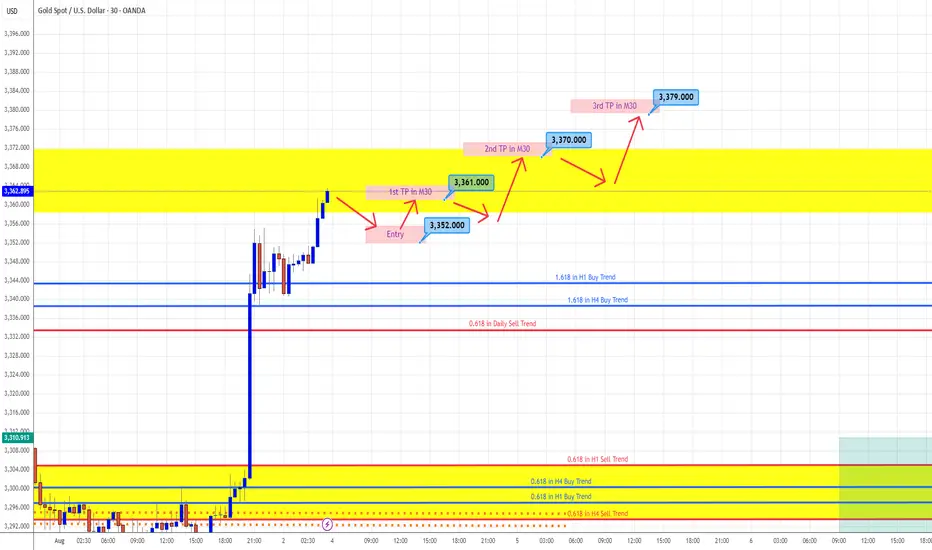

Strategy Type: Intraday Trend Trading (Buy-the-Dip)

Timeframe: 30-Minute (M30)

Market Bias: Bullish

Execution Style: Step-Ladder Scaling into Strength

🧠 Market Outlook

Gold remains in a bullish trend structure, supported by geopolitical risk, moderate inflation sentiment, and the weakening US Dollar. While Friday showed signs of short-term exhaustion, price is still forming higher lows on the 30-minute chart, suggesting intraday momentum remains to the upside.

Based on current price action and Fibonacci retracement levels, I expect a healthy pullback early Monday before a push towards new short-term highs. I will be trading in phases — buying on dips and scaling out at each resistance zone.

✅ Phase 1: Buy on Dip at 3352 (Key Support Zone)

Entry Zone: 3352

Reasoning:

3352 lines up with M30 demand zone (previous accumulation area)

61.8% Fibonacci retracement of the last M30 bullish swing

Likely to act as intraday support if price retraces from current levels

Confirmation:

Strong bullish candlestick reversal (e.g. bullish engulfing, hammer, or rejection wick) on M30

Volume uptick or bullish divergence on RSI preferred

Stop Loss:

Just below 3346 (below the last valid swing low to protect the trade)

🎯 Target 1: 3361

Why: This is the first intraday resistance and previous minor high on M30

Action:

Secure partial profits (~50%)

Move SL to breakeven or +5 pips to protect capital

Wait for next retracement

✅ Phase 2: Wait for Pullback After 3361

Retracement Zone: Expected dip to 3356–3358 area (new higher low)

Re-Entry Condition:

Retest of breakout level with strong bullish candle on M30

Maintain bullish market structure

🎯 Target 2: 3370

Why: This is the next resistance zone and price magnet based on Friday's volume profile

Action:

Secure additional 30% profit

Trail SL below structure (~3362)

✅ Phase 3: Wait for Final Dip Before Final Push

Retracement Zone: Around 3364–3366 (support flip area)

Re-Entry Condition:

Rejection of this zone with continuation pattern (bullish flag, ascending triangle)

🎯 Target 3: 3379

Why: 3379 is near the top of current intraday channel and strong resistance on 4H/M30

Action:

Close all remaining positions

Assess for potential breakout above 3380 only if momentum is strong

⚠️ Risk Management Plan

Max Risk: 1.5% account risk split across 3 phases (0.5% per entry)

All SLs defined before entry — no averaging down

Trades invalidated if price breaks and closes below 3346 on M30

🔁 Summary Table

Entry Level Target Action

Buy @ 3352 TP1 = 3361 Secure partial profit, trail SL

Re-buy ~3356–3358 TP2 = 3370 Secure partial profit, trail SL

Re-buy ~3364–3366 TP3 = 3379 Close full position

🧭 Other Key Watch Points

DXY: Watching for rejection below 104.60 – bullish for Gold

News Events: Low-impact day; watch for any unscheduled Fed speakers

RSI + Volume: Using RSI (14) and OBV to confirm entry strength on M30

Timeframe: 30-Minute (M30)

Market Bias: Bullish

Execution Style: Step-Ladder Scaling into Strength

🧠 Market Outlook

Gold remains in a bullish trend structure, supported by geopolitical risk, moderate inflation sentiment, and the weakening US Dollar. While Friday showed signs of short-term exhaustion, price is still forming higher lows on the 30-minute chart, suggesting intraday momentum remains to the upside.

Based on current price action and Fibonacci retracement levels, I expect a healthy pullback early Monday before a push towards new short-term highs. I will be trading in phases — buying on dips and scaling out at each resistance zone.

✅ Phase 1: Buy on Dip at 3352 (Key Support Zone)

Entry Zone: 3352

Reasoning:

3352 lines up with M30 demand zone (previous accumulation area)

61.8% Fibonacci retracement of the last M30 bullish swing

Likely to act as intraday support if price retraces from current levels

Confirmation:

Strong bullish candlestick reversal (e.g. bullish engulfing, hammer, or rejection wick) on M30

Volume uptick or bullish divergence on RSI preferred

Stop Loss:

Just below 3346 (below the last valid swing low to protect the trade)

🎯 Target 1: 3361

Why: This is the first intraday resistance and previous minor high on M30

Action:

Secure partial profits (~50%)

Move SL to breakeven or +5 pips to protect capital

Wait for next retracement

✅ Phase 2: Wait for Pullback After 3361

Retracement Zone: Expected dip to 3356–3358 area (new higher low)

Re-Entry Condition:

Retest of breakout level with strong bullish candle on M30

Maintain bullish market structure

🎯 Target 2: 3370

Why: This is the next resistance zone and price magnet based on Friday's volume profile

Action:

Secure additional 30% profit

Trail SL below structure (~3362)

✅ Phase 3: Wait for Final Dip Before Final Push

Retracement Zone: Around 3364–3366 (support flip area)

Re-Entry Condition:

Rejection of this zone with continuation pattern (bullish flag, ascending triangle)

🎯 Target 3: 3379

Why: 3379 is near the top of current intraday channel and strong resistance on 4H/M30

Action:

Close all remaining positions

Assess for potential breakout above 3380 only if momentum is strong

⚠️ Risk Management Plan

Max Risk: 1.5% account risk split across 3 phases (0.5% per entry)

All SLs defined before entry — no averaging down

Trades invalidated if price breaks and closes below 3346 on M30

🔁 Summary Table

Entry Level Target Action

Buy @ 3352 TP1 = 3361 Secure partial profit, trail SL

Re-buy ~3356–3358 TP2 = 3370 Secure partial profit, trail SL

Re-buy ~3364–3366 TP3 = 3379 Close full position

🧭 Other Key Watch Points

DXY: Watching for rejection below 104.60 – bullish for Gold

News Events: Low-impact day; watch for any unscheduled Fed speakers

RSI + Volume: Using RSI (14) and OBV to confirm entry strength on M30

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.