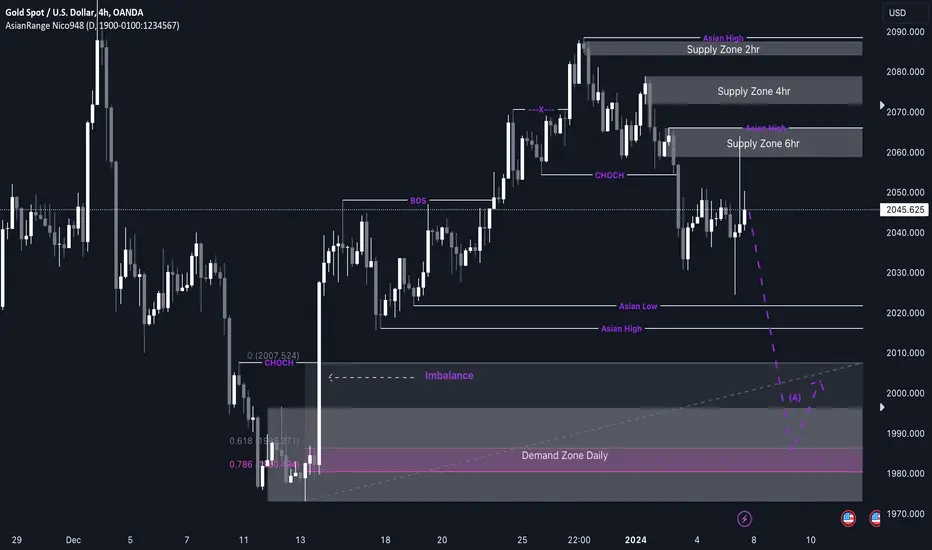

Following the recent interaction with my 6hr supply zone during the NFP event, I anticipate a further downward movement in price to clear the pool of liquidity below and eventually reach my Daily Demand zone. Once there, I'll be on the lookout for significant buying opportunities to support a continuation of the bullish trend.

While I recognize it may take some time to reach that point, I'll promptly identify a new supply zone if price breaks the structure to the downside. This will become my new Point of Interest (POI) for potential counter-trend sells back down to the demand level

Confluences for GOLD buys are as follows:

- Bullish pressure weakens, evident in a CHOCH and confirmed by a BOS

- A daily demand zone below triggered a break of structure to the upside.

- The market trend is bullish, aligning with this idea.

- Imbalance above the demand signals favourable reaction at my POI.

- Abundant liquidity above, including trend lines and untouched Asian highs.

- Price needs to dip to a significant demand level for an upward rally to persist.

P.S.While my Point of Interest (POI) seems likely, I wouldn't be shocked if the price rises and retests the 6hr supply, reaching a new supply level located just above the old zone on the 4-hourly. In such a scenario, I anticipate a bearish reaction if the price decides to move upward to that area.

Hope everyone has a profitable first month!

While I recognize it may take some time to reach that point, I'll promptly identify a new supply zone if price breaks the structure to the downside. This will become my new Point of Interest (POI) for potential counter-trend sells back down to the demand level

Confluences for GOLD buys are as follows:

- Bullish pressure weakens, evident in a CHOCH and confirmed by a BOS

- A daily demand zone below triggered a break of structure to the upside.

- The market trend is bullish, aligning with this idea.

- Imbalance above the demand signals favourable reaction at my POI.

- Abundant liquidity above, including trend lines and untouched Asian highs.

- Price needs to dip to a significant demand level for an upward rally to persist.

P.S.While my Point of Interest (POI) seems likely, I wouldn't be shocked if the price rises and retests the 6hr supply, reaching a new supply level located just above the old zone on the 4-hourly. In such a scenario, I anticipate a bearish reaction if the price decides to move upward to that area.

Hope everyone has a profitable first month!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.