Spot  XAUUSD ended its rally this week on Friday (July 25) and closed down nearly 1%, mainly affected by the recovery of the US Dollar

XAUUSD ended its rally this week on Friday (July 25) and closed down nearly 1%, mainly affected by the recovery of the US Dollar  DXY and progress in trade negotiations that weakened safe-haven demand.

DXY and progress in trade negotiations that weakened safe-haven demand.

DXY recovered 0.27% on Friday to close at 97.642, ending a two-week low, making gold less attractive than its direct correlation.

Earlier, news of a US-Japan trade deal and a breakthrough in US-EU talks weakened the market's demand for safe-haven assets.

For the content of the US-Japan trade deal, readers can review it in the daily publications during the past trading week.

Data and Fed Expectations

The latest US jobless claims fell to a three-month low, suggesting the job market remains solid. This gives the Federal Reserve reason to maintain interest rates at 4.25%-4.50%, despite President Trump once again pressuring Powell to cut rates.

However, in the short term, the fundamental direction of gold may need to wait for the Federal Reserve to announce more policy signals at its meeting next week.

Speculative Longs Hit High Near April Peak

Data from the U.S. Commodity Futures Trading Commission (CFTC) showed that as of the week of July 22, the speculative net long position in COMEX gold rose by 27,211 lots to 170,868 lots, the highest level since April. This shows that as gold prices fall again, buyers are still actively deploying, waiting for more guidance from policy and data.

Last Week Review and This Week’s Fundamental Outlook

Last week, gold prices initially rose and then fell. Due to risk aversion and volatility in the US dollar, gold prices surpassed the $3,400/ounce mark at the start of the week, but as trade optimism increased and profit-taking emerged, gold prices fell back, trying to stay above $3,300/ounce.

Investors will face several major events this week:

Federal Reserve policy meeting (Wednesday): Markets expect interest rates to remain unchanged, but Powell’s speech could influence market expectations for a rate cut this year.

Macro data will be released in batches: including ADP employment data on Wednesday, PCE price index on Thursday and non-farm payrolls report on Friday. These data will determine the next move of gold.

Global central bank trends: The Bank of Canada and the Bank of Japan also hold policy meetings next week. Investors will be watching to see if their policy signals cause volatility in the US dollar and gold prices.

![GOLD MARKET ANALYSIS AND COMMENTARY - [Jul 28 - Aug 01]](https://tradingview.sweetlogin.com/proxy-s3/0/0IejNEuc_mid.png)

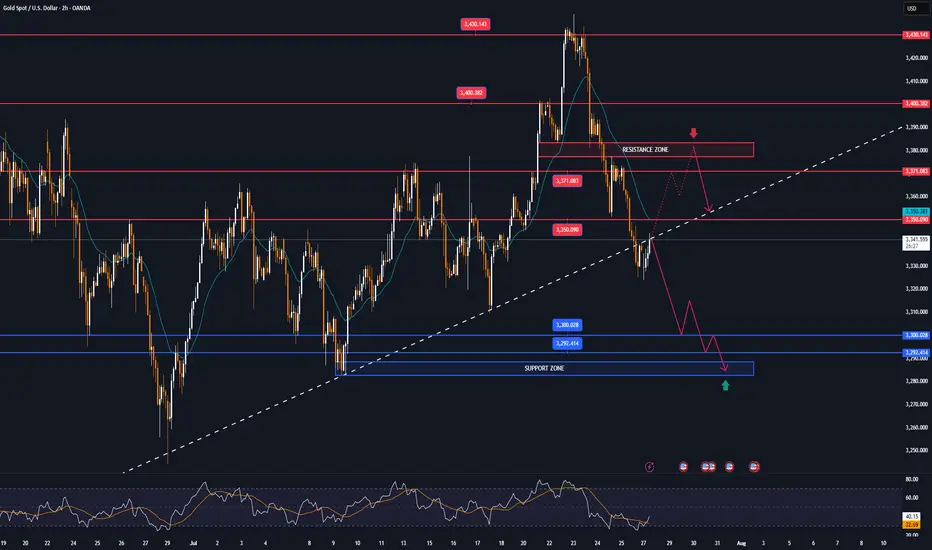

Technical Outlook Analysis XAUUSD

XAUUSD

On the daily chart, gold is in a rather important position after 3 consecutive corrective declines. However, the bearish momentum still keeps gold above the base price, which is an important psychological point for the bullish expectation of 3,300 USD.

In terms of position and indicators, gold has not completely lost the ability for a bullish outlook. Specifically, gold is still in a short-term rising channel and supported by the EMA21. On the other hand, it is still supported by the horizontal support level of 3,310 USD, followed by the psychological level of 3,300 USD and the 0.382% Fibonacci retracement.

Gold will only qualify for a bearish cycle if it sells below the 0.382% Fibonacci retracement level, then the target will be around 3,246 USD in the short term, more than the 0.50% Fibonacci level.

RSI is sloping down, but has not yet crossed the 50 level, and in the current case, the 50 level acts as a momentum support for the RSI. It shows that there is still room for an increase in price, and if RSI sloping up from 50, it will provide a bullish signal with relatively wide room.

If gold rises above the 0.236% Fibonacci retracement level (3,371 USD), it will be eligible for a new bullish cycle with a target of around 3,400 USD in the short term, more than 3,430 – 3,450 USD then the all-time high.

In the coming time, in terms of position and indicators, gold still has a technical outlook leaning more towards the upside and the notable points will be listed as follows.

Support: 3,310 – 3,300 – 3,292 USD

Resistance: 3,350 – 3,371 – 3,400 – 3,430 USD

SELL XAUUSD PRICE 3371 - 3369⚡️

↠↠ Stop Loss 3375

→Take Profit 1 3363

↨

→Take Profit 2 3357

BUY XAUUSD PRICE 3303 - 3305⚡️

↠↠ Stop Loss 3299

→Take Profit 1 3311

↨

→Take Profit 2 3317

DXY recovered 0.27% on Friday to close at 97.642, ending a two-week low, making gold less attractive than its direct correlation.

Earlier, news of a US-Japan trade deal and a breakthrough in US-EU talks weakened the market's demand for safe-haven assets.

For the content of the US-Japan trade deal, readers can review it in the daily publications during the past trading week.

Data and Fed Expectations

The latest US jobless claims fell to a three-month low, suggesting the job market remains solid. This gives the Federal Reserve reason to maintain interest rates at 4.25%-4.50%, despite President Trump once again pressuring Powell to cut rates.

However, in the short term, the fundamental direction of gold may need to wait for the Federal Reserve to announce more policy signals at its meeting next week.

Speculative Longs Hit High Near April Peak

Data from the U.S. Commodity Futures Trading Commission (CFTC) showed that as of the week of July 22, the speculative net long position in COMEX gold rose by 27,211 lots to 170,868 lots, the highest level since April. This shows that as gold prices fall again, buyers are still actively deploying, waiting for more guidance from policy and data.

Last Week Review and This Week’s Fundamental Outlook

Last week, gold prices initially rose and then fell. Due to risk aversion and volatility in the US dollar, gold prices surpassed the $3,400/ounce mark at the start of the week, but as trade optimism increased and profit-taking emerged, gold prices fell back, trying to stay above $3,300/ounce.

Investors will face several major events this week:

Federal Reserve policy meeting (Wednesday): Markets expect interest rates to remain unchanged, but Powell’s speech could influence market expectations for a rate cut this year.

Macro data will be released in batches: including ADP employment data on Wednesday, PCE price index on Thursday and non-farm payrolls report on Friday. These data will determine the next move of gold.

Global central bank trends: The Bank of Canada and the Bank of Japan also hold policy meetings next week. Investors will be watching to see if their policy signals cause volatility in the US dollar and gold prices.

![GOLD MARKET ANALYSIS AND COMMENTARY - [Jul 28 - Aug 01]](https://tradingview.sweetlogin.com/proxy-s3/0/0IejNEuc_mid.png)

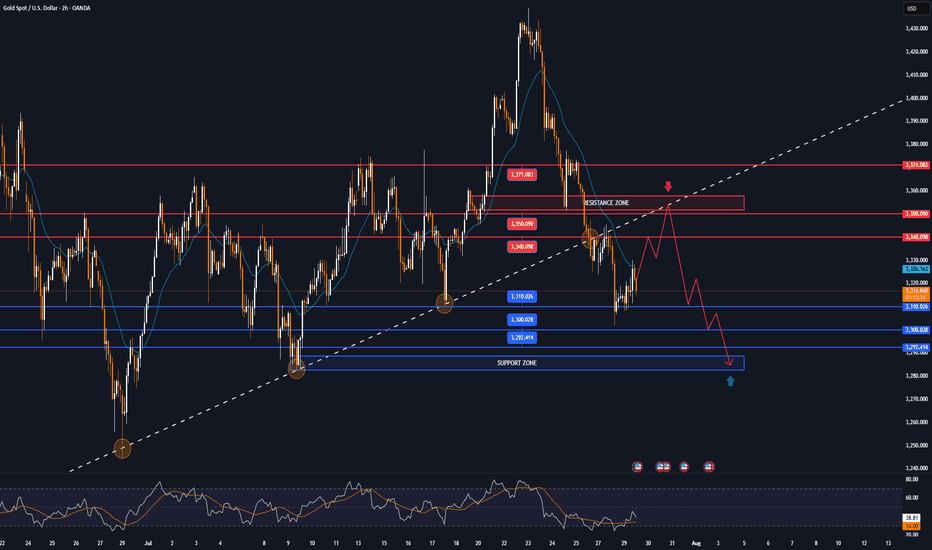

Technical Outlook Analysis

On the daily chart, gold is in a rather important position after 3 consecutive corrective declines. However, the bearish momentum still keeps gold above the base price, which is an important psychological point for the bullish expectation of 3,300 USD.

In terms of position and indicators, gold has not completely lost the ability for a bullish outlook. Specifically, gold is still in a short-term rising channel and supported by the EMA21. On the other hand, it is still supported by the horizontal support level of 3,310 USD, followed by the psychological level of 3,300 USD and the 0.382% Fibonacci retracement.

Gold will only qualify for a bearish cycle if it sells below the 0.382% Fibonacci retracement level, then the target will be around 3,246 USD in the short term, more than the 0.50% Fibonacci level.

RSI is sloping down, but has not yet crossed the 50 level, and in the current case, the 50 level acts as a momentum support for the RSI. It shows that there is still room for an increase in price, and if RSI sloping up from 50, it will provide a bullish signal with relatively wide room.

If gold rises above the 0.236% Fibonacci retracement level (3,371 USD), it will be eligible for a new bullish cycle with a target of around 3,400 USD in the short term, more than 3,430 – 3,450 USD then the all-time high.

In the coming time, in terms of position and indicators, gold still has a technical outlook leaning more towards the upside and the notable points will be listed as follows.

Support: 3,310 – 3,300 – 3,292 USD

Resistance: 3,350 – 3,371 – 3,400 – 3,430 USD

SELL XAUUSD PRICE 3371 - 3369⚡️

↠↠ Stop Loss 3375

→Take Profit 1 3363

↨

→Take Profit 2 3357

BUY XAUUSD PRICE 3303 - 3305⚡️

↠↠ Stop Loss 3299

→Take Profit 1 3311

↨

→Take Profit 2 3317

Note

Gold: Started the week down sharply due to US-EU deal, then recovered.Trade active

Plan BUY +70pips close a part move SL to entry.🔥Trade closed: target reached

Plan BUY Hit Full TP2 + 140pips🤕🤕🤕. Congratulations everyoneNote

Gold prices recovered slightly after a sharp drop, hovering around $3,330/oz, as investors awaited the Fed's interest rate decision, US Q2 GDP data and the ADP employment report. The Fed is expected to keep interest rates unchanged but may send a "dove" signal, especially when the US bond market shows high demand for shelter.Note

Trump Reacts to 3% Q2 GDP: It's Too Late to Cut Rates Now. No Inflation! Let People Buy and Refinance Their Homes!Note

▫️Spot gold price reached 3310 USD/ounce, up 1.07% on the day.Note

Gold prices rose to a record high of $3,314.71 an ounce amid growing global concerns over US-international trade tensions, rising US inflation and escalating geopolitical tensions in the Middle East. President Trump’s executive order to increase import tariffs on many countries has caused investors to flock to gold as a safe haven asset.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.