Summary:  XAUUSD fell sharply in Asian trading on Wednesday (August 27), after rising sharply in the previous session. Prices are currently trading around $3,374/oz, down nearly $20 on the day.

XAUUSD fell sharply in Asian trading on Wednesday (August 27), after rising sharply in the previous session. Prices are currently trading around $3,374/oz, down nearly $20 on the day.

XAUUSD is retreating from a two-week high near $3,400/oz after hitting that high on Wednesday morning. However, concerns about the Federal Reserve's autonomy and the latest U.S. tariff threats could ease the downward pressure on gold.

XAUUSD is retreating from a two-week high near $3,400/oz after hitting that high on Wednesday morning. However, concerns about the Federal Reserve's autonomy and the latest U.S. tariff threats could ease the downward pressure on gold.

The US Dollar DXY rebounded on Wednesday, putting pressure on gold prices. However, the dollar's gains appeared to be limited by concerns about the Federal Reserve and tariffs.

DXY rebounded on Wednesday, putting pressure on gold prices. However, the dollar's gains appeared to be limited by concerns about the Federal Reserve and tariffs.

XAUUSD may be buying lower as investors look to buy on dips. Gold prices had earlier surged to a two-week high on Tuesday as US President Donald Trump announced the firing of Federal Reserve Governor Tim Cook, shaking investor confidence in the Fed's independence and boosting demand for safe havens.

XAUUSD may be buying lower as investors look to buy on dips. Gold prices had earlier surged to a two-week high on Tuesday as US President Donald Trump announced the firing of Federal Reserve Governor Tim Cook, shaking investor confidence in the Fed's independence and boosting demand for safe havens.

Additionally, Bloomberg reported on Tuesday that U.S. President Trump has threatened to impose new tariffs and export restrictions on advanced technologies and semiconductors in retaliation for other countries imposing digital services taxes on U.S. tech companies. Trump’s recent trade brinkmanship has reignited tariff uncertainty among U.S. trading partners. Earlier this month, shortly after concluding negotiations with dozens of partners on tariffs targeting specific countries, Trump announced new tariffs on a range of imported products. Last week, he said he would impose new tariffs on imported furniture.

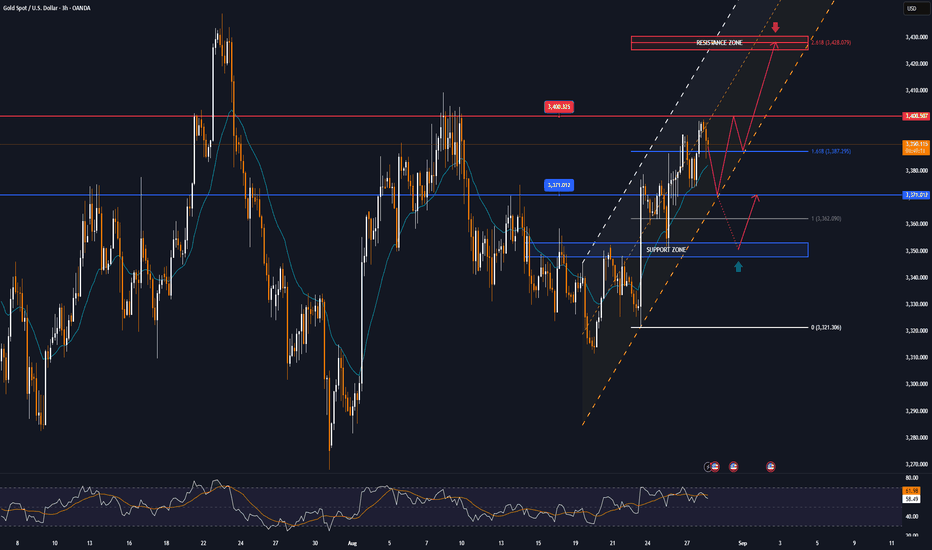

Technical Outlook Analysis XAUUSD

XAUUSD

Gold has yet to reach its upside target at the $3,400 base level, but has come under some pressure as it approaches this level and has declined in early trading today. Spot gold is currently trading at $3,376, close to the 0.236% Fibonacci retracement level. After breaking above the 0.236% Fibonacci retracement level, this Fibonacci level now acts as the closest technical support, below which gold could retest the 21-day EMA at around $3,350.

As mentioned to readers throughout the past publications, the overall trend of gold is still in a sideways accumulation phase. This is shown by the fact that RSI is hovering around 50, showing that the market sentiment is still hesitant in terms of momentum. When gold has enough conditions for a long-term trend, I will update readers quickly, but currently in the short term, gold has some technical factors supporting the possibility of price increases, with support at Fibonacci 0.236% and EMA21 and RSI above 50.

However, short-term open positions should still be prioritized during this period of sideways accumulation, along with the notable points that will be listed as follows.

Support: 3,371 – 3,350 USD

Resistance: 3,400 – 3,430 USD

SELL XAUUSD PRICE 3430 - 3428⚡️

↠↠ Stop Loss 3434

→Take Profit 1 3322

↨

→Take Profit 2 3316

BUY XAUUSD PRICE 3350 - 3352⚡️

↠↠ Stop Loss 3346

→Take Profit 1 3358

↨

→Take Profit 2 3364

The US Dollar

Additionally, Bloomberg reported on Tuesday that U.S. President Trump has threatened to impose new tariffs and export restrictions on advanced technologies and semiconductors in retaliation for other countries imposing digital services taxes on U.S. tech companies. Trump’s recent trade brinkmanship has reignited tariff uncertainty among U.S. trading partners. Earlier this month, shortly after concluding negotiations with dozens of partners on tariffs targeting specific countries, Trump announced new tariffs on a range of imported products. Last week, he said he would impose new tariffs on imported furniture.

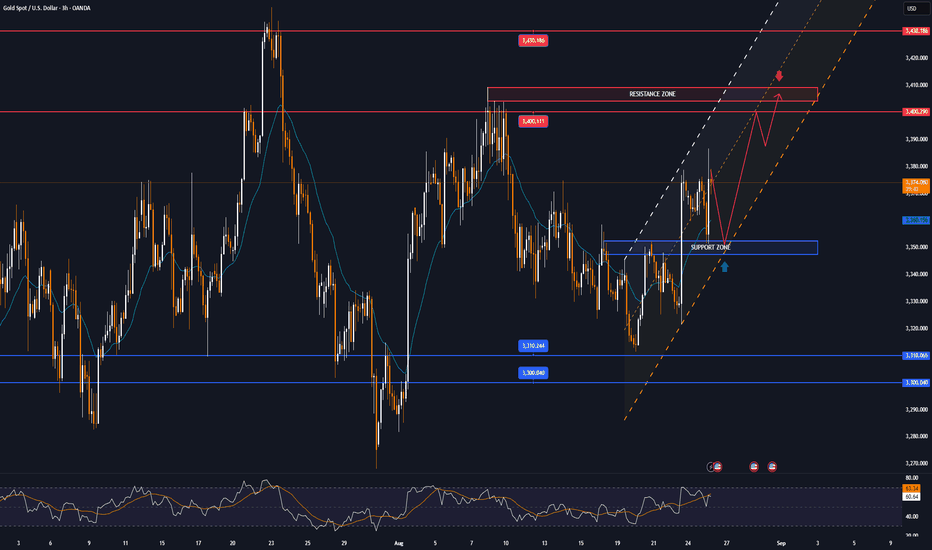

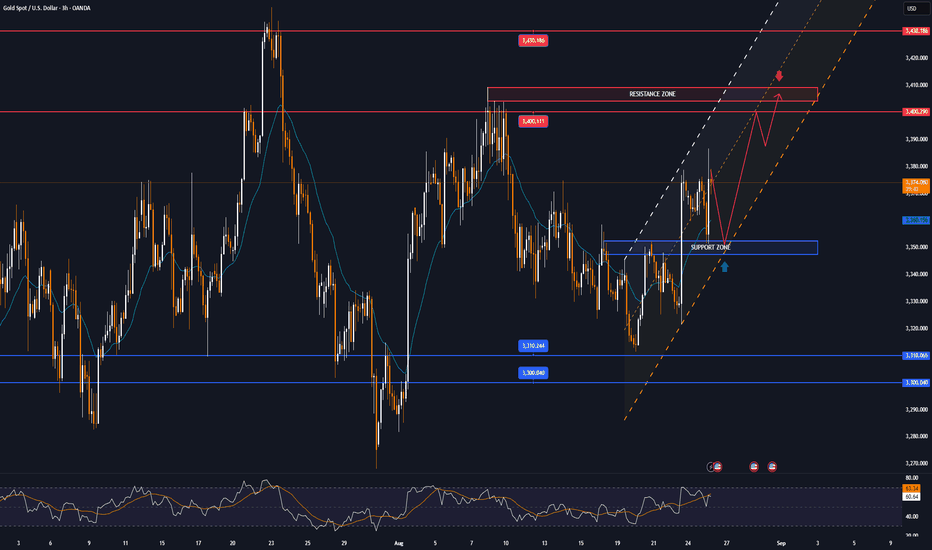

Technical Outlook Analysis

Gold has yet to reach its upside target at the $3,400 base level, but has come under some pressure as it approaches this level and has declined in early trading today. Spot gold is currently trading at $3,376, close to the 0.236% Fibonacci retracement level. After breaking above the 0.236% Fibonacci retracement level, this Fibonacci level now acts as the closest technical support, below which gold could retest the 21-day EMA at around $3,350.

As mentioned to readers throughout the past publications, the overall trend of gold is still in a sideways accumulation phase. This is shown by the fact that RSI is hovering around 50, showing that the market sentiment is still hesitant in terms of momentum. When gold has enough conditions for a long-term trend, I will update readers quickly, but currently in the short term, gold has some technical factors supporting the possibility of price increases, with support at Fibonacci 0.236% and EMA21 and RSI above 50.

However, short-term open positions should still be prioritized during this period of sideways accumulation, along with the notable points that will be listed as follows.

Support: 3,371 – 3,350 USD

Resistance: 3,400 – 3,430 USD

SELL XAUUSD PRICE 3430 - 3428⚡️

↠↠ Stop Loss 3434

→Take Profit 1 3322

↨

→Take Profit 2 3316

BUY XAUUSD PRICE 3350 - 3352⚡️

↠↠ Stop Loss 3346

→Take Profit 1 3358

↨

→Take Profit 2 3364

Note

Gold prices remained below $3,400 an ounce as investors remained cautious ahead of PCE data – a key inflation measure that will determine expectations for a September Fed rate cut.Note

▫️Spot gold lost the $3,440/ounce mark, down 0.23% on the day.Note

Gold hit a record high of $3,578 an ounce on Wednesday before retreating to $3,550 on profit-taking and concerns ahead of the U.S. jobs report. Recent weak jobs data reinforced expectations of an early Fed rate cut, supporting safe-haven demand for gold.Note

▫️Spot gold price reached 3590 USD/ounce, up 0.10% on the day.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.