Based on various factors, the outlook for gold prices in the medium and long term appears bullish.

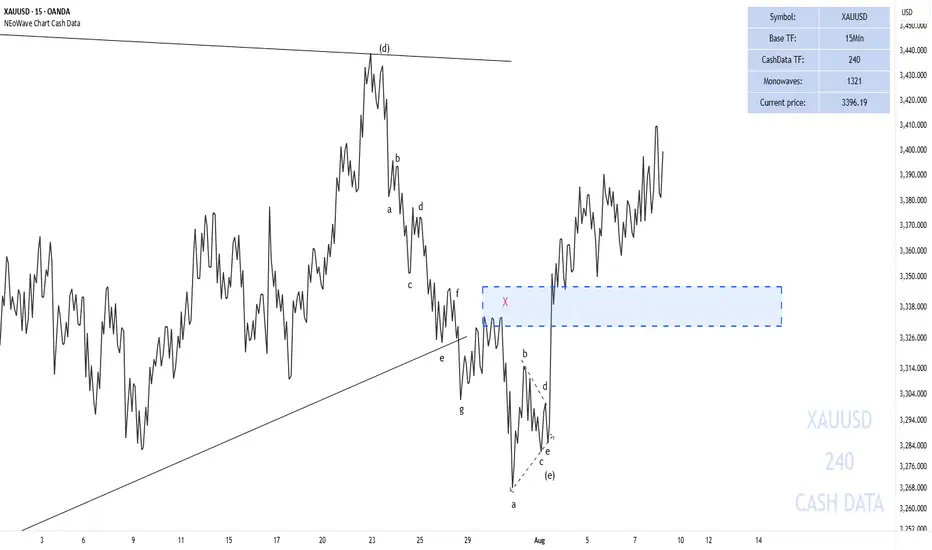

- From a technical analysis perspective, gold has the potential to move toward $3,500 and beyond, although the momentum of the recent upward trend has slightly weakened, suggesting a possible short-term price correction. If a correction occurs in the short term, it could reach the $3,346–$3,300 range, but gold is unlikely to fall below $3,268. Any pullback to these support levels could present a buying opportunity, as previously mentioned.

- Economic reports and the likelihood of interest rate cuts by the Federal Reserve (expected 50 basis point reduction by the end of 2025) due to projected global inflation above 5% enhance gold’s appeal as a non-yielding asset. Geopolitical issues, including U.S.-China trade tensions, new tariffs (e.g., 25% tariffs on Indian imports due to oil purchases from Russia), and concerns about an economic recession, have bolstered demand for gold as a safe-haven asset. Forecasts such as Goldman Sachs’ ($3,700 by the end of 2025) and J.P. Morgan’s ($4,000 by mid-2026) further support this bullish outlook.

- In the long term, factors such as the declining value of the dollar, rising investment demand (ETFs saw a 98.54% inflow increase in February 2025), and consistent purchases by central banks make gold an attractive option for investors. Therefore, as previously noted, any price pullback can be considered an opportunity to enter the market, particularly given the potential for investors to flock to gold amid unstable economic and geopolitical conditions.

Note:

This analysis is a personal opinion and not investment advice.

Good luck

NEoWave Chart

- From a technical analysis perspective, gold has the potential to move toward $3,500 and beyond, although the momentum of the recent upward trend has slightly weakened, suggesting a possible short-term price correction. If a correction occurs in the short term, it could reach the $3,346–$3,300 range, but gold is unlikely to fall below $3,268. Any pullback to these support levels could present a buying opportunity, as previously mentioned.

- Economic reports and the likelihood of interest rate cuts by the Federal Reserve (expected 50 basis point reduction by the end of 2025) due to projected global inflation above 5% enhance gold’s appeal as a non-yielding asset. Geopolitical issues, including U.S.-China trade tensions, new tariffs (e.g., 25% tariffs on Indian imports due to oil purchases from Russia), and concerns about an economic recession, have bolstered demand for gold as a safe-haven asset. Forecasts such as Goldman Sachs’ ($3,700 by the end of 2025) and J.P. Morgan’s ($4,000 by mid-2026) further support this bullish outlook.

- In the long term, factors such as the declining value of the dollar, rising investment demand (ETFs saw a 98.54% inflow increase in February 2025), and consistent purchases by central banks make gold an attractive option for investors. Therefore, as previously noted, any price pullback can be considered an opportunity to enter the market, particularly given the potential for investors to flock to gold amid unstable economic and geopolitical conditions.

Note:

This analysis is a personal opinion and not investment advice.

Good luck

NEoWave Chart

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.