☘️Fundamental analysis

Gold prices (XAU/USD) trimmed gains after hitting a fresh record high around $2,482-$2,483 during the Asian session on Wednesday and are now trading near the lower end of their daily range . The pullback lacks any clear fundamental catalysts and is likely to remain cushioned amid dovish Federal Reserve (Fed) expectations.

Investors now appear to believe that the US central bank will begin an interest rate cutting cycle in September, which has sent US Treasury yields falling to near multi-month lows. This has not helped the US Dollar (USD) register any meaningful recovery from the more than three-month low it hit earlier this week and will continue to act as a driving force behind Gold prices. yield. Therefore, any subsequent price slippage could still be seen as a buying opportunity. Traders are now looking to US Industrial Production figures for near-term momentum.

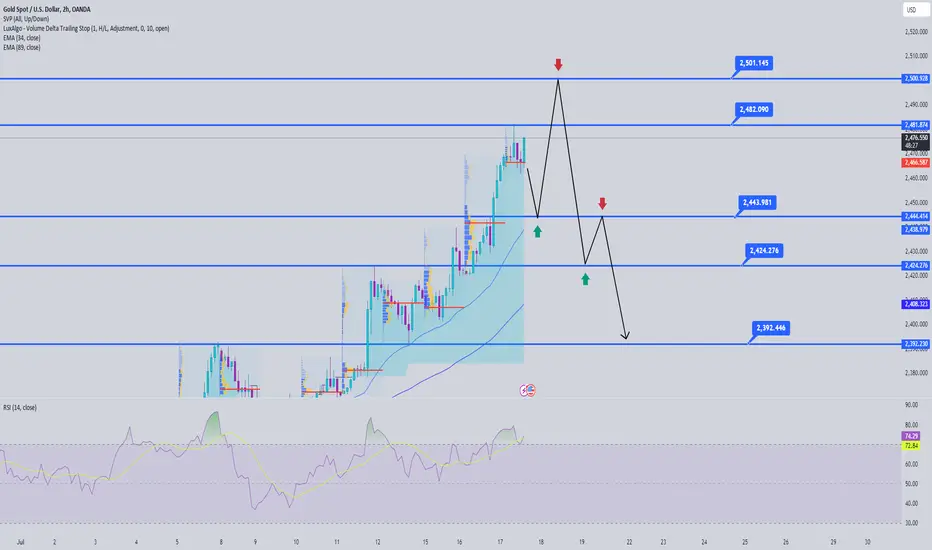

☘️Technical analysis:

The continuous breakout through the $2,450 supply zone has left gold with no clear resistance area above. Any further upside move will most likely encounter some resistance and stop near the psychological $2,500 mark.

On the other hand, any meaningful slide below the $2,450 zone could now be seen as a buying opportunity and the next cap is near the $2,445-2,425 resistance, which has now turned into support. However, a convincing break below the latter could prompt some technical selling and drag Gold prices down to the $2,400 mark. The possibility of 2400 in the current context is unlikely because world economic and political factors are still supporting Gold.

Support: 2450 - 2442 - 2426 - 2418

Resistance: 2500

BUY zone 2451 - 2449 stoploss 2445

BUY zone 2442 - 2440 stoploss 2336

SELL zone 2500 Stoploss 2505

Gold prices (XAU/USD) trimmed gains after hitting a fresh record high around $2,482-$2,483 during the Asian session on Wednesday and are now trading near the lower end of their daily range . The pullback lacks any clear fundamental catalysts and is likely to remain cushioned amid dovish Federal Reserve (Fed) expectations.

Investors now appear to believe that the US central bank will begin an interest rate cutting cycle in September, which has sent US Treasury yields falling to near multi-month lows. This has not helped the US Dollar (USD) register any meaningful recovery from the more than three-month low it hit earlier this week and will continue to act as a driving force behind Gold prices. yield. Therefore, any subsequent price slippage could still be seen as a buying opportunity. Traders are now looking to US Industrial Production figures for near-term momentum.

☘️Technical analysis:

The continuous breakout through the $2,450 supply zone has left gold with no clear resistance area above. Any further upside move will most likely encounter some resistance and stop near the psychological $2,500 mark.

On the other hand, any meaningful slide below the $2,450 zone could now be seen as a buying opportunity and the next cap is near the $2,445-2,425 resistance, which has now turned into support. However, a convincing break below the latter could prompt some technical selling and drag Gold prices down to the $2,400 mark. The possibility of 2400 in the current context is unlikely because world economic and political factors are still supporting Gold.

Support: 2450 - 2442 - 2426 - 2418

Resistance: 2500

BUY zone 2451 - 2449 stoploss 2445

BUY zone 2442 - 2440 stoploss 2336

SELL zone 2500 Stoploss 2505

Trade active

Note

Gold price stays supported at $2,450 amid risk aversion, Fed easing betsGold price sees some fresh buying interest above $2,450 in the Asian session on Thursday, stalling a retracement from a fresh record high. Gold price cheers broad risk aversion and heightened Fed easing expectations ahead of mid-tier US data and more Fedspeak.

Note

The price has reacted at the important support zone of 2418JOIN OUR FREE TELEGRAM GROUP t.me/+7rqP7ECMjpUxMzBl

MESSAGE US FOR VIP SIGNALS🏆 t.me/Leilani8597

MESSAGE US FOR VIP SIGNALS🏆 t.me/Leilani8597

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

JOIN OUR FREE TELEGRAM GROUP t.me/+7rqP7ECMjpUxMzBl

MESSAGE US FOR VIP SIGNALS🏆 t.me/Leilani8597

MESSAGE US FOR VIP SIGNALS🏆 t.me/Leilani8597

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.