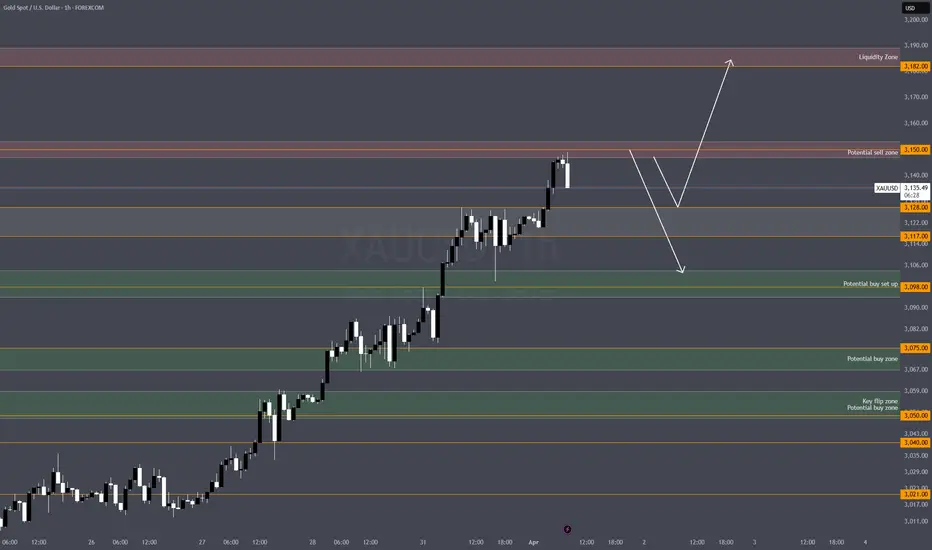

Gold is extending higher, tapping into untested liquidity above. However, signs of exhaustion are creeping in. Watch for potential liquidity sweeps before reversals.

Key Untapped Liquidity Zones

Upside: $3,182 - $3,189

Downside: $3,103 - $3,094

🔴 Sell Setups (Short)

1️⃣ Intraday Reversal Short

Entry Zone: $3,182 - $3,189

Stop Loss (SL): Above $3,193

Take Profit (TP) Levels:

TP1: $3,150 (First reaction)

TP2: $3,128 (Key liquidity)

TP3: $3,103 (Imbalance fill)

📌 Reasoning:

Untested supply at $3,182-$3,189

Price may sweep liquidity above $3,180 before a sharp rejection

2️⃣ Aggressive Short (Scalp)

Entry Zone: $3,150 - $3,153

Stop Loss (SL): Above $3,157

Take Profit (TP) Levels:

TP1: $3,128

TP2: $3,117

TP3: $3,103

📌 Reasoning:

Liquidity grab before a possible retrace

Strong momentum-based rejection expected

🟢 Buy Setups (Long)

3️⃣ Safe Long (Key Demand Zone)

Entry Zone: $3,103 - $3,094

Stop Loss (SL): Below $3,089

Take Profit (TP) Levels:

TP1: $3,128

TP2: $3,150

TP3: $3,182

📌 Reasoning:

Untested demand at $3,103-$3,094

Imbalance below $3,103 should act as a magnet

Liquidity sitting at $3,094

4️⃣ Deep Liquidity Sweep Buy

Entry Zone: $3,074 - $3,067

Stop Loss (SL): Below $3,060

Take Profit (TP) Levels:

TP1: $3,103

TP2: $3,128

TP3: $3,150

📌 Reasoning:

Liquidity sweep target at $3,074-$3,067

If price taps this zone, a high-probability reversal could follow

Heavy imbalance would need correction

👀 Keep an Eye On:

1️⃣ DXY movements—if the dollar strengthens, gold may struggle to break higher.

2️⃣ News events—major economic data could trigger liquidity grabs before reversals.

3️⃣ Reactions at key levels—watch for wicks, aggressive rejections, and volume spikes.

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your own plan and wait for confirmation before taking action.

Good luck on the market today.

Key Untapped Liquidity Zones

Upside: $3,182 - $3,189

Downside: $3,103 - $3,094

🔴 Sell Setups (Short)

1️⃣ Intraday Reversal Short

Entry Zone: $3,182 - $3,189

Stop Loss (SL): Above $3,193

Take Profit (TP) Levels:

TP1: $3,150 (First reaction)

TP2: $3,128 (Key liquidity)

TP3: $3,103 (Imbalance fill)

📌 Reasoning:

Untested supply at $3,182-$3,189

Price may sweep liquidity above $3,180 before a sharp rejection

2️⃣ Aggressive Short (Scalp)

Entry Zone: $3,150 - $3,153

Stop Loss (SL): Above $3,157

Take Profit (TP) Levels:

TP1: $3,128

TP2: $3,117

TP3: $3,103

📌 Reasoning:

Liquidity grab before a possible retrace

Strong momentum-based rejection expected

🟢 Buy Setups (Long)

3️⃣ Safe Long (Key Demand Zone)

Entry Zone: $3,103 - $3,094

Stop Loss (SL): Below $3,089

Take Profit (TP) Levels:

TP1: $3,128

TP2: $3,150

TP3: $3,182

📌 Reasoning:

Untested demand at $3,103-$3,094

Imbalance below $3,103 should act as a magnet

Liquidity sitting at $3,094

4️⃣ Deep Liquidity Sweep Buy

Entry Zone: $3,074 - $3,067

Stop Loss (SL): Below $3,060

Take Profit (TP) Levels:

TP1: $3,103

TP2: $3,128

TP3: $3,150

📌 Reasoning:

Liquidity sweep target at $3,074-$3,067

If price taps this zone, a high-probability reversal could follow

Heavy imbalance would need correction

👀 Keep an Eye On:

1️⃣ DXY movements—if the dollar strengthens, gold may struggle to break higher.

2️⃣ News events—major economic data could trigger liquidity grabs before reversals.

3️⃣ Reactions at key levels—watch for wicks, aggressive rejections, and volume spikes.

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your own plan and wait for confirmation before taking action.

Good luck on the market today.

Trade closed: target reached

Update on today's Sell :Entry Zone: $3,147 - $3,153

Stop Loss (SL): $3,157

Take Profit (TP) Levels:

TP1: $3,128

TP2: $3,117

TP3: $3,103

All three TP's hit.

Note

🟢 Buy Setups (Long)/ ACTIVE 3️⃣ Safe Long (Key Demand Zone)

Entry Zone: $3,103 - $3,094

Stop Loss (SL): Below $3,089

Take Profit (TP) Levels:

TP1: $3,128

TP2: $3,150

TP3: $3,182//

up 100 pips in profit at 3114 ( usually at 80-100 pips part of the profit should be locked in, and SL moved to BE)

Telegram t.me/GoldMindsFX_AI ⭐

⭐VIP ACCESS & Mentorship XAUUSD⭐

t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

⭐VIP ACCESS & Mentorship XAUUSD⭐

t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Telegram t.me/GoldMindsFX_AI ⭐

⭐VIP ACCESS & Mentorship XAUUSD⭐

t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

⭐VIP ACCESS & Mentorship XAUUSD⭐

t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.