📊 Technical Analysis

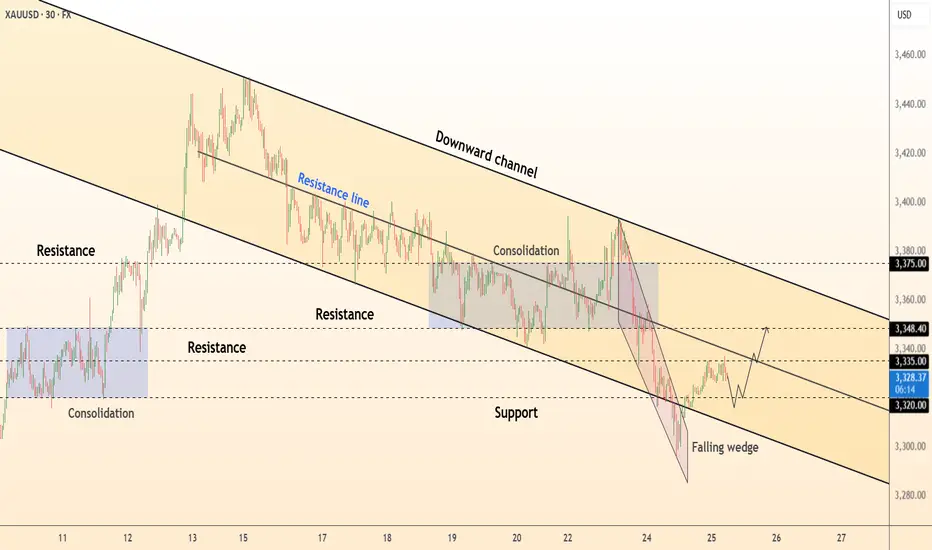

● Price bounced from the channel floor (≈ 3 320) forming a bullish falling-wedge whose breakout target coincides with the median resistance at 3 348.

● Hidden RSI divergence and a series of higher lows inside today’s micro-range show buyers absorbing supply; reclaiming the wedge apex should accelerate toward the upper channel band near 3 375.

💡 Fundamental Analysis

● Spot-ETF inflows resumed and Fed-funds futures now price only one cut this year while real yields eased after soft US consumer-confidence data, trimming dollar bid and reviving gold demand.

✨ Summary

Long 3 320-3 330; wedge break > 3 335 eyes 3 348 then 3 375. Bull view void on a 30 min close below 3 300.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

● Price bounced from the channel floor (≈ 3 320) forming a bullish falling-wedge whose breakout target coincides with the median resistance at 3 348.

● Hidden RSI divergence and a series of higher lows inside today’s micro-range show buyers absorbing supply; reclaiming the wedge apex should accelerate toward the upper channel band near 3 375.

💡 Fundamental Analysis

● Spot-ETF inflows resumed and Fed-funds futures now price only one cut this year while real yields eased after soft US consumer-confidence data, trimming dollar bid and reviving gold demand.

✨ Summary

Long 3 320-3 330; wedge break > 3 335 eyes 3 348 then 3 375. Bull view void on a 30 min close below 3 300.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Trade active

Trade Active Now!Trade closed: target reached

A consolidation above support led to a solid rebound and the achievement of our goal!90% accuracy in telegram

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

90% accuracy in telegram

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.