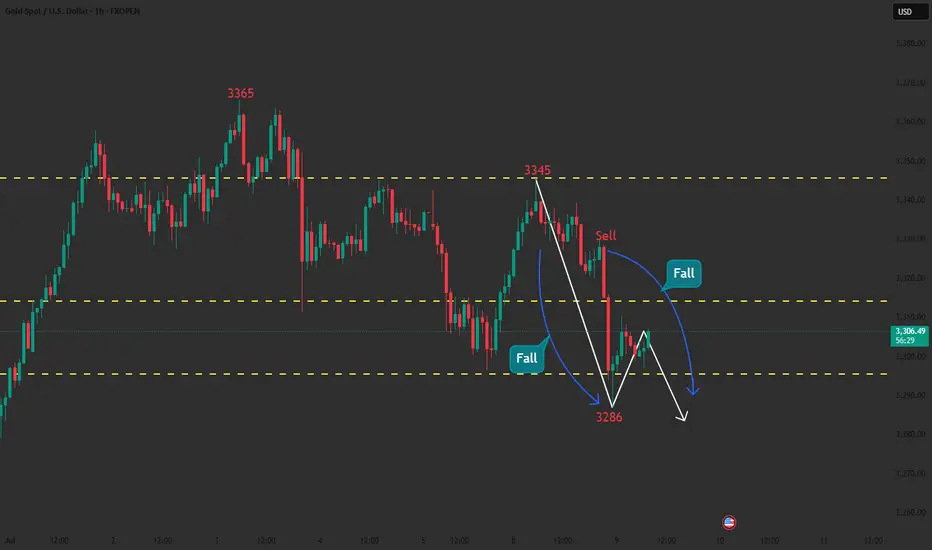

Gold, the price fell from the historical high of 3500 to 3120 in the first round this year, and is now in the second round of downward cycle after rising to 3452. The mid-term top idea is maintained, and the operating target is 3120; after bottoming out and rebounding to 3345 on Monday, it did not continue on Tuesday, and fell to 3287 in a weak position; the daily chart recorded a real big Yin, and the K-line combination was short-term, and the bearish trend continued during the day, and attention was paid to the impact of the Federal Reserve's monetary policy minutes on Thursday morning;

Opening at 3301, short-term resistance at 3308-3310 during the Asian session, strong resistance at 3315 and daily chart MA5-3320, the limit rebound is not more than here; short-term support at 3293, strong support at 3287, and the previous parallel low at 3247 is expected to be seen if it breaks;

Opening at 3301, short-term resistance at 3308-3310 during the Asian session, strong resistance at 3315 and daily chart MA5-3320, the limit rebound is not more than here; short-term support at 3293, strong support at 3287, and the previous parallel low at 3247 is expected to be seen if it breaks;

Join My Telegram Channel

t.me/+fnp-H0nQpQU4ODQ8

Join my signal channel

t.me/+fnp-H0nQpQU4ODQ8

t.me/+fnp-H0nQpQU4ODQ8

Join my signal channel

t.me/+fnp-H0nQpQU4ODQ8

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join My Telegram Channel

t.me/+fnp-H0nQpQU4ODQ8

Join my signal channel

t.me/+fnp-H0nQpQU4ODQ8

t.me/+fnp-H0nQpQU4ODQ8

Join my signal channel

t.me/+fnp-H0nQpQU4ODQ8

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.