US President Trump said on Friday he would raise tariffs on steel and aluminium imports from the US to 50% from the current 25% starting June 4. This has once again disrupted international trade, Reuters reported.

A European Commission spokesperson expressed deep regret over the US announcement that it would raise tariffs and said the EU was ready to take countermeasures.

Gold prices surged on Monday to a more than four-week high and continued to rise early this morning (Tuesday, June 3) as geopolitical risks from the conflict between Russia and Ukraine escalated as US President Donald Trump continued to threaten tariffs. Trump doubled tariffs on steel and aluminum imports to 50%, effective June 4, adding to jitters in global markets.

Ukraine launched its biggest drone attack since the war against Ukraine on Sunday, targeting a wide swath of Russian air bases on the eve of a second round of direct talks between the two countries. The drones, hidden in trucks, penetrated deep into Russia and hit strategic airfields as far away as eastern Siberia. At the same time, Moscow launched one of its longest drone and missile strikes on Kiev.

In key US data on Monday, the ISM Manufacturing Purchasing Managers’ Index (PMI) for May showed a contraction in business activity. The ISM Manufacturing Purchasing Managers’ Index for May came in at 48.5, down from 48.7 in April, the lowest reading since November.

Investors will also be closely watching comments from Federal Reserve policymakers this week for clues on the path of U.S. interest rates. Gold tends to benefit in low-interest-rate environments and times of geopolitical tension.

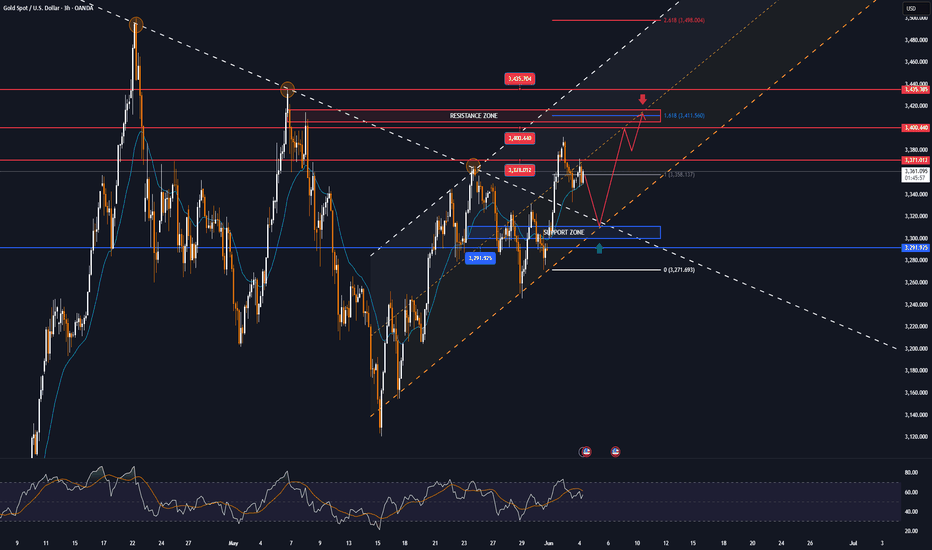

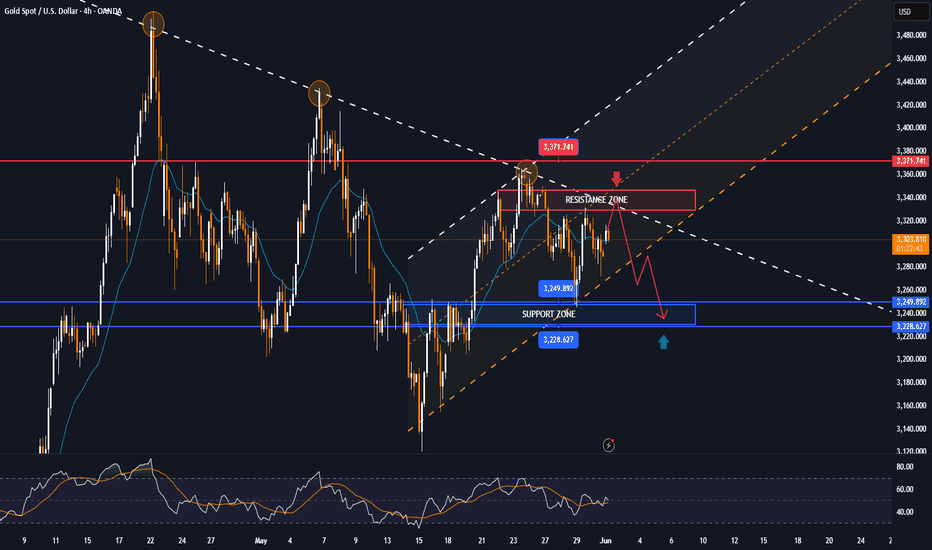

Technical Outlook Analysis

After reaching the target increase at 3,371 USD, gold temporarily decreased slightly but overall it has enough conditions to continue to increase in price towards the next target at 3,400 USD in the coming time.

In the short term, gold also formed an upward price channel, which is noted by the price channel, describing the short-term technical trend. Meanwhile, in terms of momentum, RSI is operating above 50, still quite far from the overbought area, showing that there is still a lot of room for growth ahead.

For the day, the main outlook for gold is bullish, any pullbacks that fail to break below the confluence of the EMA21 with the 0.382% Fibonacci retracement should be considered only as a short-term correction, or a fresh buying opportunity.

Finally, the short-term bullish trend for gold will be focused again on the following positions.

Support: 3,326 – 3,300 – 3,292 USD

Resistance: 3,371 – 3,400 – 3,435 USD

SELL XAUUSD PRICE 3412 - 3410⚡️

↠↠ Stop Loss 3416

→Take Profit 1 3404

↨

→Take Profit 2 3398

BUY XAUUSD PRICE 3324 - 3326⚡️

↠↠ Stop Loss 3320

→Take Profit 1 3332

↨

→Take Profit 2 3338

Note

Spot gold prices fell below $3,360 an ounce, down 0.64% on the day.Note

Spot gold prices fell more than 1.00% on the day and are currently trading at $3,347.21 an ounce.Note

GOLD is reacting negatively to the situation after a positive phone call from TRUMP and XI JINPINGNote

Gold prices fell slightly on June 6 after hitting $3,403 an ounce as signs of cooling from the phone call between Trump and Xi Jinping reduced demand for safe havens.Note

🔴Spot gold prices fell below $3,300/ounce, down 0.35% on the day.Note

▫️Spot gold price reached 3330 USD/ounce, up 0.22% on the day.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.