This week, the international  XAUUSD price increased quite strongly from 3,352 USD/oz to 3,453 USD/oz. The reason for the continued increase in gold price is because investors are still expecting the FED to cut interest rates by 0.25% at the upcoming September meeting, as well as the conflict between the Trump administration and the FED.

XAUUSD price increased quite strongly from 3,352 USD/oz to 3,453 USD/oz. The reason for the continued increase in gold price is because investors are still expecting the FED to cut interest rates by 0.25% at the upcoming September meeting, as well as the conflict between the Trump administration and the FED.

Next week, financial markets in the US will be closed for Labor Day on Monday. On Tuesday, the Institute for Supply Management (ISM) will release its manufacturing PMI data. The PMI is forecast to increase slightly to 48.6 in August from 48 in July. If the forecast is correct, it will have a negative impact on gold prices next week.

In addition, on Friday, the US will release the August non-farm payrolls (NFP) report. If the NFP continues to decline compared to the expected 74,000 jobs, it will force the Fed to cut interest rates in September, which will have a positive impact on gold prices next week. On the contrary, a stronger-than-expected NFP growth, combined with an unchanged unemployment rate of 4.2%, could make the market tilt towards the Fed continuing to delay interest rate cuts, causing gold prices to fall next week. However, given the current US economic situation, the August NFP may continue to decline.

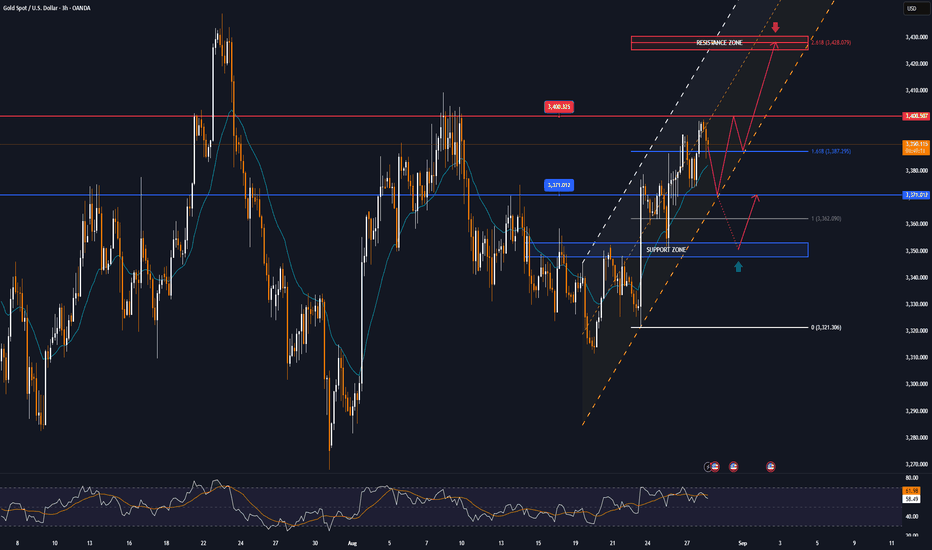

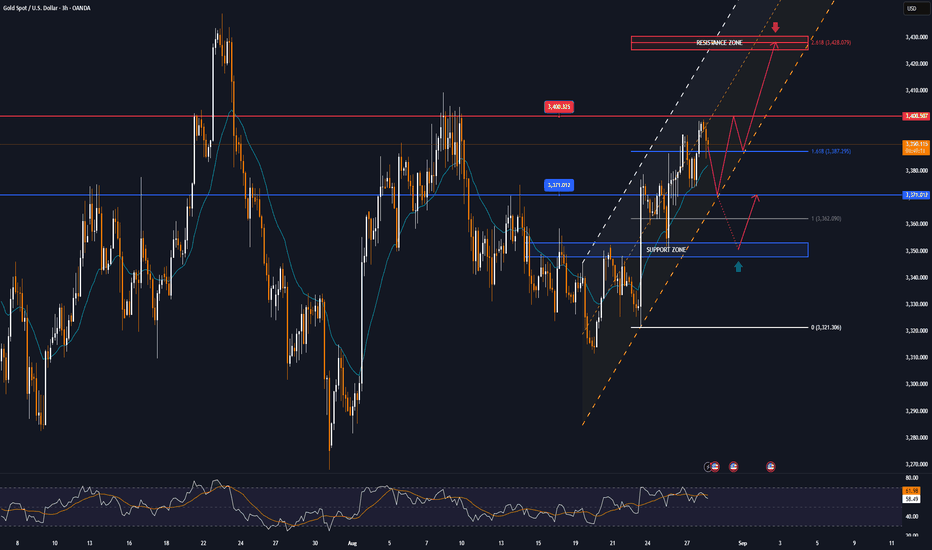

📌Technically, on the H4 chart, the gold price broke the Trendline and it is likely that the price will continue to increase to near the threshold of 3500 USD/oz. In case the price corrects again, it will return to the resistance zone at the threshold of 3370.

Notable technical levels are listed below.

Support: 3,430 – 3,400 – 3,371USD

Resistance: 3,450 – 3,500USD

SELL XAUUSD PRICE 3541 - 3539⚡️

↠↠ Stop Loss 3545

BUY XAUUSD PRICE 3369 - 3371⚡️

↠↠ Stop Loss 3365

Next week, financial markets in the US will be closed for Labor Day on Monday. On Tuesday, the Institute for Supply Management (ISM) will release its manufacturing PMI data. The PMI is forecast to increase slightly to 48.6 in August from 48 in July. If the forecast is correct, it will have a negative impact on gold prices next week.

In addition, on Friday, the US will release the August non-farm payrolls (NFP) report. If the NFP continues to decline compared to the expected 74,000 jobs, it will force the Fed to cut interest rates in September, which will have a positive impact on gold prices next week. On the contrary, a stronger-than-expected NFP growth, combined with an unchanged unemployment rate of 4.2%, could make the market tilt towards the Fed continuing to delay interest rate cuts, causing gold prices to fall next week. However, given the current US economic situation, the August NFP may continue to decline.

📌Technically, on the H4 chart, the gold price broke the Trendline and it is likely that the price will continue to increase to near the threshold of 3500 USD/oz. In case the price corrects again, it will return to the resistance zone at the threshold of 3370.

Notable technical levels are listed below.

Support: 3,430 – 3,400 – 3,371USD

Resistance: 3,450 – 3,500USD

SELL XAUUSD PRICE 3541 - 3539⚡️

↠↠ Stop Loss 3545

BUY XAUUSD PRICE 3369 - 3371⚡️

↠↠ Stop Loss 3365

Note

▫️Spot gold lost the $3,440/ounce mark, down 0.23% on the day.Note

Gold hit a record high of $3,578 an ounce on Wednesday before retreating to $3,550 on profit-taking and concerns ahead of the U.S. jobs report. Recent weak jobs data reinforced expectations of an early Fed rate cut, supporting safe-haven demand for gold.Note

▫️Spot gold price reached 3590 USD/ounce, up 0.10% on the day.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

![GOLD MARKET ANALYSIS AND COMMENTARY - [Sep 08 - Sep 12]](https://tradingview.sweetlogin.com/proxy-s3/p/P2GgsvtS_mid.png)