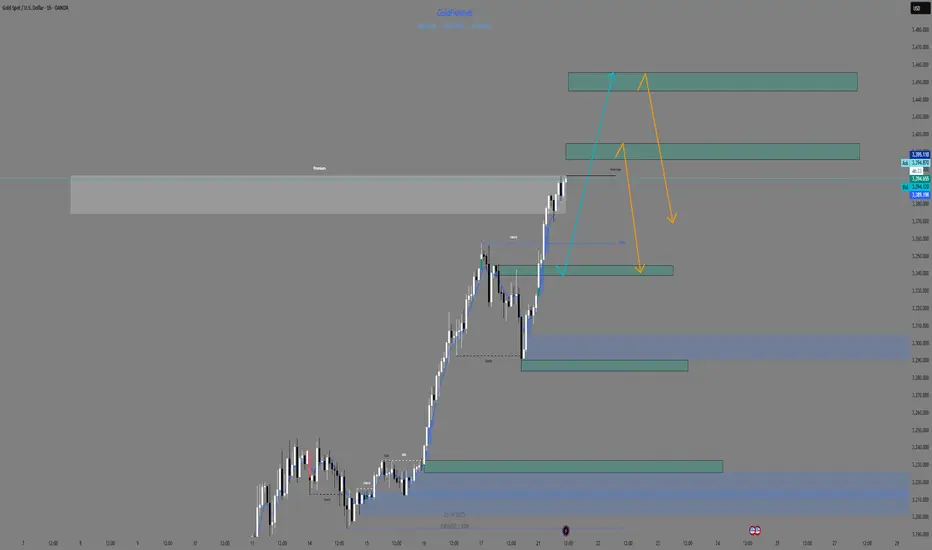

🧭 Market Overview:

XAUUSD just printed new ATH at 3396, with price now pushing again into premium, currently testing 3392.7–3393.6 — a zone with weak high inducement. Price action is extremely vertical, with no clear pullback since 3285.

📈 H1 Structure:

Bullish CHoCH and BOS series from April 9

Trend is vertical, clean impulsive waves

No internal sign of exhaustion — yet

🧠 Context:

H1 candles show price slowing slightly around the weak high area. Smart money will look to trap late buyers above 3396 if price does not break cleanly.

🔼 Key Levels ABOVE Price

Type Zone Notes

🧲 Weak High Zone 3393.6–3396.0 Current zone – may act as final inducement trap

🎯 Fibo 1.0 Extension 3405–3415 First proper extension level for late buyers’ liquidation

🚨 Fibo 1.272 Zone 3445–3455 If we spike irrationally → this zone becomes the macro reversal trap

🔽 Key Levels BELOW Price

Type Zone Notes

🔵 Micro Demand 3340–3345 Small M15 OB zone – valid for reaction scalps only

🟢 Confirmed OB Zone 3284–3288 Last valid H1 OB + FVG confluence → strong buy reentry

⚓️ Macro Demand Base 3220–3235 Institutional reaccumulation zone from previous rally

🎯 H1 Bias:

Still bullish — but close to final exhaustion levels.

📌 Look for LTF reversal signs around 3393–3405 to consider safe short entries.

XAUUSD just printed new ATH at 3396, with price now pushing again into premium, currently testing 3392.7–3393.6 — a zone with weak high inducement. Price action is extremely vertical, with no clear pullback since 3285.

📈 H1 Structure:

Bullish CHoCH and BOS series from April 9

Trend is vertical, clean impulsive waves

No internal sign of exhaustion — yet

🧠 Context:

H1 candles show price slowing slightly around the weak high area. Smart money will look to trap late buyers above 3396 if price does not break cleanly.

🔼 Key Levels ABOVE Price

Type Zone Notes

🧲 Weak High Zone 3393.6–3396.0 Current zone – may act as final inducement trap

🎯 Fibo 1.0 Extension 3405–3415 First proper extension level for late buyers’ liquidation

🚨 Fibo 1.272 Zone 3445–3455 If we spike irrationally → this zone becomes the macro reversal trap

🔽 Key Levels BELOW Price

Type Zone Notes

🔵 Micro Demand 3340–3345 Small M15 OB zone – valid for reaction scalps only

🟢 Confirmed OB Zone 3284–3288 Last valid H1 OB + FVG confluence → strong buy reentry

⚓️ Macro Demand Base 3220–3235 Institutional reaccumulation zone from previous rally

🎯 H1 Bias:

Still bullish — but close to final exhaustion levels.

📌 Look for LTF reversal signs around 3393–3405 to consider safe short entries.

Trade active

🧭 TURN LOGIC (Directional Triggers)EMA5 Cross & Lock Zone Effect

🔼 Above 3414 Unlocks possible run to 3448 – 3455

🔼 Above 3455 Opens 3503 blow-off level

🔻 Below 3372 Confirms weakness → targets 3340 then 3288

🔻 Below 3282 Major retracement opens → targets 3224 and 3190

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.