"One push too far, or just the warm-up?"

Hello traders 👋

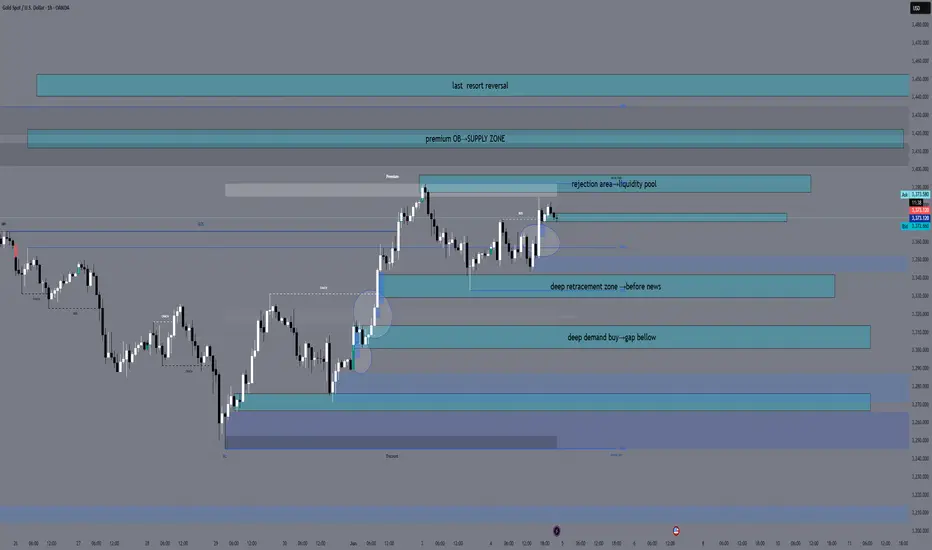

After Wednesday’s irrational 400+ pip run triggered by soft ADP and weak ISM data, Gold entered premium zones with no correction. But tomorrow, things get real: Unemployment Claims hit the scene — and that’s the one market actually listens to.

Price is now sitting on a thin floor, with liquidity stacked both above and below. Will we see continuation or reversal?

Let’s break down the map 🎯👇

🧠 Macro Bias & Structure

Daily & H4: Still holding a bullish market structure, but clearly overextended into premium zones.

H1 + M30: Minor CHoCH printed; no BOS down yet. RSI showing bearish divergence.

Fundamentals: ADP + ISM = weak, dollar bearish. But Thursday's jobless claims could decide the next leg. Until then: price is floating on air.

🔎 Bias: Mixed – bullish unless reversal is confirmed with BOS below 3373.

🔼 Bullish Zones (buy if price confirms support)

Zone Price Range Rationale

1. Deep Demand Buy 3315 – 3302 Full H1–H4 demand OB, FVG, and clean discount confluence. Strongest zone for rebound if news drives sell-off.

2. Daily OB Buy Zone 3342 – 3330 Untested D1 OB + fib 61.8% + equilibrium. Clean long trigger if market dumps before news.

DZ. Decision Zone (Not for blind buys) 3376 – 3373 Not a sniper buy. This is now a reaction zone: if price holds above, intraday longs may hold. If broken → bearish confirmation.

🔽 Bearish Zones (sell only with clean PA rejection)

Zone Price Range Rationale

1. Liquidity Sweep Sell 3389 – 3397 Clean stop-hunt zone above NY high. Weak hands will long too late — ideal for rejections.

2. Premium OB Sell 3412 – 3422 Unmitigated OB inside fib 1.0 extension. If we push up here pre-NFP, look for sweep + drop.

3. Trap Zone – Top of Move 3440 – 3452 Only valid if news overreacts. Last-resort reversal zone. Use LTF confirmation only.

⚠️ Key Notes:

Thursday = liquidity trap day before unemployment claims. Expect false breakouts.

Let price come to the levels — no chasing.

Don’t force the bias. Read the reaction.

💬 Final Word from GoldFxMinds:

We don’t chase candles. We don’t guess direction.

We prepare, we wait, we strike. ⚔️

Leave a comment if you’re watching this madness with us. Follow for more sniper-level breakdowns — and remember, we’re not here for hype. We’re here for precision.

📍Stay sharp, stay patient.

— GoldFxMinds

Hello traders 👋

After Wednesday’s irrational 400+ pip run triggered by soft ADP and weak ISM data, Gold entered premium zones with no correction. But tomorrow, things get real: Unemployment Claims hit the scene — and that’s the one market actually listens to.

Price is now sitting on a thin floor, with liquidity stacked both above and below. Will we see continuation or reversal?

Let’s break down the map 🎯👇

🧠 Macro Bias & Structure

Daily & H4: Still holding a bullish market structure, but clearly overextended into premium zones.

H1 + M30: Minor CHoCH printed; no BOS down yet. RSI showing bearish divergence.

Fundamentals: ADP + ISM = weak, dollar bearish. But Thursday's jobless claims could decide the next leg. Until then: price is floating on air.

🔎 Bias: Mixed – bullish unless reversal is confirmed with BOS below 3373.

🔼 Bullish Zones (buy if price confirms support)

Zone Price Range Rationale

1. Deep Demand Buy 3315 – 3302 Full H1–H4 demand OB, FVG, and clean discount confluence. Strongest zone for rebound if news drives sell-off.

2. Daily OB Buy Zone 3342 – 3330 Untested D1 OB + fib 61.8% + equilibrium. Clean long trigger if market dumps before news.

DZ. Decision Zone (Not for blind buys) 3376 – 3373 Not a sniper buy. This is now a reaction zone: if price holds above, intraday longs may hold. If broken → bearish confirmation.

🔽 Bearish Zones (sell only with clean PA rejection)

Zone Price Range Rationale

1. Liquidity Sweep Sell 3389 – 3397 Clean stop-hunt zone above NY high. Weak hands will long too late — ideal for rejections.

2. Premium OB Sell 3412 – 3422 Unmitigated OB inside fib 1.0 extension. If we push up here pre-NFP, look for sweep + drop.

3. Trap Zone – Top of Move 3440 – 3452 Only valid if news overreacts. Last-resort reversal zone. Use LTF confirmation only.

⚠️ Key Notes:

Thursday = liquidity trap day before unemployment claims. Expect false breakouts.

Let price come to the levels — no chasing.

Don’t force the bias. Read the reaction.

💬 Final Word from GoldFxMinds:

We don’t chase candles. We don’t guess direction.

We prepare, we wait, we strike. ⚔️

Leave a comment if you’re watching this madness with us. Follow for more sniper-level breakdowns — and remember, we’re not here for hype. We’re here for precision.

📍Stay sharp, stay patient.

— GoldFxMinds

Trade active

🔄 XAUUSD Market Update – June 5, 2025Title: Break Above 3395 – Trend Shift Confirmed?

Price has officially broken above the 3395 flip trap zone, invalidating the previous bearish rejection structure and signaling a new short-term bullish continuation. Let’s break down the structure and expectations:

🔍 Market Structure Overview (Multi-timeframe)

📍 H4:

Clean bullish BOS printed above the last LH.

Price entered and pushed through the premium OB/FVG zone (3384–3395), signaling strength.

No clear rejection yet, liquidity above previous swing high (3395) has been swept.

The next high-interest zone is around 3432–3440 (FVG + OB supply imbalance above current price).

📍 H1:

After multiple CHoCHs and higher lows, we now have a confirmed BOS above 3395, validating the shift.

A clear FVG and gap structure sits at 3405–3415, which could act as a short-term magnet.

EMA5/21/50 are all aligned bullish and locked, confirming short-term upside momentum.

📍 M30–M15:

Clean liquidity sweep followed by strong impulse.

Recent BOS on M15 at 3380 was retested, and price pushed cleanly toward 3399+.

Minor retracement zones to watch:

3372–3360 (discount OB/FVG zone for potential bullish re-entry)

3390–3384 (newly created support after breakout of 3395)

🎯 Intraday Bullish Targets

Zone Level (approx.) Context

TP1 3405 FVG + psychological round level

TP2 3420 Previous imbalance gap zone

TP3 3432–3440 H4 supply + premium OB

⚠️ Key Support / Reentry Zones

Zone (Buy) Price Range Confluence

3390–3384 Retest of breakout Fresh OB + BOS origin

3372–3360 Pullback zone Discount OB + FVG + EMA50 support (M30)

🧠 Bias Update:

✅ Short-term bias flipped to bullish after the clean break of 3395.

However, price is currently inside a higher timeframe premium zone, so watch for exhaustion or reversal patterns around 3432–3440.

📅 News & Macro Context:

ADP data showed slowing job growth (bullish for gold).

All eyes now on Unemployment Claims and Friday's NFP, which could trigger high volatility.

Powell’s recent speech had limited effect – Fed stance still cautious.

📌 Scenarios to Watch

🔸 Bullish Scenario:

Break above 3405 → continuation to 3420 → liquidity grab near 3432–3440 before deeper correction.

🔹 Bearish Scenario:

Failure to hold above 3395 → dump below 3384 → revisit 3372–3360. Only break below 3360 would signal structure shift back to bearish.

📢 Final Note from GoldFxMinds:

Looks like structure just proved it again: never assume rejection without confirmation. ✅

If we hold above 3395, bulls are in full control toward 3420+.

Drop your thoughts, like & follow for more sniper updates — see you at NY Open! 🚀👑

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.