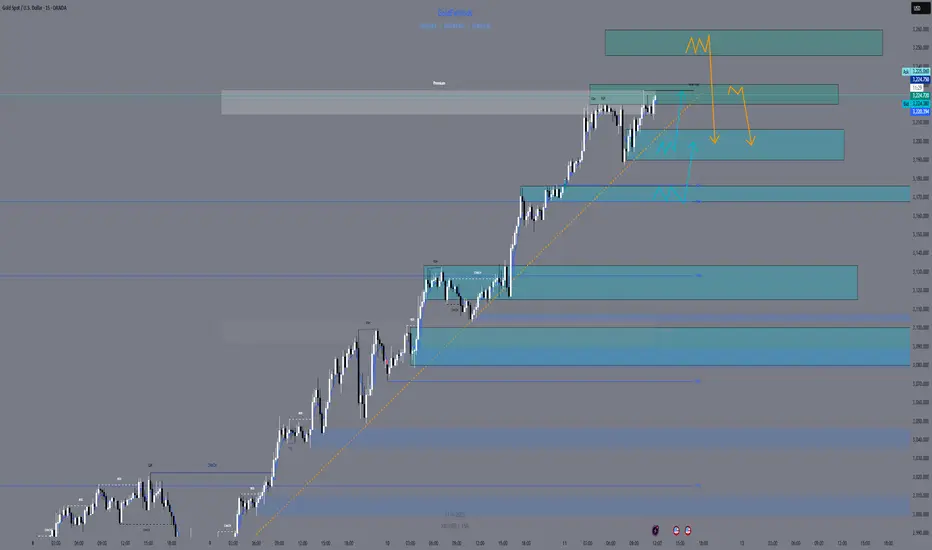

XAUUSD Daily Trading Plan - Sniper Entries 🚀

🔹 Price Action Overview:

Trend: Bullish (H1, H4, M15)

Current Price: ~3,217

Market Sentiment: Positive, with strong bullish momentum, consolidating after breaking recent highs.

Key News: Core PPI (m/m) and Prelim UoM Consumer Sentiment due today, watch for volatility during the New York session.

🚨 Potential Sniper Entry Zones:

1st Buy Entry Zone 📈

Price Range: 3,172 – 3,175

Why: Strong Order Block (OB) on M15 & M5, CHoCH confirming trend reversal with a clear liquidity grab.

Confirmation: Expect a bounce from support as price retraces into the zone, offering favorable risk/reward for a buy continuation.

Stop Loss (SL): 3,160 (tight risk management)

Take Profit (TP):

TP1: 3,200

TP2: 3,220

TP3: 3,240

2nd Buy Entry Zone 🛒

Price Range: 3,200 – 3,205

Why: Minor support with the market showing consistent bullish action around this zone.

Confirmation: Watch for market structure to hold; this will be a second-tier entry in case of shallow retracements.

Stop Loss (SL): 3,190

Take Profit (TP):

TP1: 3,220

TP2: 3,240

TP3: 3,260

1st Sell Entry Zone 🔻

Price Range: 3,220 – 3,230

Why: Possible Premium zone as the price tests recent highs, near overbought conditions. Look for rejections here.

Confirmation: Watch for FVG & Price Action rejection signals.

Stop Loss (SL): 3,240

Take Profit (TP):

TP1: 3,200

TP2: 3,180

TP3: 3,150

2nd Sell Entry Zone 🔻

Price Range: 3,240 – 3,250

Why: Testing the Premium area near previous highs; watch for signs of a strong reversal.

Confirmation: Look for Bearish Divergence or Order Block Rejections.

Stop Loss (SL): 3,260

Take Profit (TP):

TP1: 3,220

TP2: 3,200

TP3: 3,180

⏰ Key Trading Hours:

New York Session (14:30 – 22:00 UTC+2): Pay attention to Core PPI data and Prelim UoM Consumer Sentiment for volatility. Watch for price reaction during these times to align with the entry zones.

🔑 Summary & Final Notes:

Buy Bias is dominant in this market given the recent strong bullish momentum. However, be mindful of resistance zones as price approaches key levels.

Ensure Risk-to-Reward is always favorable before entering.

Monitor key news events around 3:30 PM UTC for potential market reactions.

💬 Let's trade smart! Drop a comment below if you like the setup! 🔥 Follow and subscribe for more analysis!

🔹 Price Action Overview:

Trend: Bullish (H1, H4, M15)

Current Price: ~3,217

Market Sentiment: Positive, with strong bullish momentum, consolidating after breaking recent highs.

Key News: Core PPI (m/m) and Prelim UoM Consumer Sentiment due today, watch for volatility during the New York session.

🚨 Potential Sniper Entry Zones:

1st Buy Entry Zone 📈

Price Range: 3,172 – 3,175

Why: Strong Order Block (OB) on M15 & M5, CHoCH confirming trend reversal with a clear liquidity grab.

Confirmation: Expect a bounce from support as price retraces into the zone, offering favorable risk/reward for a buy continuation.

Stop Loss (SL): 3,160 (tight risk management)

Take Profit (TP):

TP1: 3,200

TP2: 3,220

TP3: 3,240

2nd Buy Entry Zone 🛒

Price Range: 3,200 – 3,205

Why: Minor support with the market showing consistent bullish action around this zone.

Confirmation: Watch for market structure to hold; this will be a second-tier entry in case of shallow retracements.

Stop Loss (SL): 3,190

Take Profit (TP):

TP1: 3,220

TP2: 3,240

TP3: 3,260

1st Sell Entry Zone 🔻

Price Range: 3,220 – 3,230

Why: Possible Premium zone as the price tests recent highs, near overbought conditions. Look for rejections here.

Confirmation: Watch for FVG & Price Action rejection signals.

Stop Loss (SL): 3,240

Take Profit (TP):

TP1: 3,200

TP2: 3,180

TP3: 3,150

2nd Sell Entry Zone 🔻

Price Range: 3,240 – 3,250

Why: Testing the Premium area near previous highs; watch for signs of a strong reversal.

Confirmation: Look for Bearish Divergence or Order Block Rejections.

Stop Loss (SL): 3,260

Take Profit (TP):

TP1: 3,220

TP2: 3,200

TP3: 3,180

⏰ Key Trading Hours:

New York Session (14:30 – 22:00 UTC+2): Pay attention to Core PPI data and Prelim UoM Consumer Sentiment for volatility. Watch for price reaction during these times to align with the entry zones.

🔑 Summary & Final Notes:

Buy Bias is dominant in this market given the recent strong bullish momentum. However, be mindful of resistance zones as price approaches key levels.

Ensure Risk-to-Reward is always favorable before entering.

Monitor key news events around 3:30 PM UTC for potential market reactions.

💬 Let's trade smart! Drop a comment below if you like the setup! 🔥 Follow and subscribe for more analysis!

Trade active

🔻 LIVE Sniper SELL Plan – April 11 Update🔴 Sell Entry #1 – Active Setup

📍 Entry: 3,220 – 3,230 (Already tapped)

📉 SL: 3,240

🎯 TP1: 3,200

🎯 TP2: 3,185

🎯 TP3: 3,172

⚠️ Confirmation:

• CHoCH confirmed on M1 + clean BOS

• Premium zone tapped + overbought + FVG filled

• High probability short unless price reclaims 3,230 cleanly

💬 Optional Minds Caption (Catchy):

“Liquidity harvested, sellers activated. Don’t chase – wait for price to bleed slow and clean. First blood: 3,200 👀🩸”

🟢 Sniper Buy Plan – “Discount Reclaim” Setup

🟩 Buy Entry Zone #1 – M5 OB + FVG Reaction

📍 Entry: 3,170 – 3,175

📉 SL: 3,160

🎯 TP1: 3,195

🎯 TP2: 3,210

🎯 TP3: 3,227

🧠 Logic & Confluence:

• M5 Bullish OB + unmitigated FVG

• Discount pricing zone with RSI likely oversold

• Wait for CHoCH / bullish engulfing on M1/M5 before entry

• NY session + Friday = volatility bounce potential

Trade closed: target reached

🔻 2nd Sell from Premium Zone Hit TP1 🎯Well played, gold traders 🏆 — our sniper entry from the 3,240–3,250 premium range delivered exactly what we needed:

✅ Price tapped the Premium + Previous Highs

✅ Gave us clear M5/M15 rejection + CHoCH

✅ Dropped clean to TP1 at 3,220 for a swift intraday win!

This confirms that the premium zone continues to act as a highly reactive SMC level, and shows the power of waiting for confirmation inside key liquidity areas.

📊 Trade Recap:

Entry Zone: 3,240 – 3,250

SL: 3,260

TP1: ✅ 3,220 (hit)

TP2: 3,210 (next in line)

TP3: 3,192 (discount zone target)

Still holding partials? Manage risk wisely, as NY close approaches.

💬 How did this play out for you?

Did you catch the sniper or still waiting for the full drop?

Let’s talk setups, confirmations, and reentries below 👇

🔔 Follow for daily sniper entries

❤️ Like if you got that TP

🧠 Stay sharp — next week we strike again!

#XAUUSD #GoldTrading #SniperEntry #SmartMoneyConcepts #SMC #TradingView

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.