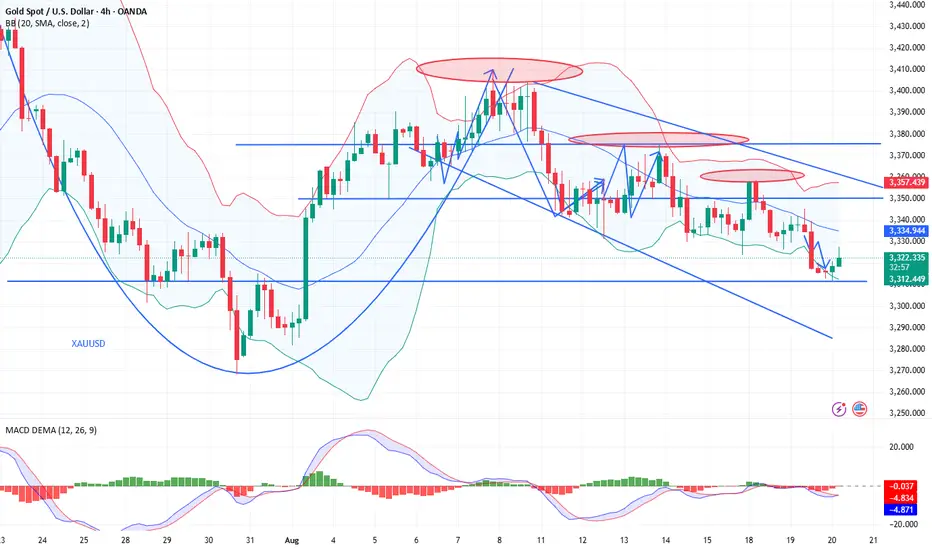

Gold (XAU/USD) continued its decline during Wednesday's Asian trading session, hitting a near three-week low and approaching the key 100-day simple moving average (SMA). A break below this level would trigger further bearish activity.

The recently released US Producer Price Index (PPI) for July showed a resurgence in price pressures, leading the market to significantly reduce bets on a "super-large rate cut." The US dollar rose for a third consecutive day, reaching a more than one-week high, becoming a key factor weighing on gold prices.

According to the CME FedWatch tool, the market expects the Federal Reserve to cut interest rates by 25 basis points in September, with one more cut possible this year.

An institutional commentary stated: "The continued strength of the US dollar is putting pressure on gold. Even with geopolitical risks remaining, investors prefer to hold income-generating assets rather than non-yielding gold."

Regarding the geopolitical situation, Russia-Ukraine peace talks are accelerating. White House spokesperson Leavitt stated that preparations are underway for a bilateral meeting between the Russian and Ukrainian leaders. Trump has explicitly ruled out deploying ground troops but hinted at air support as part of a potential agreement. The market interpreted this as a positive sign of easing tensions, further weakening safe-haven demand for gold.

If gold prices fall below the 100-day moving average and fall below 3,270, it could confirm a mid-term top and potentially enter a new downward range. Conversely, if gold prices rebound, short-term resistance lies at 3,335, followed by 3,358 and 3,375. A break above 3,400 could challenge the upper limit of the 3,434-3,435 range.

One analyst noted, "Once gold prices fall below the 100-day moving average, further downside potential will open up, and market bears may accelerate their intervention."

From the current perspective, gold prices have entered a sensitive technical range, with the US dollar's performance and Fed policy signals being key determinants. If the meeting minutes and Powell's speech are dovish, gold could experience a short-term rebound.

However, if inflationary pressures are re-emphasized, gold may remain under pressure. Be wary of the risk of an accelerated decline below 3,270. XAUUSD

XAUUSD  GOLD

GOLD  XAUUSD

XAUUSD  GOLD

GOLD  XAUUSD

XAUUSD  GOLD

GOLD  XAUUSD

XAUUSD  XAUUSD

XAUUSD  GOLD

GOLD

The recently released US Producer Price Index (PPI) for July showed a resurgence in price pressures, leading the market to significantly reduce bets on a "super-large rate cut." The US dollar rose for a third consecutive day, reaching a more than one-week high, becoming a key factor weighing on gold prices.

According to the CME FedWatch tool, the market expects the Federal Reserve to cut interest rates by 25 basis points in September, with one more cut possible this year.

An institutional commentary stated: "The continued strength of the US dollar is putting pressure on gold. Even with geopolitical risks remaining, investors prefer to hold income-generating assets rather than non-yielding gold."

Regarding the geopolitical situation, Russia-Ukraine peace talks are accelerating. White House spokesperson Leavitt stated that preparations are underway for a bilateral meeting between the Russian and Ukrainian leaders. Trump has explicitly ruled out deploying ground troops but hinted at air support as part of a potential agreement. The market interpreted this as a positive sign of easing tensions, further weakening safe-haven demand for gold.

If gold prices fall below the 100-day moving average and fall below 3,270, it could confirm a mid-term top and potentially enter a new downward range. Conversely, if gold prices rebound, short-term resistance lies at 3,335, followed by 3,358 and 3,375. A break above 3,400 could challenge the upper limit of the 3,434-3,435 range.

One analyst noted, "Once gold prices fall below the 100-day moving average, further downside potential will open up, and market bears may accelerate their intervention."

From the current perspective, gold prices have entered a sensitive technical range, with the US dollar's performance and Fed policy signals being key determinants. If the meeting minutes and Powell's speech are dovish, gold could experience a short-term rebound.

However, if inflationary pressures are re-emphasized, gold may remain under pressure. Be wary of the risk of an accelerated decline below 3,270.

Real-time strategies are like a beacon guiding your investment path. The market will never disappoint those who persevere and explore wisely....🚀🚀VIP Channel t.me/EagleEyePrecisionAnalysis

👉Exclusive address t.me/Eagle_PreciseAnalysis

👉Exclusive address t.me/Eagle_PreciseAnalysis

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Real-time strategies are like a beacon guiding your investment path. The market will never disappoint those who persevere and explore wisely....🚀🚀VIP Channel t.me/EagleEyePrecisionAnalysis

👉Exclusive address t.me/Eagle_PreciseAnalysis

👉Exclusive address t.me/Eagle_PreciseAnalysis

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.