Hello everyone! Do you think gold will rise or fall? Let’s dive into the latest movements of this precious metal.

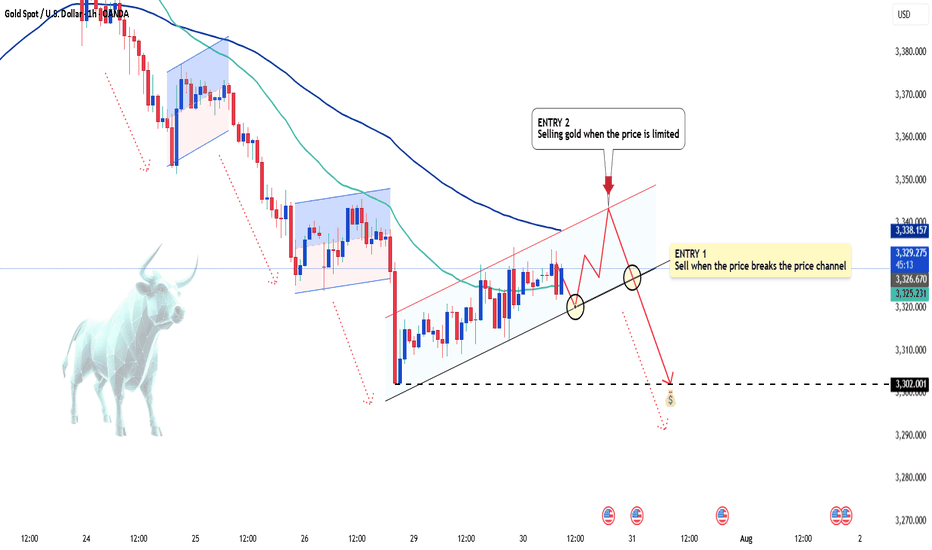

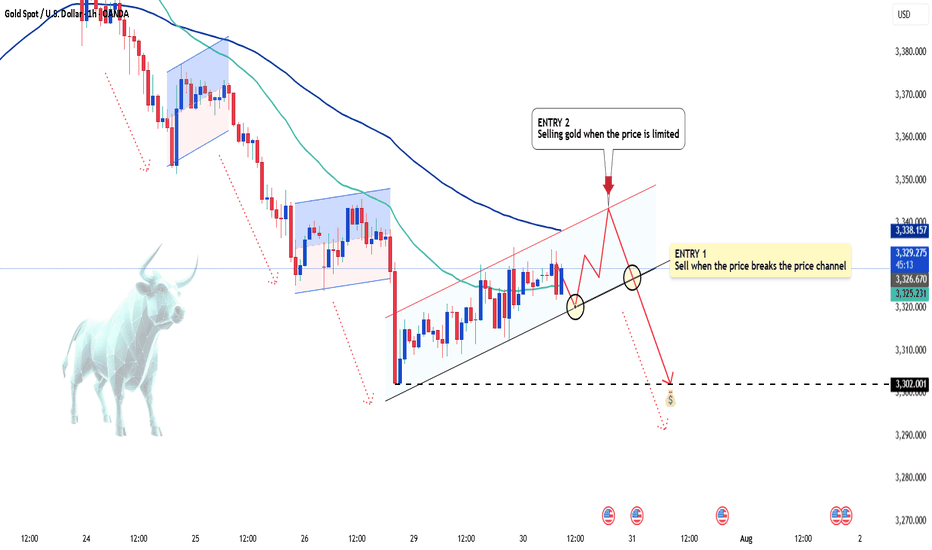

Just as we anticipated in yesterday’s strategy , gold has extended its downward move, with the bears firmly in control. The precious metal is currently trading around 3,290 USD, clearly signaling a short-term downtrend after breaking the ascending trendline that started in early July. Although there was a slight bounce, price remains capped below the key resistance zone of 3,333 – 3,350 USD, which coincides with the confluence of the 0.618 – 0.5 Fibonacci retracement and the EMA 34/89 — adding even more downside pressure.

, gold has extended its downward move, with the bears firmly in control. The precious metal is currently trading around 3,290 USD, clearly signaling a short-term downtrend after breaking the ascending trendline that started in early July. Although there was a slight bounce, price remains capped below the key resistance zone of 3,333 – 3,350 USD, which coincides with the confluence of the 0.618 – 0.5 Fibonacci retracement and the EMA 34/89 — adding even more downside pressure.

The main reason behind this recent drop lies in the easing of trade tensions following the US-EU tariff agreement, which has significantly weakened gold’s safe-haven appeal. At the same time, the FOMC meeting yesterday failed to provide any bullish catalyst for gold. Even though the Fed is expected to keep rates unchanged, a single hawkish remark from Chair Powell was enough to intensify short-term selling pressure.

From a technical perspective, gold attempted to retest the broken trendline but failed, confirming the bearish structure. A new wave of correction could emerge soon, but the overall outlook remains tilted toward further downside.

My personal view:

Target 1 is at the 1.272 Fibonacci extension.

Target 2 lies at the 1.618 Fibonacci level — which could be the next destination.

And you — what do you think about this trendline break? Let’s discuss in the comments!

Just as we anticipated in yesterday’s strategy

The main reason behind this recent drop lies in the easing of trade tensions following the US-EU tariff agreement, which has significantly weakened gold’s safe-haven appeal. At the same time, the FOMC meeting yesterday failed to provide any bullish catalyst for gold. Even though the Fed is expected to keep rates unchanged, a single hawkish remark from Chair Powell was enough to intensify short-term selling pressure.

From a technical perspective, gold attempted to retest the broken trendline but failed, confirming the bearish structure. A new wave of correction could emerge soon, but the overall outlook remains tilted toward further downside.

My personal view:

Target 1 is at the 1.272 Fibonacci extension.

Target 2 lies at the 1.618 Fibonacci level — which could be the next destination.

And you — what do you think about this trendline break? Let’s discuss in the comments!

Trade active

✅ Receive 7–10 high-quality signals daily for Forex, Gold, and Bitcoin

✅ Fast updates, accurate alerts

✅ Suitable for both beginners and experienced traders

👉 Join now by clicking this link:

t.me/+6v7LMJO7cI04Nzg1

✅ Fast updates, accurate alerts

✅ Suitable for both beginners and experienced traders

👉 Join now by clicking this link:

t.me/+6v7LMJO7cI04Nzg1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅ Receive 7–10 high-quality signals daily for Forex, Gold, and Bitcoin

✅ Fast updates, accurate alerts

✅ Suitable for both beginners and experienced traders

👉 Join now by clicking this link:

t.me/+6v7LMJO7cI04Nzg1

✅ Fast updates, accurate alerts

✅ Suitable for both beginners and experienced traders

👉 Join now by clicking this link:

t.me/+6v7LMJO7cI04Nzg1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.