🌍 XAUUSD Weekly Outlook – “Gold’s Cooling Off… Or Just Reloading? 🔁💥”

📅 Week of May 5–9, 2025

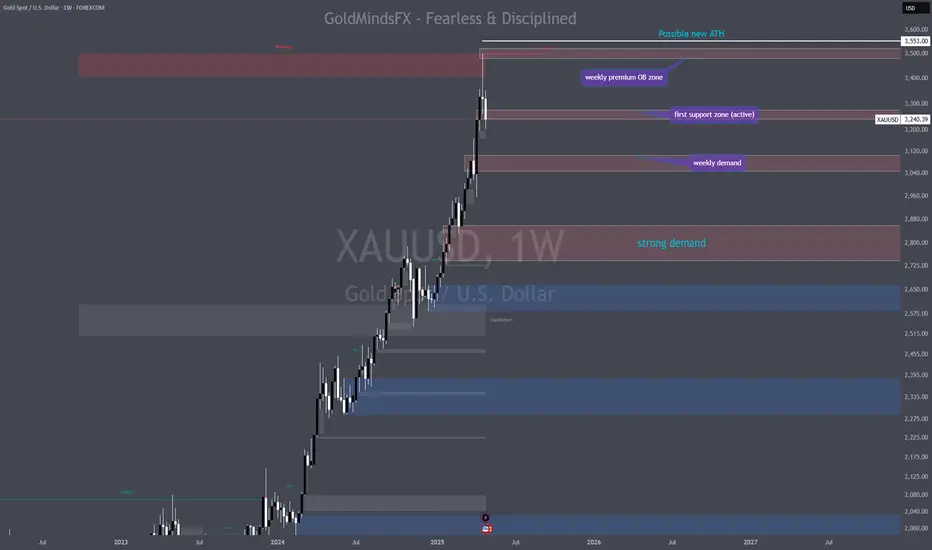

After breaking records with a fiery move into 3533, Gold just blinked. But is this the start of a deeper pullback — or simply a power nap before another skyrocket? Let’s break it down.

🧱 Macro Structure:

🔹 Massive bullish expansion from sub-2000 to 3533 → clear weekly BOS & continuation

🔹 First real retracement candle after months of nonstop gains

🔹 Price now hovering around the 3240–3270 mid-range FVG zone

🔑 Key Weekly Levels + Real Confluence:

📍 Price Range Zone Type What’s Here & Why It Matters

3533 🔺 ATH / Weak High Top liquidity grab + Premium high — supply reaction confirmed

3480–3510 ⚠ Reversal OB zone Weekly OB + clean FVG + sell-off origin = potential rejection zone

3240–3270 🔵 Micro Demand Mid-imbalance fill + minor OB + current retest base

3050–3100 🟦 Weekly Demand Block Big boy OB + 50% FIB retrace + macro HL zone → sniper reentry magnet

2750–2850 🧠 Strong HTF Demand Long-term CHoCH zone + discount imbalance stack = last line of defense

🔎 Weekly Confluences:

✅ SMC: BOS confirmed, CHoCH flipped in 2023 = macro bullish bias holds

📐 FIBO: 3050–3100 = perfect golden pocket (50%) of last full impulse

📊 EMA 5/21: Full bullish lock, no signs of EMA cross down

🔥 Liquidity: Above 3533 = final weak highs, below 3050 = deep liquidity pool

🧭 Bias Summary:

Bullish overall, but watching for:

A trap sell into 3050–3100 (clean sniper reentry zone)

🧲 Liquidity grab near 3300+ that could fuel another leg up or fakeout

🙏 Like this breakdown? Boost and follow us for sniper setups all week.

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your plan and wait for confirmation before taking action.

#XAUUSD #GoldOutlook #SMC #LiquidityHunt #SmartMoneyFlow

📅 Week of May 5–9, 2025

After breaking records with a fiery move into 3533, Gold just blinked. But is this the start of a deeper pullback — or simply a power nap before another skyrocket? Let’s break it down.

🧱 Macro Structure:

🔹 Massive bullish expansion from sub-2000 to 3533 → clear weekly BOS & continuation

🔹 First real retracement candle after months of nonstop gains

🔹 Price now hovering around the 3240–3270 mid-range FVG zone

🔑 Key Weekly Levels + Real Confluence:

📍 Price Range Zone Type What’s Here & Why It Matters

3533 🔺 ATH / Weak High Top liquidity grab + Premium high — supply reaction confirmed

3480–3510 ⚠ Reversal OB zone Weekly OB + clean FVG + sell-off origin = potential rejection zone

3240–3270 🔵 Micro Demand Mid-imbalance fill + minor OB + current retest base

3050–3100 🟦 Weekly Demand Block Big boy OB + 50% FIB retrace + macro HL zone → sniper reentry magnet

2750–2850 🧠 Strong HTF Demand Long-term CHoCH zone + discount imbalance stack = last line of defense

🔎 Weekly Confluences:

✅ SMC: BOS confirmed, CHoCH flipped in 2023 = macro bullish bias holds

📐 FIBO: 3050–3100 = perfect golden pocket (50%) of last full impulse

📊 EMA 5/21: Full bullish lock, no signs of EMA cross down

🔥 Liquidity: Above 3533 = final weak highs, below 3050 = deep liquidity pool

🧭 Bias Summary:

Bullish overall, but watching for:

A trap sell into 3050–3100 (clean sniper reentry zone)

🧲 Liquidity grab near 3300+ that could fuel another leg up or fakeout

🙏 Like this breakdown? Boost and follow us for sniper setups all week.

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your plan and wait for confirmation before taking action.

#XAUUSD #GoldOutlook #SMC #LiquidityHunt #SmartMoneyFlow

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.