🧠 Overview

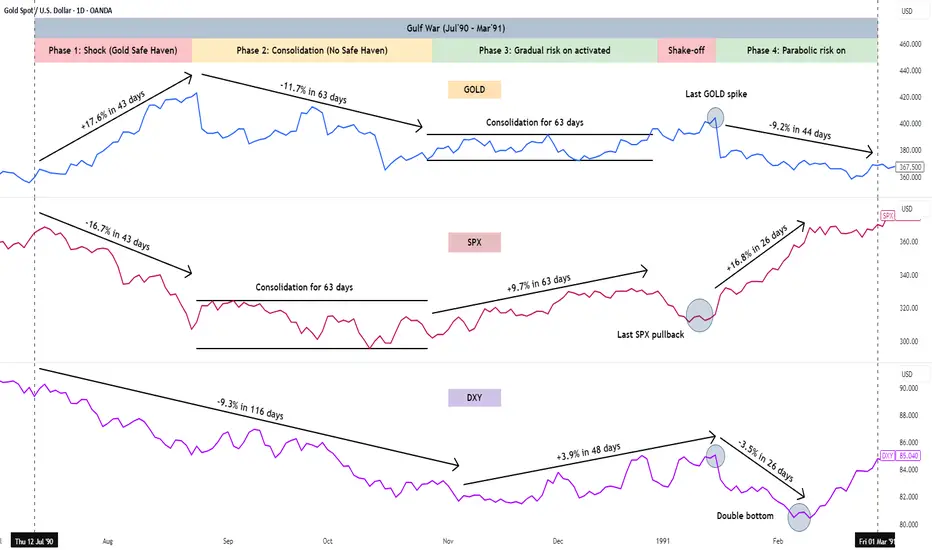

As global tensions escalate and risk sentiment deteriorates, it’s worth revisiting how major asset classes behaved during past war scenarios. The Gulf War (July 1990 – March 1991) offers a clean case study with distinct phases of market psychology.

📊 What This Chart Shows

A synchronized visual comparison of:

Gold – Classic safe haven behavior

S&P 500 – Risk asset sentiment

DXY – USD demand during crisis

🧭 Phases Identified

Phase 1 – Shock

📈 Gold spikes | 📉 Stocks crash | 📉 USD weakens

→ Panic phase as markets price in uncertainty

Phase 2 – Consolidation

Market stalls, both risk and safe haven flows stabilize.

Phase 3 – Gradual Risk-On

Equities begin recovering as risk appetite cautiously returns.

Phase 4 – Shake-Off & Parabolic Rally

Gold rolls over, stocks go parabolic, and DXY forms a double bottom.

🔍 Key Insights

🟡 Gold surged +17% in 43 days, then faded

🔴 SPX dropped -17%, then reversed with a +26% rally

🟣 DXY fell -9%, but rebounded sharply later

⏱️ Timing matters: Safe havens perform early — but are not eternal shelters.

💡 Why It Matters Today

If current geopolitical risks evolve into a Gulf War-type scenario, we might observe:

🟡 A first wave into Gold or USD

🔁 A rotation back into risk assets as clarity improves

📈 Opportunities for reversals in oversold names

This chart is not a forecast — it’s a framework. Patterns may not repeat, but they often rhyme.

✍️ Ongoing Series

This is part of a multi-part series exploring how markets react to war and crisis. Future posts will include:

Iraq War

Russia-Ukraine 2022

9/11 aftermath

COVID-19 as a “war-like” shock

📌 Follow for the next studies.

🧷 Chart: Gold, SPX & DXY during the Gulf War

🔖 Annotated and structured by fredcast80

As global tensions escalate and risk sentiment deteriorates, it’s worth revisiting how major asset classes behaved during past war scenarios. The Gulf War (July 1990 – March 1991) offers a clean case study with distinct phases of market psychology.

📊 What This Chart Shows

A synchronized visual comparison of:

Gold – Classic safe haven behavior

S&P 500 – Risk asset sentiment

DXY – USD demand during crisis

🧭 Phases Identified

Phase 1 – Shock

📈 Gold spikes | 📉 Stocks crash | 📉 USD weakens

→ Panic phase as markets price in uncertainty

Phase 2 – Consolidation

Market stalls, both risk and safe haven flows stabilize.

Phase 3 – Gradual Risk-On

Equities begin recovering as risk appetite cautiously returns.

Phase 4 – Shake-Off & Parabolic Rally

Gold rolls over, stocks go parabolic, and DXY forms a double bottom.

🔍 Key Insights

🟡 Gold surged +17% in 43 days, then faded

🔴 SPX dropped -17%, then reversed with a +26% rally

🟣 DXY fell -9%, but rebounded sharply later

⏱️ Timing matters: Safe havens perform early — but are not eternal shelters.

💡 Why It Matters Today

If current geopolitical risks evolve into a Gulf War-type scenario, we might observe:

🟡 A first wave into Gold or USD

🔁 A rotation back into risk assets as clarity improves

📈 Opportunities for reversals in oversold names

This chart is not a forecast — it’s a framework. Patterns may not repeat, but they often rhyme.

✍️ Ongoing Series

This is part of a multi-part series exploring how markets react to war and crisis. Future posts will include:

Iraq War

Russia-Ukraine 2022

9/11 aftermath

COVID-19 as a “war-like” shock

📌 Follow for the next studies.

🧷 Chart: Gold, SPX & DXY during the Gulf War

🔖 Annotated and structured by fredcast80

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.