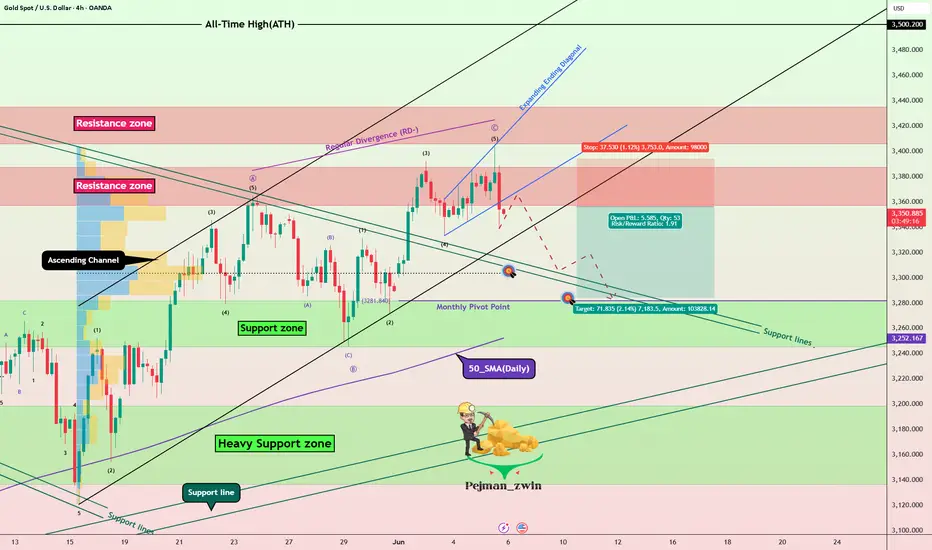

Gold( XAUUSD) rose to $3,400, as I expected in my previous idea.

XAUUSD) rose to $3,400, as I expected in my previous idea.

Gold is trading near the Resistance zone($3,387-$3,357) and has failed to break the resistance zone validly.

In terms of Elliott Wave theory, it seems that Gold has managed to complete the microwave 5 of the main wave C with the help of Expanding Ending Diagonal. It was a corrective Zigzag(ABC/5-3-5) structure.

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks.

I expect Gold to touch $3,305 after breaking the lower line of the ascending channel at the first target and then decline to the Support zone($3,281-$3,245) and Monthly Pivot Point.

Note: Stop Loss(SL)= 3394.000

Gold Analyze ( XAUUSD ), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Gold is trading near the Resistance zone($3,387-$3,357) and has failed to break the resistance zone validly.

In terms of Elliott Wave theory, it seems that Gold has managed to complete the microwave 5 of the main wave C with the help of Expanding Ending Diagonal. It was a corrective Zigzag(ABC/5-3-5) structure.

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks.

I expect Gold to touch $3,305 after breaking the lower line of the ascending channel at the first target and then decline to the Support zone($3,281-$3,245) and Monthly Pivot Point.

Note: Stop Loss(SL)= 3394.000

Gold Analyze ( XAUUSD ), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Trade active

Trade was activated = Entry Point(EP) = $3,356.470Note

Today, June 6 – Key U.S. Labor Market Data Ahead!Average Hourly Earnings m/m (Forecast: 0.3%)

Non-Farm Payrolls (Forecast: 126K)

Unemployment Rate (Forecast: 4.2%)

These are high-impact releases that often drive sharp price moves in Gold

A weaker jobs report may fuel speculation of earlier Fed rate cuts → bullish for XAU.

A stronger report could support USD strength → short-term pressure on risk assets.

Volatility expected near the release (4:30pm UTC). Use proper risk management and avoid emotional decisions.

Note

U.S. Jobs Data Just Released (Update)Average Hourly Earnings rose 0.4%, stronger than expected (0.3%)

Non-Farm Payrolls came in at 139K, slightly above forecast (126K)

Unemployment Rate remains steady at 4.2%

Wage inflation is still strong, adding pressure to the Fed’s rate cut path.

NFP data shows moderate labor market strength, but not overly hot.

Gold may face selling pressure due to a stronger USD.

🎁Welcome than a 50% bonus(Low Spread)👉vtm.pro/Y3AV7r

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🎁Welcome than a 50% bonus(Low Spread)👉vtm.pro/Y3AV7r

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.