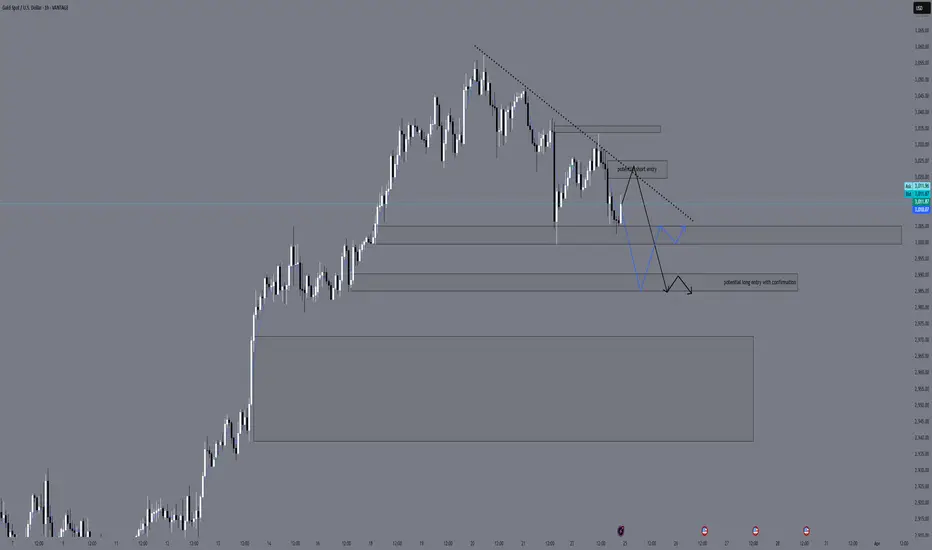

XAU/USD - Daily Review & Sniper Entry Plan - March 25th, 2025

✨ Overall Bias:

Monthly: Bullish, but with a candle showing exhaustion, potential pullback towards discount.

Weekly: Indecision, but we have a small CHoCH on the structure - possible correction towards the 2980 zone.

Daily: Clear bearish candle on Friday, followed by a mild correction on Monday. Liquidity grab below 3000, but close above.

🌐 Timeframe Breakdown:

D1:

Last confirmed CHoCH.

Imbalance and FVG in the 3022-3035 zone.

Potential bearish OB between 3031-3036.

RSI below 50, momentum fading.

H4:

Lower highs / lower lows structure.

Bearish confirmation: BOS + rejection from OB.

Imbalance 3016-3026.

EMA 21 and 50 acting as dynamic resistance.

H1:

Last CHoCH in the 3024 zone.

Bearish engulfing confirmation.

Unfilled FVG: 3016-3020.

RSI < 40, increasing volume on bearish candles.

M30 / M15:

BOS on M15 and retest in the area of interest.

Last swing high at 3018.13.

Liquidity above 3018 and 3024 (EQH), below 3000 (EQL).

🔹 Sniper Entry Scenarios

Scenario 1 (Short)

Entry: 3018 - 3022 (FVG zone + OB + 61.8% Fibonacci)

Confirmation: M15 bearish engulfing or BOS + retest.

SL: above 3028

TP1: 3000

TP2: 2985 (discount zone + liquidity)

Scenario 2 (Long - Countertrend/Scalp)

Entry: 2985 - 2990 (liquidity zone )

Confirmation: M15 BOS + bullish pattern (engulfing/pin)

SL: below 2979

TP1: 3000

TP2: 3015

🔹 POI (Key Zones):

3022-3028: FVG + OB + 61.8% Fibonacci - potential short zone

3018.13: EQH - liquidity inducement

2985: Daily OB + 78.6% Fibonacci - potential buy zone

🌍 EMA Guide:

EMA 5 < 21 on H1 and M30: bearish momentum

EMA 50 acting as dynamic resistance (on H1: 3022)

🔹 Conclusion: Favorable short on retracement to the 3018-3022 zone with confirmation. Target remains the 2985 zone for liquidity. Market response around 2985 will give clarity for potential buy/scalp.

⏳ Expectations: After the Daily close, we can expect liquidity inducement towards 3020+, followed by a dump towards 2990-2985.

🔔 Don't forget to Like, Share, and Follow for more updates! Let's hit that target together! 💰📈

👉 Like if you found this helpful and follow for future setups!

✨ Overall Bias:

Monthly: Bullish, but with a candle showing exhaustion, potential pullback towards discount.

Weekly: Indecision, but we have a small CHoCH on the structure - possible correction towards the 2980 zone.

Daily: Clear bearish candle on Friday, followed by a mild correction on Monday. Liquidity grab below 3000, but close above.

🌐 Timeframe Breakdown:

D1:

Last confirmed CHoCH.

Imbalance and FVG in the 3022-3035 zone.

Potential bearish OB between 3031-3036.

RSI below 50, momentum fading.

H4:

Lower highs / lower lows structure.

Bearish confirmation: BOS + rejection from OB.

Imbalance 3016-3026.

EMA 21 and 50 acting as dynamic resistance.

H1:

Last CHoCH in the 3024 zone.

Bearish engulfing confirmation.

Unfilled FVG: 3016-3020.

RSI < 40, increasing volume on bearish candles.

M30 / M15:

BOS on M15 and retest in the area of interest.

Last swing high at 3018.13.

Liquidity above 3018 and 3024 (EQH), below 3000 (EQL).

🔹 Sniper Entry Scenarios

Scenario 1 (Short)

Entry: 3018 - 3022 (FVG zone + OB + 61.8% Fibonacci)

Confirmation: M15 bearish engulfing or BOS + retest.

SL: above 3028

TP1: 3000

TP2: 2985 (discount zone + liquidity)

Scenario 2 (Long - Countertrend/Scalp)

Entry: 2985 - 2990 (liquidity zone )

Confirmation: M15 BOS + bullish pattern (engulfing/pin)

SL: below 2979

TP1: 3000

TP2: 3015

🔹 POI (Key Zones):

3022-3028: FVG + OB + 61.8% Fibonacci - potential short zone

3018.13: EQH - liquidity inducement

2985: Daily OB + 78.6% Fibonacci - potential buy zone

🌍 EMA Guide:

EMA 5 < 21 on H1 and M30: bearish momentum

EMA 50 acting as dynamic resistance (on H1: 3022)

🔹 Conclusion: Favorable short on retracement to the 3018-3022 zone with confirmation. Target remains the 2985 zone for liquidity. Market response around 2985 will give clarity for potential buy/scalp.

⏳ Expectations: After the Daily close, we can expect liquidity inducement towards 3020+, followed by a dump towards 2990-2985.

🔔 Don't forget to Like, Share, and Follow for more updates! Let's hit that target together! 💰📈

👉 Like if you found this helpful and follow for future setups!

Trade closed manually

XAU/USD - Daily Review | March 25, 2025The main scenario from yesterday played out partially. The 3018–3020 sell zone was temporarily broken to grab liquidity above the EQH (3030–3031.50), followed by a strong bearish rejection.

Executed trades:

Two sell positions entered in the 3028–3030 zone

Both closed manually at 3019 with +90–100 pips profit

Unfilled orders:

Some pending sell orders around 3018.50 remained untriggered before the stop hunt spike.

Liquidity:

Liquidity above EQH was taken, followed by sharp rejection — classic liquidity grab setup.

Market sentiment:

72% of traders were short during the spike — a clear retail trap

Bearish reaction after the liquidity grab confirms smart money activity

Conclusion: Bias remains bearish as long as price holds below 3031.50.

The 3018–3020 zone remains a valid POI. Looking for further confirmation toward 2999.85 / 2985.15 as next targets.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.