stays neutral within the range.

🔹 Channel Half-line Bounce

That rejection into 3272 also matched the channel half line, and the bounce there further cements this area as critical support. The latest rally to 3397 reinforces the strength of this pivot.

Updated Key Levels

📉 Support – 3272

Still the major pivot. Buy zones remain valid here unless we see a confirmed breakdown.

📈 Resistance – 3433

Now clearly tested and rejected more than once. Any clean break and hold above could change the dynamic, but until then, it’s solid resistance with 3397 as support.

Thanks as always for your support.

Mr Gold

GoldViewFX

Daily Chart Update

Another Clean Rejection: Structure Still Dominates

Following up on the recent price action last week, the 3372 support level continued to provide support aligned perfectly with the channel half-line, giving us the bounce that continued all the way up to 3409, just short of the 3433 resistance, which once again remains open for a potential test.

We remain in the same structured range, with price still rotating between 3272 and 3433, a 170+ pip zone that continues to deliver high-probability trade setups.

Here’s where we are now:

🔹 Range Still Active

Price is respecting the 3272–3433 boundaries with precision. Until we get a decisive break and hold outside this range, range bound strategies remain in play.

🔹 No Breakout = Clean Rejection

The failure to sustain above 3433 confirms resistance is still valid. We're watching EMA5 for potential breakout confirmation, until then, the bias stays neutral within the range.

🔹 Channel Half-line Bounce

That rejection into 3272 also matched the channel half line, and the bounce there further cements this area as critical support. The latest rally to 3397 reinforces the strength of this pivot.

Updated Key Levels

📉 Support – 3272

Still the major pivot. Buy zones remain valid here unless we see a confirmed breakdown.

📈 Resistance – 3433

Now clearly tested and rejected more than once. Any clean break and hold above could change the dynamic, but until then, it’s solid resistance with 3397 as support.

Thanks as always for your support.

Mr Gold

GoldViewFX

🪙 JOIN OUR FREE TELEGRAM GROUP 🪙 t.me/GoldView_FX

🪙 JOIN OUR DISCORD FOR BACKUP 🪙

discord.com/invite/9ZrEHGuaE2

🏆MESSAGE US FOR VIP SIGNALS🏆

t.me/GoldviewFX

or

email goldviewfx@gmail com

🪙 JOIN OUR DISCORD FOR BACKUP 🪙

discord.com/invite/9ZrEHGuaE2

🏆MESSAGE US FOR VIP SIGNALS🏆

t.me/GoldviewFX

or

email goldviewfx@gmail com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🪙 JOIN OUR FREE TELEGRAM GROUP 🪙 t.me/GoldView_FX

🪙 JOIN OUR DISCORD FOR BACKUP 🪙

discord.com/invite/9ZrEHGuaE2

🏆MESSAGE US FOR VIP SIGNALS🏆

t.me/GoldviewFX

or

email goldviewfx@gmail com

🪙 JOIN OUR DISCORD FOR BACKUP 🪙

discord.com/invite/9ZrEHGuaE2

🏆MESSAGE US FOR VIP SIGNALS🏆

t.me/GoldviewFX

or

email goldviewfx@gmail com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.