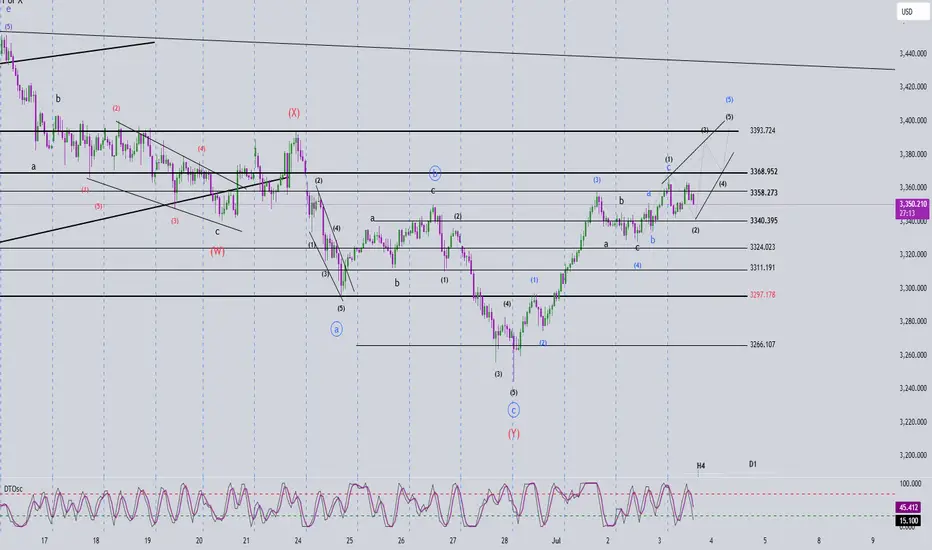

🌀 Elliott Wave Structure

On the H1 chart, wave 3 appears to have completed, and price is now entering a phase with an unusual structural behavior.

Wave 3 previously showed strong momentum, moving steeply and continuously, with no clear internal pullbacks – a classic impulse wave. Following this, we observed a corrective abc pattern in black, suggesting the end of wave 3.

Interestingly, although yesterday's ADP report was extremely bullish, gold only managed a mild breakout above the wave 3 high before pulling back this morning. Notably, the upward move followed a 3-wave abc structure in green, and price action is now showing overlapping waves with no clear directional momentum.

🧩 These signs suggest a high probability that:

🔹 Wave 5 is forming as an Ending Diagonal – a 5-wave structure with a 3-3-3-3-3 pattern.

🔹 This is typically seen at the end of a bullish cycle and often precedes a sharp reversal.

Although it's too early to confirm, we should patiently observe the upcoming price action. If the ending diagonal completes, it may present a strong sell opportunity.

🎯 Target for wave 5: around 3395, provided all 5 sub-waves within the diagonal complete.

⚠️ If price breaks below 3324, we must consider that the full 5-wave structure is already done, and a new abc corrective phase may have begun.

🔍 Momentum Analysis

Daily (D1): Momentum is about to turn bearish from overbought territory → suggests a weakening uptrend.

H4: Momentum is turning upward → likely a mild rally or sideways movement today before H4 reaches overbought again.

📌 Trading Plan

Given the current wave behavior and overlapping structure, it is best to remain patient and wait for confirmation before taking a strong position. If the Ending Diagonal structure is confirmed, it could signal a major reversal.

SELL Zone: 3392 – 3395

Stop Loss: 3403

Take Profits:

• TP1: 3368

• TP2: 3340

• TP3: 3324

On the H1 chart, wave 3 appears to have completed, and price is now entering a phase with an unusual structural behavior.

Wave 3 previously showed strong momentum, moving steeply and continuously, with no clear internal pullbacks – a classic impulse wave. Following this, we observed a corrective abc pattern in black, suggesting the end of wave 3.

Interestingly, although yesterday's ADP report was extremely bullish, gold only managed a mild breakout above the wave 3 high before pulling back this morning. Notably, the upward move followed a 3-wave abc structure in green, and price action is now showing overlapping waves with no clear directional momentum.

🧩 These signs suggest a high probability that:

🔹 Wave 5 is forming as an Ending Diagonal – a 5-wave structure with a 3-3-3-3-3 pattern.

🔹 This is typically seen at the end of a bullish cycle and often precedes a sharp reversal.

Although it's too early to confirm, we should patiently observe the upcoming price action. If the ending diagonal completes, it may present a strong sell opportunity.

🎯 Target for wave 5: around 3395, provided all 5 sub-waves within the diagonal complete.

⚠️ If price breaks below 3324, we must consider that the full 5-wave structure is already done, and a new abc corrective phase may have begun.

🔍 Momentum Analysis

Daily (D1): Momentum is about to turn bearish from overbought territory → suggests a weakening uptrend.

H4: Momentum is turning upward → likely a mild rally or sideways movement today before H4 reaches overbought again.

📌 Trading Plan

Given the current wave behavior and overlapping structure, it is best to remain patient and wait for confirmation before taking a strong position. If the Ending Diagonal structure is confirmed, it could signal a major reversal.

SELL Zone: 3392 – 3395

Stop Loss: 3403

Take Profits:

• TP1: 3368

• TP2: 3340

• TP3: 3324

👉 Join the channel to receive more scalping signals!

Channel Telegram: t.me/+XkFQ95yHVOEwNDc1

Channel Telegram: t.me/+XkFQ95yHVOEwNDc1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👉 Join the channel to receive more scalping signals!

Channel Telegram: t.me/+XkFQ95yHVOEwNDc1

Channel Telegram: t.me/+XkFQ95yHVOEwNDc1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.