Hey Everyone,

Follow up on our Weekly Goldturn channel outlook.

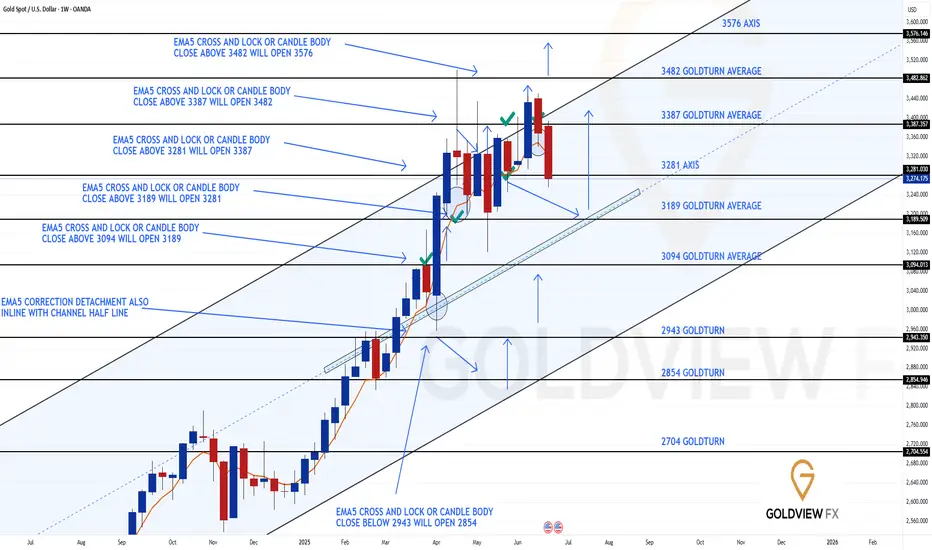

Last week’s action delivered the rejection at the channel top, right in line with expectations. Importantly, we did not get an EMA5 lock confirmation, reinforcing the rejection. We still have the previous weekly candle body close above 3387, leaving the gap at 3482 active and exposed overhead.

The early rejection saw a swift retrace into the 3281 Goldturn axis support, where price is currently attempting to stabilise. This is a pivotal level. From here, we are watching two potential paths unfold:

1. Bounce Scenario: If 3281 holds and buyers step in, we’ll look for a gradual climb within the channel, testing key in between levels. EMA5 cross and lock confirmation will be key for directional bias. A reclaim and continuation higher keeps the 3482 gap firmly in play as a target.

2. Breakdown Scenario: If 3281 gives way, we have a body close gap to the channel mid-line, which becomes the next key level for potential support and Goldturn reaction. A move into this area could offer another structured long opportunity, aligned with the overall bullish framework.

Despite the rejection at the highs, the broader channel structure remains intact, and the longer term outlook still favours a measured move up level by level, using Goldturn levels and EMA5 as our compass.

Key Focus:

Support: 3281 → Channel Half-line (if broken)

Resistance: 3387 → 3482 (gap target)

We remain patient and continue reacting to clean structure backed opportunities.

Mr Gold

GoldViewFX

Follow up on our Weekly Goldturn channel outlook.

Last week’s action delivered the rejection at the channel top, right in line with expectations. Importantly, we did not get an EMA5 lock confirmation, reinforcing the rejection. We still have the previous weekly candle body close above 3387, leaving the gap at 3482 active and exposed overhead.

The early rejection saw a swift retrace into the 3281 Goldturn axis support, where price is currently attempting to stabilise. This is a pivotal level. From here, we are watching two potential paths unfold:

1. Bounce Scenario: If 3281 holds and buyers step in, we’ll look for a gradual climb within the channel, testing key in between levels. EMA5 cross and lock confirmation will be key for directional bias. A reclaim and continuation higher keeps the 3482 gap firmly in play as a target.

2. Breakdown Scenario: If 3281 gives way, we have a body close gap to the channel mid-line, which becomes the next key level for potential support and Goldturn reaction. A move into this area could offer another structured long opportunity, aligned with the overall bullish framework.

Despite the rejection at the highs, the broader channel structure remains intact, and the longer term outlook still favours a measured move up level by level, using Goldturn levels and EMA5 as our compass.

Key Focus:

Support: 3281 → Channel Half-line (if broken)

Resistance: 3387 → 3482 (gap target)

We remain patient and continue reacting to clean structure backed opportunities.

Mr Gold

GoldViewFX

🪙 JOIN OUR FREE TELEGRAM GROUP 🪙 t.me/GoldView_FX

🪙 JOIN OUR DISCORD FOR BACKUP 🪙

discord.com/invite/9ZrEHGuaE2

🏆MESSAGE US FOR VIP SIGNALS🏆

t.me/GoldviewFX

or

email goldviewfx@gmail com

🪙 JOIN OUR DISCORD FOR BACKUP 🪙

discord.com/invite/9ZrEHGuaE2

🏆MESSAGE US FOR VIP SIGNALS🏆

t.me/GoldviewFX

or

email goldviewfx@gmail com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🪙 JOIN OUR FREE TELEGRAM GROUP 🪙 t.me/GoldView_FX

🪙 JOIN OUR DISCORD FOR BACKUP 🪙

discord.com/invite/9ZrEHGuaE2

🏆MESSAGE US FOR VIP SIGNALS🏆

t.me/GoldviewFX

or

email goldviewfx@gmail com

🪙 JOIN OUR DISCORD FOR BACKUP 🪙

discord.com/invite/9ZrEHGuaE2

🏆MESSAGE US FOR VIP SIGNALS🏆

t.me/GoldviewFX

or

email goldviewfx@gmail com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.