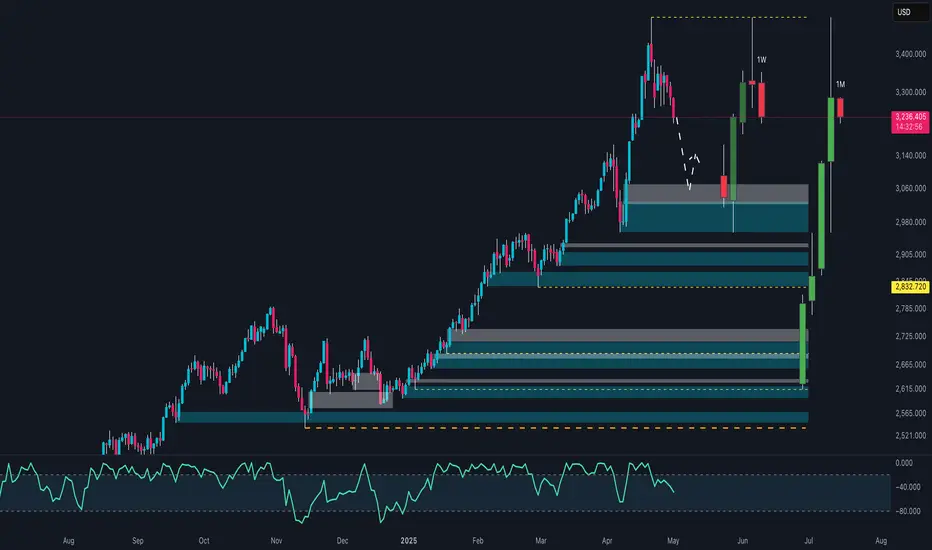

Gold (XAU/USD) is showing signs of exhaustion after its explosive rally that pushed it beyond $3,400. We are now witnessing a pullback phase, with price directly testing a key demand zone between $3,050 and $2,980. From a technical standpoint, this is the last major defense before a potential drop toward the $2,832 area.

The current bearish pressure is supported by a powerful blend of macro, positioning, and behavioral factors:

COT Report – Gold: Non-commercials (speculators) are aggressively closing long positions and opening shorts, which signals a breakdown in the short-term bullish narrative. On the other hand, commercials (hedgers), also known as the "smart money", are steadily increasing their long exposure, hinting at a potential accumulation zone forming.

COT Report – USD Index: Speculative funds are stacking long positions on the dollar, which continues to add downside pressure on gold. As long as this persists, any upside attempt on XAU/USD will likely face headwinds.

Seasonality: May tends to be historically bullish for gold, but June is seasonally weak. The strongest seasonal window opens between July and August, suggesting the possibility of a deeper pullback before the next bullish wave.

Retail Sentiment: Over 75% of retail traders are long on XAU/USD, typically a contrarian signal. This sets the stage for a classic stop-hunt scenario, where price flushes lower to trigger retail stop-losses before a potential reversal.

📌 Conclusion: In true Bridgewater fashion, we’re seeing a divergence between positioning and price action. In the short term, gold remains vulnerable to a move toward $2,832. However, if that zone holds, it could provide a compelling opportunity to accumulate for a potential summer swing rally toward all-time highs.

The current bearish pressure is supported by a powerful blend of macro, positioning, and behavioral factors:

COT Report – Gold: Non-commercials (speculators) are aggressively closing long positions and opening shorts, which signals a breakdown in the short-term bullish narrative. On the other hand, commercials (hedgers), also known as the "smart money", are steadily increasing their long exposure, hinting at a potential accumulation zone forming.

COT Report – USD Index: Speculative funds are stacking long positions on the dollar, which continues to add downside pressure on gold. As long as this persists, any upside attempt on XAU/USD will likely face headwinds.

Seasonality: May tends to be historically bullish for gold, but June is seasonally weak. The strongest seasonal window opens between July and August, suggesting the possibility of a deeper pullback before the next bullish wave.

Retail Sentiment: Over 75% of retail traders are long on XAU/USD, typically a contrarian signal. This sets the stage for a classic stop-hunt scenario, where price flushes lower to trigger retail stop-losses before a potential reversal.

📌 Conclusion: In true Bridgewater fashion, we’re seeing a divergence between positioning and price action. In the short term, gold remains vulnerable to a move toward $2,832. However, if that zone holds, it could provide a compelling opportunity to accumulate for a potential summer swing rally toward all-time highs.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.