Current Price: 3368.76

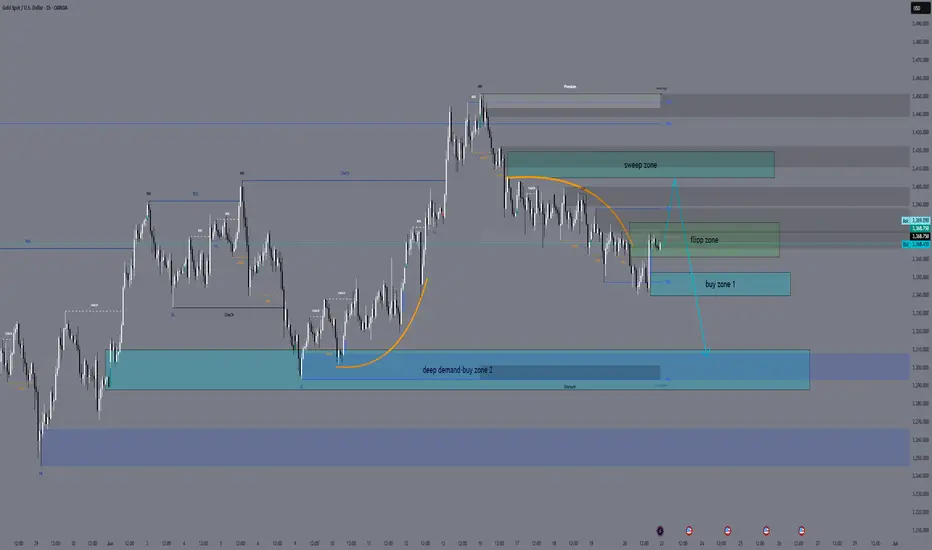

Trend: Bearish on H4 | Corrective on H1 | Weak Bullish Attempt on M15

Market Context: Gold is consolidating under EMA pressure after FOMC. Price is pinned inside a key flip zone, awaiting Monday’s fundamental triggers.

🔸 HTF Overview (D1, H4, H1)

📰 Macro + Economic Context – Week of June 23–28:

This is a high-impact week for USD with Fed speeches, inflation, and growth data. Monday opens with caution:

Monday, June 23

🟠 FOMC Member Waller Speaks

🔴 Flash Manufacturing & Services PMI

🟠 Existing Home Sales

Tuesday, June 24

🔴 Fed Chair Powell Testifies

🟠 CB Consumer Confidence

🟠 Richmond Manufacturing Index

Wednesday, June 25

🔴 Powell Testimony (Day 2)

🟠 New Home Sales

Thursday, June 26

🔴 Final GDP q/q

🔴 Unemployment Claims

🟠 Durable Goods Orders

🟠 Pending Home Sales

Friday, June 27

🔴 Core PCE Price Index

🟠 Revised UoM Consumer Sentiment

📌 Monday is lighter in impact, but PMI data and Waller’s speech may spark the week’s directional bias. Avoid trading blindly into PMI spikes.

H4 Structure & Bias:

Bearish trend intact: Lower High = 3418, Lower Low = 3311

EMAs (21/50/100) aligned downward — price capped below 3380

RSI still under 60 = no bullish momentum

Rejection zone remains valid at 3406–3420 (H4 OB)

Strong demand expected at 3340–3352 and extreme at 3310–3288

🔸 LTF Precision (M30, M15)

Price compressing around 3365–3372

RSI around 56 → indecision

No bullish HH above 3380 = still within bearish control

EMA flattening → prepare for trap setups around NY open

🧭 Trade Scenarios

🔻 Sell Zone – 3406–3420

H4 OB, FVG top, liquidity above 3405

Entry: 3412

SL: 3426

TP1: 3312

TP2: 3288

TP3: 3265

🧠 Wait for sweep or strong bearish reaction — no early entries.

⚠️ Flip Zone – 3360–3380

No-trade zone: EMA cluster + mid-FVG

Only use for confirmations, not entries

🟢 Buy Zone – 3340–3352

OB + demand + Fib retracement

Entry: 3348

SL: 3334

TP1: 3448

TP2: 3472

TP3: 3490

🟢 Buy Zone – 3310–3288

Below LL sweep (3311)

Deep liquidity + OB demand

Entry: 3298

SL: 3280

TP1: 3365

TP2: 3405

TP3: 3440

📍 Key Structural Levels – June 23

Level Type Role

3460 Bull Trap Limit Irrational spike area

3445 FOMC Unfilled wick – trap zone

3426 Sell Zone Risk protection above OB

3418 H4 LH Confirmed bearish structure

3410 OB Midpoint Micro-rejection inside OB

3395 Previous HH Inducement target

3384 FVG Top Minor LTF rejection

3360–3380 ⚠️ Flip Zone MA/FVG compression – avoid entries

3352 OB entry edge Buy Zone 1 upper limit

3340 OB base Buy Zone 1 key level

3311 H4 LL Confirms bear structure

3300 Round Level Psychological + liquidity

3288 OB base Final demand structure zone

3265 Final TP Bearish extension only

✅ Final Action Plan

📉 Stay bearish below 3380 unless a clean HH + OB support forms

⚠️ Avoid trading inside 3360–3380 flip zone during NY PMI data

🛒 Longs valid only from 3340 or 3310 with confirmation (RSI, PA, OB)

🧠 Focus on structure integrity and clean OB rejections only

💬 Will you fade the 3412 OB or wait for the sniper bounce at 3348?

🔔 Follow and 🚀GoldFxMinds for premium breakdowns, macro updates, and real-time sniper execution guidance.

🔹 Disclosure: As part of Trade Nation’s Influencer Program, we receive monthly compensation for using their charts.

GoldFxMinds

Trend: Bearish on H4 | Corrective on H1 | Weak Bullish Attempt on M15

Market Context: Gold is consolidating under EMA pressure after FOMC. Price is pinned inside a key flip zone, awaiting Monday’s fundamental triggers.

🔸 HTF Overview (D1, H4, H1)

📰 Macro + Economic Context – Week of June 23–28:

This is a high-impact week for USD with Fed speeches, inflation, and growth data. Monday opens with caution:

Monday, June 23

🟠 FOMC Member Waller Speaks

🔴 Flash Manufacturing & Services PMI

🟠 Existing Home Sales

Tuesday, June 24

🔴 Fed Chair Powell Testifies

🟠 CB Consumer Confidence

🟠 Richmond Manufacturing Index

Wednesday, June 25

🔴 Powell Testimony (Day 2)

🟠 New Home Sales

Thursday, June 26

🔴 Final GDP q/q

🔴 Unemployment Claims

🟠 Durable Goods Orders

🟠 Pending Home Sales

Friday, June 27

🔴 Core PCE Price Index

🟠 Revised UoM Consumer Sentiment

📌 Monday is lighter in impact, but PMI data and Waller’s speech may spark the week’s directional bias. Avoid trading blindly into PMI spikes.

H4 Structure & Bias:

Bearish trend intact: Lower High = 3418, Lower Low = 3311

EMAs (21/50/100) aligned downward — price capped below 3380

RSI still under 60 = no bullish momentum

Rejection zone remains valid at 3406–3420 (H4 OB)

Strong demand expected at 3340–3352 and extreme at 3310–3288

🔸 LTF Precision (M30, M15)

Price compressing around 3365–3372

RSI around 56 → indecision

No bullish HH above 3380 = still within bearish control

EMA flattening → prepare for trap setups around NY open

🧭 Trade Scenarios

🔻 Sell Zone – 3406–3420

H4 OB, FVG top, liquidity above 3405

Entry: 3412

SL: 3426

TP1: 3312

TP2: 3288

TP3: 3265

🧠 Wait for sweep or strong bearish reaction — no early entries.

⚠️ Flip Zone – 3360–3380

No-trade zone: EMA cluster + mid-FVG

Only use for confirmations, not entries

🟢 Buy Zone – 3340–3352

OB + demand + Fib retracement

Entry: 3348

SL: 3334

TP1: 3448

TP2: 3472

TP3: 3490

🟢 Buy Zone – 3310–3288

Below LL sweep (3311)

Deep liquidity + OB demand

Entry: 3298

SL: 3280

TP1: 3365

TP2: 3405

TP3: 3440

📍 Key Structural Levels – June 23

Level Type Role

3460 Bull Trap Limit Irrational spike area

3445 FOMC Unfilled wick – trap zone

3426 Sell Zone Risk protection above OB

3418 H4 LH Confirmed bearish structure

3410 OB Midpoint Micro-rejection inside OB

3395 Previous HH Inducement target

3384 FVG Top Minor LTF rejection

3360–3380 ⚠️ Flip Zone MA/FVG compression – avoid entries

3352 OB entry edge Buy Zone 1 upper limit

3340 OB base Buy Zone 1 key level

3311 H4 LL Confirms bear structure

3300 Round Level Psychological + liquidity

3288 OB base Final demand structure zone

3265 Final TP Bearish extension only

✅ Final Action Plan

📉 Stay bearish below 3380 unless a clean HH + OB support forms

⚠️ Avoid trading inside 3360–3380 flip zone during NY PMI data

🛒 Longs valid only from 3340 or 3310 with confirmation (RSI, PA, OB)

🧠 Focus on structure integrity and clean OB rejections only

💬 Will you fade the 3412 OB or wait for the sniper bounce at 3348?

🔔 Follow and 🚀GoldFxMinds for premium breakdowns, macro updates, and real-time sniper execution guidance.

🔹 Disclosure: As part of Trade Nation’s Influencer Program, we receive monthly compensation for using their charts.

GoldFxMinds

Note

🔸 HTF Overview (D1–H4)🌍 Macro & Geopolitical Outlook:

Global tensions are escalating fast following a direct US–Israel strike on Iran’s nuclear facilities. This is no longer just a military skirmish — it’s a potential global trigger:

Trump declared: “We obliterated them” after US B-2 bombers hit Fordow and Natanz.

Iran responded: “They will never recover from the mistake they’ve made” – signaling possible retaliation on US or Israeli targets.

The risk of a regional chain reaction is real. Markets are now pricing in fear and uncertainty.

📊 Key Structural Levels Above Price

Level Type Notes

3430–3435 Inducement / wick trap FOMC rejection zone

3452 H1 Higher High Last confirmed HH

3472–3475 FVG Unfilled H4 gap

💬 This is not a time for aggressive entries. Let the chart prove itself. This week could mark the beginning of a larger macro shift, especially if Iran retaliates.

📌 Analysis based on real-time SMC + structure logic. No hype. No noise. Only clean execution.

Trade active

📈 XAUUSD Market Update – June 23, 2025"The bounce was clean, but the game’s not over yet."

🔸 Macro & Sentiment:

Gold has rebounded strongly from the 3340–3343 area following last week's FOMC volatility. With the new week starting slow and Powell's testimony coming up, we're seeing signs of bullish continuation—but we’re still sitting inside a potential trap zone in premium, so caution is required.

🔍 1H/15M Market Structure Recap

✅ 3340 marked the LL + origin of bullish leg after strong downside liquidity sweep.

✅ From there, we saw the first bullish CHoCH at 3360, followed by a bearish CHoCH that retested cleanly at 3343–3344 OB.

✅ Then: direct bullish push → 3375, consolidation → breakout to 3395.

✅ Pullback to 3347, then bullish leg to 3382, and retracement to 3359–3362 OB, now pushing back up toward 3391–3395.

⚔ Current Conditions (as of 3390):

🟢 Short-Term Bias: Bullish while above 3359–3362

⚠ Mid-Term Risk Zone: Price is testing the premium trap zone 3391–3400+

🔁 Invalidation: Clean break and close below 3359 suggests short-term weakness

🧠 Key Intraday Zones

🔹 Valid Demand OB → 3343–3344: Clean retest + strong reaction

🔹 Flip / Minor OB → 3359–3362: Held the recent retrace before impulse

⚠ Warning Zone / Premium Trap → 3391–3406: High risk for engineered sweep

🔻 Upper Sell Zone (structure-based) → 3406–3420: Strong HTF OB + premium zone

🎯 What to Watch Next

If price holds above 3360–3362, we may see another extension toward 3400+.

However, if we reject strongly from 3395–3400, it may confirm this as a liquidity trap, aiming for a deeper retracement back to 3355–3344.

For bulls: wait for confirmation above 3395 with volume.

For bears: watch for rejection wicks or CHoCH below 3362 as a trigger.

💬 Stay sharp — structure is evolving, and this could be a fakeout before real move. Let price confirm the direction.

If this helped, like, comment your bias, and follow GoldFxMinds for daily precision plans.

📌 Disclosure: I am part of Trade Nation’s Influencer Program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.