👋 Hello traders,

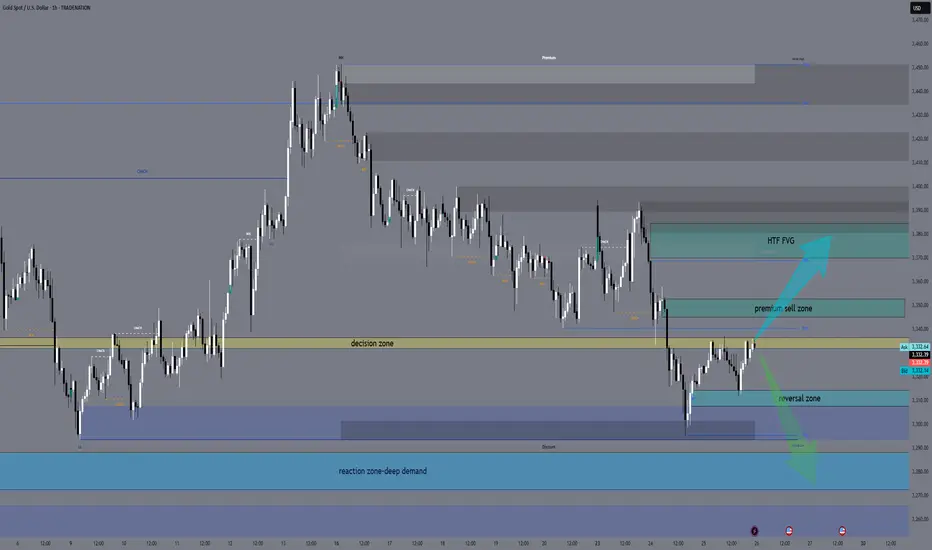

Gold is currently consolidating after recent downside liquidity sweeps, and Thursday brings high-impact USD catalysts. Let’s break it down and build a precise plan for sniper entries around these volatile zones. We’re trading structure, not noise — eyes on the prize. 🎯

🔸 HTF Outlook (D1 → H4 → H1)

🌐 Macro & Geopolitical Context

Markets are bracing for:

USD Unemployment Claims (Forecast: 244K, previous: 245K)

Final GDP q/q and Durable Goods Orders

Fed speakers (Barkin, Barr, Harker)

Stronger-than-expected data could reinforce USD bullish sentiment, sending gold down. Weaker reports + dovish Fed = bullish pressure on gold.

🗺️ Daily Bias: Neutral to Bullish

Price is ranging above a key CHoCH low + Daily OB (3272–3288)

Strong bullish continuation only confirmed with a break above 3370–3384

FIBO: 50% retracement of the last swing is near 3310, giving structure to Buy Zone 1

Bias: Bullish as long as 3272 holds — PA supports HL structure above imbalance

🕓 H4 Bias: Bearish Pullback

CHoCH at 3384 → clean Lower High + price failed to close above premium FVG

Pullback testing EMA 50/100 + FVG at 3345

FIBO extension zone at 161.8% aligns near 3288 = reactive downside target

Bias: Reactive bearish under 3352. If 3370 breaks cleanly → short invalid.

🕐 H1 Bias: Bullish Short-Term

CHoCH → HL printed at 3310 → higher lows forming toward supply

EMA 21/50 crossed to the upside, RSI mid-range (50–60)

PA structure showing ascending triangle under resistance

Bias: Bullish continuation valid toward 3352–3370, unless breakdown under 3308

🔸 LTF Precision (M30 → M15)

🔹 Sell Zone 1 – 3352–3345

H1 OB + M15 FVG + upper range sweep

RSI expected to peak near 70 → potential divergence

FIBO: 78.6% retracement of previous bearish leg

PA: Watch for M15 liquidity sweep + bearish engulfing

🔸 Entry: Wait for break/retest → confirmation on M5–M15 BOS

🔹 Sell Zone 2 – 3370–3384

HTF premium imbalance zone + weak high above

RSI likely in exhaustion zone

FIBO extension 1.272–1.618 completes inside this supply

PA: Only enter after stop hunt wick + clear CHoCH (M5)

🔸 Entry: Reactive fade after liquidity trap

🔸 Buy Zone 1 – 3308–3313

H1 CHoCH + OB + EQ zone

RSI bounce zone (30–40)

FIBO 50–61.8% retracement of bullish swing

PA: Watch for M15 bullish engulfing or double bottom formation

🔸 Entry: Only on structure break + retest confirmation

🔸 Buy Zone 2 – 3288–3272

Daily OB + HTF FVG + massive imbalance

RSI expected to overshoot under 30

FIBO: 1.618 extension from previous M15 bullish leg

PA: High-RR reversal zone if flushed by NY open

🔸 Entry: Enter only after M5 CHoCH or strong engulfing near the OB

⚖️ Decision Zone – 3333–3336

Previous supply turned EQ zone

PA shows indecision — do not enter here

Useful for monitoring if price holds support or rejects

🔸 Trade Scenarios

🟢 Bullish Scenario

If USD data is weak:

Flush to 3308 or 3288

Confirm HL formation → sniper buy from OB → aim 3345+, possibly 3370 sweep

🔴 Bearish Scenario

If USD prints strong:

Price spikes into 3352 or 3370 zones → rejection + BOS

Sniper short entry → targets 3310 → 3288

🔸 Final Plan & Action Points

✅ Patience is key during news. Let structure confirm.

✅ Track price behavior near 14:30 CEST, avoid instant spikes.

✅ Best sniper RR zones:

🔹 Sell from 3352 or 3370

🔸 Buy from 3308 or 3288

📊 Precision matters. Structure wins.

👍 Like this if it helped you map the move, and 🔔 follow for tomorrow’s sniper entry.

— GoldFxMinds

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Gold is currently consolidating after recent downside liquidity sweeps, and Thursday brings high-impact USD catalysts. Let’s break it down and build a precise plan for sniper entries around these volatile zones. We’re trading structure, not noise — eyes on the prize. 🎯

🔸 HTF Outlook (D1 → H4 → H1)

🌐 Macro & Geopolitical Context

Markets are bracing for:

USD Unemployment Claims (Forecast: 244K, previous: 245K)

Final GDP q/q and Durable Goods Orders

Fed speakers (Barkin, Barr, Harker)

Stronger-than-expected data could reinforce USD bullish sentiment, sending gold down. Weaker reports + dovish Fed = bullish pressure on gold.

🗺️ Daily Bias: Neutral to Bullish

Price is ranging above a key CHoCH low + Daily OB (3272–3288)

Strong bullish continuation only confirmed with a break above 3370–3384

FIBO: 50% retracement of the last swing is near 3310, giving structure to Buy Zone 1

Bias: Bullish as long as 3272 holds — PA supports HL structure above imbalance

🕓 H4 Bias: Bearish Pullback

CHoCH at 3384 → clean Lower High + price failed to close above premium FVG

Pullback testing EMA 50/100 + FVG at 3345

FIBO extension zone at 161.8% aligns near 3288 = reactive downside target

Bias: Reactive bearish under 3352. If 3370 breaks cleanly → short invalid.

🕐 H1 Bias: Bullish Short-Term

CHoCH → HL printed at 3310 → higher lows forming toward supply

EMA 21/50 crossed to the upside, RSI mid-range (50–60)

PA structure showing ascending triangle under resistance

Bias: Bullish continuation valid toward 3352–3370, unless breakdown under 3308

🔸 LTF Precision (M30 → M15)

🔹 Sell Zone 1 – 3352–3345

H1 OB + M15 FVG + upper range sweep

RSI expected to peak near 70 → potential divergence

FIBO: 78.6% retracement of previous bearish leg

PA: Watch for M15 liquidity sweep + bearish engulfing

🔸 Entry: Wait for break/retest → confirmation on M5–M15 BOS

🔹 Sell Zone 2 – 3370–3384

HTF premium imbalance zone + weak high above

RSI likely in exhaustion zone

FIBO extension 1.272–1.618 completes inside this supply

PA: Only enter after stop hunt wick + clear CHoCH (M5)

🔸 Entry: Reactive fade after liquidity trap

🔸 Buy Zone 1 – 3308–3313

H1 CHoCH + OB + EQ zone

RSI bounce zone (30–40)

FIBO 50–61.8% retracement of bullish swing

PA: Watch for M15 bullish engulfing or double bottom formation

🔸 Entry: Only on structure break + retest confirmation

🔸 Buy Zone 2 – 3288–3272

Daily OB + HTF FVG + massive imbalance

RSI expected to overshoot under 30

FIBO: 1.618 extension from previous M15 bullish leg

PA: High-RR reversal zone if flushed by NY open

🔸 Entry: Enter only after M5 CHoCH or strong engulfing near the OB

⚖️ Decision Zone – 3333–3336

Previous supply turned EQ zone

PA shows indecision — do not enter here

Useful for monitoring if price holds support or rejects

🔸 Trade Scenarios

🟢 Bullish Scenario

If USD data is weak:

Flush to 3308 or 3288

Confirm HL formation → sniper buy from OB → aim 3345+, possibly 3370 sweep

🔴 Bearish Scenario

If USD prints strong:

Price spikes into 3352 or 3370 zones → rejection + BOS

Sniper short entry → targets 3310 → 3288

🔸 Final Plan & Action Points

✅ Patience is key during news. Let structure confirm.

✅ Track price behavior near 14:30 CEST, avoid instant spikes.

✅ Best sniper RR zones:

🔹 Sell from 3352 or 3370

🔸 Buy from 3308 or 3288

📊 Precision matters. Structure wins.

👍 Like this if it helped you map the move, and 🔔 follow for tomorrow’s sniper entry.

— GoldFxMinds

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD ⭐

Telegram: t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD ⭐

Telegram: t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD ⭐

Telegram: t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD ⭐

Telegram: t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.