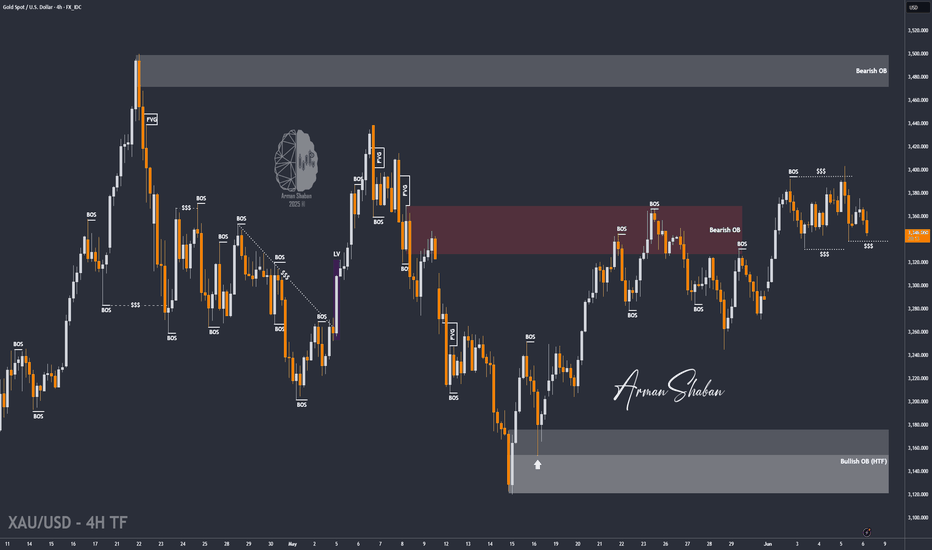

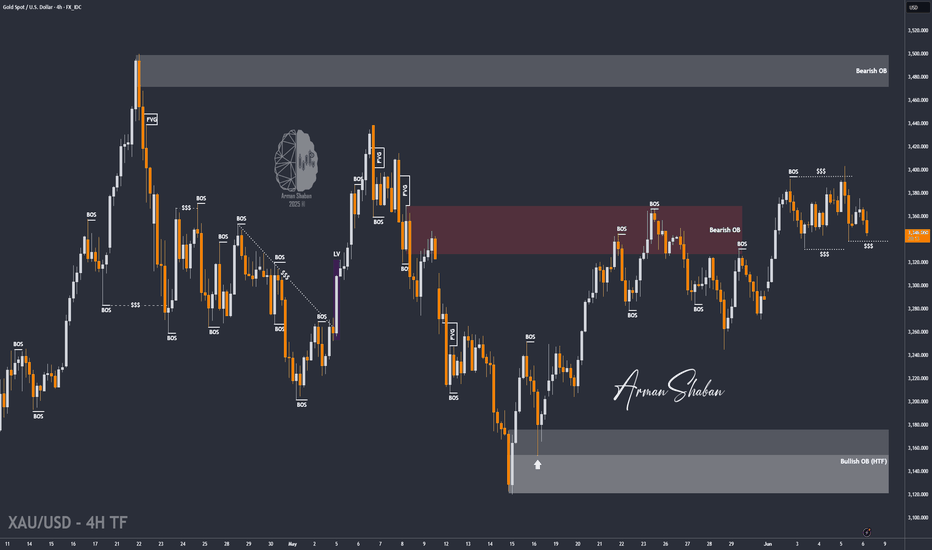

By examining the gold chart on the 4-hour timeframe, we can see that in last week’s analysis, the price successfully hit all four targets: $3338, $3332, $3326, and $3317, and finally closed on Friday at $3309. This move delivered over 390 pips of return, and I hope you made the most out of it!

Now, let’s move on to the latest gold analysis: As you can see, today gold dropped to the $3294 zone, finally filling the liquidity gap previously marked on the chart. Currently, gold is trading around $3315, and I expect further bullish movement toward the $3330 area as the first upside target.

After that, we should closely watch the $3332–$3352 zone for a potential corrective reaction.

There are more details in this analysis that I’ll share soon — with your support!

THE MAIN TA :

Now, let’s move on to the latest gold analysis: As you can see, today gold dropped to the $3294 zone, finally filling the liquidity gap previously marked on the chart. Currently, gold is trading around $3315, and I expect further bullish movement toward the $3330 area as the first upside target.

After that, we should closely watch the $3332–$3352 zone for a potential corrective reaction.

There are more details in this analysis that I’ll share soon — with your support!

THE MAIN TA :

Trade closed: target reached

By examining the gold chart on the 4-hour timeframe, we can see that yesterday, the price successfully reached its first target at \$3330 as expected, delivering over 150 pips of return.But gold didn’t stop there — it extended the rally up to \$3338, and then, just as anticipated, started to pull back, correcting down to \$3301.

Following that, gold surged again from \$3301 to \$3349, hitting the third target as well.

The total return from this move — excluding the retracement trade — has already exceeded 650 pips!

Now, watch closely for a possible rejection and bearish move from the current zone.

Note

By analyzing the gold chart on the 4-hour timeframe, we can see that yesterday, as expected, the price corrected from the $3345 to $3315 zone, delivering over 300 pips of return.Following the release of the CPI data, gold saw a strong bullish move and surged up to $3360. However, after reaching this key level, it faced a sharp rejection and dropped back to $3330.

Currently, gold is trading around $3336, and only if the price stabilizes below $3340 can we expect further downside movement

⚜️ Free Telegram Channel : t.me/PriceAction_ICT

⚜️ JOIN THE VIP : t.me/PriceAction_ICT/5946

⚜️ Contact Me : t.me/ArmanShabanTrading

💥Join BitMart Exchange – Ultra Low Fees : bitmart.com/invite/c5JVJK/en-US

⚜️ JOIN THE VIP : t.me/PriceAction_ICT/5946

⚜️ Contact Me : t.me/ArmanShabanTrading

💥Join BitMart Exchange – Ultra Low Fees : bitmart.com/invite/c5JVJK/en-US

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⚜️ Free Telegram Channel : t.me/PriceAction_ICT

⚜️ JOIN THE VIP : t.me/PriceAction_ICT/5946

⚜️ Contact Me : t.me/ArmanShabanTrading

💥Join BitMart Exchange – Ultra Low Fees : bitmart.com/invite/c5JVJK/en-US

⚜️ JOIN THE VIP : t.me/PriceAction_ICT/5946

⚜️ Contact Me : t.me/ArmanShabanTrading

💥Join BitMart Exchange – Ultra Low Fees : bitmart.com/invite/c5JVJK/en-US

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.