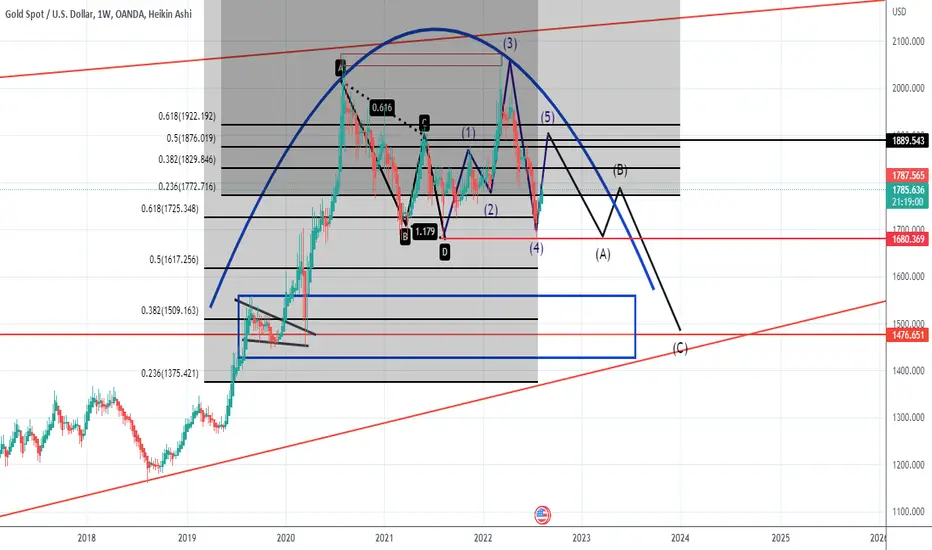

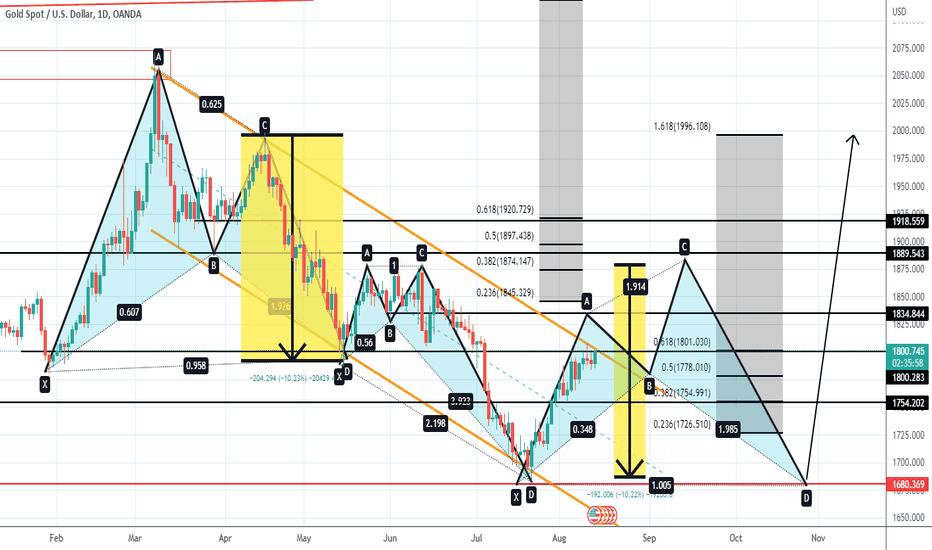

Observing Gold's weekly chart, It now appears its in a rounding Top/ Bearish Inverted Cup and Handle Pattern. In Addition to that It also appears we're possibly in the 4th wave up leading into the 5th wave, which is a retest of the C leg which I have at around $1889/1890. A rejection of this level also gives The 5th wave down the Right Shoulder to the bearish Head and shoulders pattern. I then see a sell off on the ABCD Pattern.. Where lastly The D leg of the ABCD pattern retesting the Flag Break Out.

I have a short Term Target of $1840. and will look to switch to the bearish side after the 5th wave is confirmed. In Fact this whole movement by gold looks like a bearish ABCD pattern. After we reach the Finally D leg, I will look to go long and see gold retest the $2,000.00 per oz

I have a short Term Target of $1840. and will look to switch to the bearish side after the 5th wave is confirmed. In Fact this whole movement by gold looks like a bearish ABCD pattern. After we reach the Finally D leg, I will look to go long and see gold retest the $2,000.00 per oz

Note

tradingview.com/chart/rByb49Ih/updated gold analysis

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.