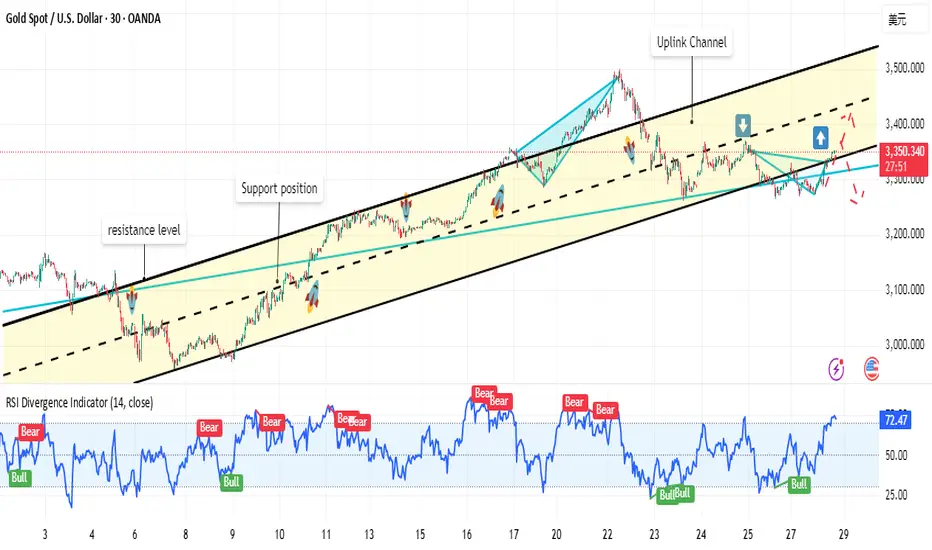

Gold started the new week on a bad note, hitting a low of 3260 in the morning, followed by a small shock adjustment; then it began to rise sharply. As of press time, it has risen to around 3350 and tried to break through the upward resistance.

Although some of gold's safe-haven appeal has weakened, its overall forecast and price trend remain optimistic. Until we see clear lower highs, lower lows, and a solid trade agreement rather than more political bragging from the Trump administration, the possibility of gold setting new highs cannot be underestimated.

Surface calm hides potential risks

Although last week's market movements and today's early trading performance show that the market is calming down, any sense of security is fragile. Under the surface, key risks remain: trade tensions, recession concerns, and uncertainty about monetary policy are real. Ongoing trade negotiations remain a key factor. If the United States sticks to its position on tariffs or the negotiations break down, risk aversion may quickly pick up, boosting demand for gold again.

Quaid's analysis:

Based on last week's market situation, Quaid conducted an analysis of gold's trend this week over the weekend. As I predicted, gold is trying to break through and try a new high.

Gold has risen to around 3350, and 3365 is a key resistance level in the upward trend. If the gold price breaks through this position and can maintain horizontal development, it will continue to rise in a stable situation.

From the upside, the initial resistance level is $3365, followed by $3430. If the bullish momentum is restored, it may soon hit the historical high of $3500 again.

On the contrary, if the price fails to break through the 3365 resistance level, Quaid believes that it is necessary to pay attention to the key support at the 3285 position.

Although some of gold's safe-haven appeal has weakened, its overall forecast and price trend remain optimistic. Until we see clear lower highs, lower lows, and a solid trade agreement rather than more political bragging from the Trump administration, the possibility of gold setting new highs cannot be underestimated.

Surface calm hides potential risks

Although last week's market movements and today's early trading performance show that the market is calming down, any sense of security is fragile. Under the surface, key risks remain: trade tensions, recession concerns, and uncertainty about monetary policy are real. Ongoing trade negotiations remain a key factor. If the United States sticks to its position on tariffs or the negotiations break down, risk aversion may quickly pick up, boosting demand for gold again.

Quaid's analysis:

Based on last week's market situation, Quaid conducted an analysis of gold's trend this week over the weekend. As I predicted, gold is trying to break through and try a new high.

Gold has risen to around 3350, and 3365 is a key resistance level in the upward trend. If the gold price breaks through this position and can maintain horizontal development, it will continue to rise in a stable situation.

From the upside, the initial resistance level is $3365, followed by $3430. If the bullish momentum is restored, it may soon hit the historical high of $3500 again.

On the contrary, if the price fails to break through the 3365 resistance level, Quaid believes that it is necessary to pay attention to the key support at the 3285 position.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.