“You don’t chase gold. You set the trap, then wait.”

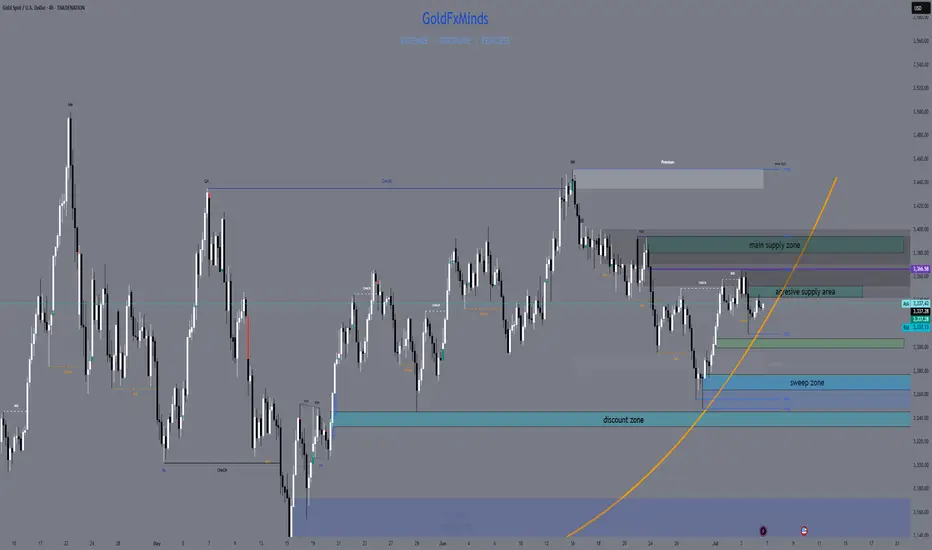

👋 Hey traders — we’re gearing up for a new week on gold, and the H4 chart is starting to speak clearly. After Friday’s clean push into premium rejection zones, price is now compressing beneath a key supply block. Structure is fragile, and the next move will likely come fast.

Let’s position with precision before the breakout.

—

🔸 H4 Bias

Structure remains bearish short-term, with clear lower highs forming below a major supply at 3344–3351.

The broader bias leans neutral as we trade between unmitigated demand and inducement-heavy resistance. Confirmation is everything.

—

🔴 Supply Zones (Sell Areas)

3344–3351

→ H4 Fair Value Gap + OB combo inside premium

→ If price wicks above recent highs and rejects here, it could trigger a clean swing sell.

3380–3394

→ Origin of the last bearish leg + liquidity wick

→ High-risk, high-reward rejection zone if price spikes impulsively this week (e.g. post-Fed tone or surprise volatility).

—

🟢 Demand Zones (Buy Areas)

3265–3275

→ H4 FVG + flip zone + prior sweep level

→ If price taps and holds here, we may see re-accumulation for a move toward 3327–3340.

3235–3246

→ Strong unmitigated OB + discount level

→ Ideal sniper long zone only on clean rejection + structure shift (BOS on M15+).

—

🟡 Flip / Decision Zone

3299–3305

→ EMA50 + micro-range equilibrium

→ If price breaks and holds above this zone with strength, bias turns short-term bullish. If it rejects, continuation down is favored.

—

🎯 Execution Notes

EMA21/50 are acting as active compression bands — watch for rejection pressure

RSI shows no clear divergence yet — but volume is thinning

Liquidity is building above 3340 and below 3265 — prepare for traps both ways

—

🔚 Final Words

Sniper traders aren’t early — they’re precise. If you’ve been reacting too fast lately, this is your week to reset. Gold is telling a story here… but only structure speaks the truth.

🚀 If this helps bring clarity to your outlook, tap follow — we do this daily, with structure, not signals.

—

📢 Disclosure: I use Trade Nation’s broker feed on TradingView and I’m part of their influencer program.

📉 This is educational content, not financial advice.

👋 Hey traders — we’re gearing up for a new week on gold, and the H4 chart is starting to speak clearly. After Friday’s clean push into premium rejection zones, price is now compressing beneath a key supply block. Structure is fragile, and the next move will likely come fast.

Let’s position with precision before the breakout.

—

🔸 H4 Bias

Structure remains bearish short-term, with clear lower highs forming below a major supply at 3344–3351.

The broader bias leans neutral as we trade between unmitigated demand and inducement-heavy resistance. Confirmation is everything.

—

🔴 Supply Zones (Sell Areas)

3344–3351

→ H4 Fair Value Gap + OB combo inside premium

→ If price wicks above recent highs and rejects here, it could trigger a clean swing sell.

3380–3394

→ Origin of the last bearish leg + liquidity wick

→ High-risk, high-reward rejection zone if price spikes impulsively this week (e.g. post-Fed tone or surprise volatility).

—

🟢 Demand Zones (Buy Areas)

3265–3275

→ H4 FVG + flip zone + prior sweep level

→ If price taps and holds here, we may see re-accumulation for a move toward 3327–3340.

3235–3246

→ Strong unmitigated OB + discount level

→ Ideal sniper long zone only on clean rejection + structure shift (BOS on M15+).

—

🟡 Flip / Decision Zone

3299–3305

→ EMA50 + micro-range equilibrium

→ If price breaks and holds above this zone with strength, bias turns short-term bullish. If it rejects, continuation down is favored.

—

🎯 Execution Notes

EMA21/50 are acting as active compression bands — watch for rejection pressure

RSI shows no clear divergence yet — but volume is thinning

Liquidity is building above 3340 and below 3265 — prepare for traps both ways

—

🔚 Final Words

Sniper traders aren’t early — they’re precise. If you’ve been reacting too fast lately, this is your week to reset. Gold is telling a story here… but only structure speaks the truth.

🚀 If this helps bring clarity to your outlook, tap follow — we do this daily, with structure, not signals.

—

📢 Disclosure: I use Trade Nation’s broker feed on TradingView and I’m part of their influencer program.

📉 This is educational content, not financial advice.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.