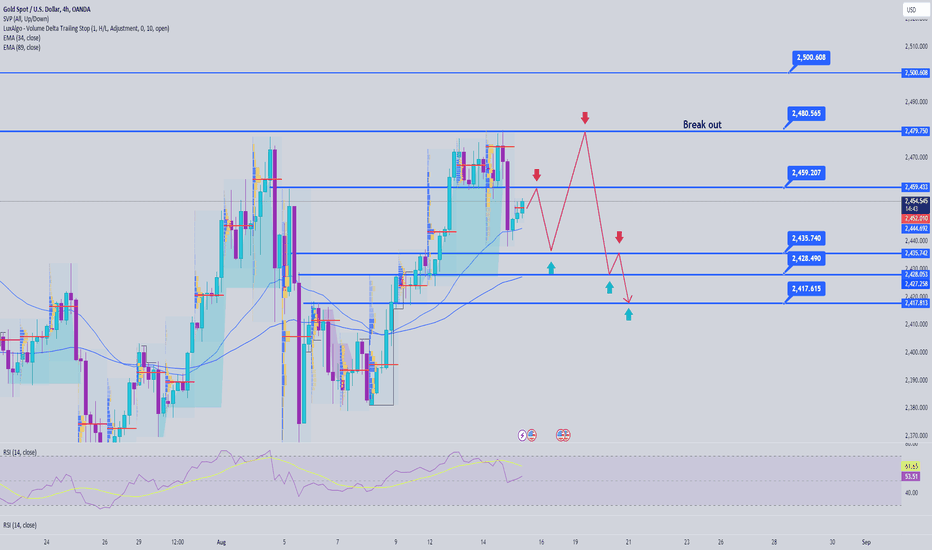

A break below $2,455 on a closing basis would help confirm the start of a fresh down leg within the range, thereby extending the sideways trend. If so, the price will probably move down to $2,400 or perhaps the range floor in the $2,390s. Due to the fact the range is tapering slightly, it might also be a triangle pattern in the final stages of development.

A decisive break above the range ceiling, however, would indicate the development of a more bullish trend. Such a breakout would probably follow through higher to at least $2,550, calculated by taking the 0.618 Fibonacci ratio of the range’s height and extrapolating it higher.

A decisive break would be one characterized by a long green candle that pierced clearly through the level and closed near its high, or three green candles in a row that breached the level.

A decisive break above the range ceiling, however, would indicate the development of a more bullish trend. Such a breakout would probably follow through higher to at least $2,550, calculated by taking the 0.618 Fibonacci ratio of the range’s height and extrapolating it higher.

A decisive break would be one characterized by a long green candle that pierced clearly through the level and closed near its high, or three green candles in a row that breached the level.

Note

Wish you a successful trading dayNote

Gold reverses below $2,500 amid profit-taking, as a key week kicks inGold price is trading below $2,500 in the Asian session on Monday, retreating from fresh record highs of $2,510. Markets resort to profit-taking, gearing up for US S&P Global PMIs, Fed Minutes and Fed Chair Powell's speech this week for fresh policy cues. Mid-East concerns could cap Gold's downside.

JOIN OUR FREE TELEGRAM GROUP t.me/+7rqP7ECMjpUxMzBl

MESSAGE US FOR VIP SIGNALS🏆 t.me/Leilani8597

MESSAGE US FOR VIP SIGNALS🏆 t.me/Leilani8597

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

JOIN OUR FREE TELEGRAM GROUP t.me/+7rqP7ECMjpUxMzBl

MESSAGE US FOR VIP SIGNALS🏆 t.me/Leilani8597

MESSAGE US FOR VIP SIGNALS🏆 t.me/Leilani8597

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.