At least in Vegas, you get free drinks.

Let’s cut the fluff.

You want to make money trading.

But here’s the problem no one wants to admit:

Most traders don’t have an edge. And they trade anyway.

Which means they’re not traders.

They’re just expensive gamblers in denial.

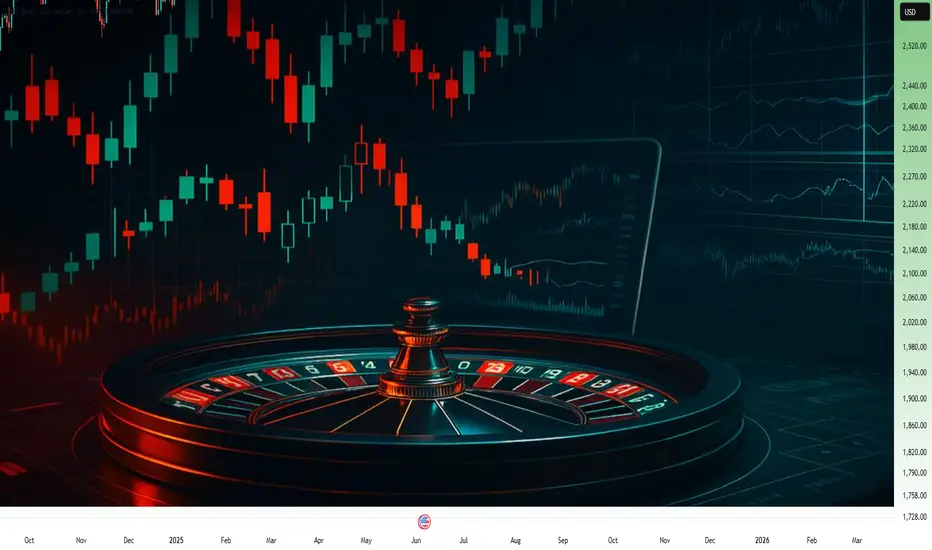

🎰 Welcome to the Casino Called “Charts”

In Vegas, the odds are clearly displayed.

You know the house has the advantage.

But in trading? You convince yourself you are the house.

You say things like:

-“This setup worked for someone on YouTube.”

- “Price is oversold, so it has to bounce.”

- “I just have a feeling it’ll go up.”

That’s not a strategy. That’s astrology.

If you can’t define your edge in one sentence, you don’t have one.

And if your edge isn’t tested over at least 100 trades — it’s fantasy.

🧠 What Is an Edge, Anyway?

An edge is not a pattern. It’s not always your gut.

It’s a repeatable, testable advantage in the market.

It could be:

- A statistical tendency in price behavior

- A setup with positive risk-to-reward over time

- A timing structure that aligns with volume or volatility

- Even psychological edge (you stay calm when others panic)

But here’s the key:

An edge is something that works often enough, with controlled risk, and consistent execution.

☠️ What Happens When You Don’t Have One

Let’s break it down.

Trading without an edge leads to:

- Random outcomes that feel emotional

- Overtrading because you’re chasing the next “feel good” moment

- Misplaced confidence after a few lucky wins

- Explosive losses when luck runs out

And worst of all?

You think you’re improving…

But in reality, you’re just getting better at losing slower.

🍹 At Least Vegas Gives You Something Back

Here’s the irony:

In Vegas, the drinks are free.

You get a show. You laugh. You know it’s a gamble.

In trading?

- You pay for your losses

- You pay for your education

- You pay for your psychology coach

- And nobody even gives you a free mojito.

If you're going to lose money without an edge, you might as well enjoy the music.

🎯 So How Do You Actually Get an Edge?

1. Backtest.

Find a setup that repeats. Track it. Chart it. Obsess over it.

2. Track your stats.

Your win rate, average R, time in trade. Know thyself.

3. Simplify.

An edge isn’t 12 indicators. It’s one thing done well.

4. Survive first, thrive later.

If you’re not around after 100 trades, your edge won’t matter anyway.

5. Learn from pain, not just profit.

Your losers have more to teach than your winners.

🧘 Final Thought – Stop Playing Pretend

If you wouldn’t go to a casino and bet $1000 on 25 without knowing the odds…

Why are you doing that in the markets?

Don’t call it trading if it’s actually coping.

Don’t call it strategy if it’s actually guessing.

Let’s cut the fluff.

You want to make money trading.

But here’s the problem no one wants to admit:

Most traders don’t have an edge. And they trade anyway.

Which means they’re not traders.

They’re just expensive gamblers in denial.

🎰 Welcome to the Casino Called “Charts”

In Vegas, the odds are clearly displayed.

You know the house has the advantage.

But in trading? You convince yourself you are the house.

You say things like:

-“This setup worked for someone on YouTube.”

- “Price is oversold, so it has to bounce.”

- “I just have a feeling it’ll go up.”

That’s not a strategy. That’s astrology.

If you can’t define your edge in one sentence, you don’t have one.

And if your edge isn’t tested over at least 100 trades — it’s fantasy.

🧠 What Is an Edge, Anyway?

An edge is not a pattern. It’s not always your gut.

It’s a repeatable, testable advantage in the market.

It could be:

- A statistical tendency in price behavior

- A setup with positive risk-to-reward over time

- A timing structure that aligns with volume or volatility

- Even psychological edge (you stay calm when others panic)

But here’s the key:

An edge is something that works often enough, with controlled risk, and consistent execution.

☠️ What Happens When You Don’t Have One

Let’s break it down.

Trading without an edge leads to:

- Random outcomes that feel emotional

- Overtrading because you’re chasing the next “feel good” moment

- Misplaced confidence after a few lucky wins

- Explosive losses when luck runs out

And worst of all?

You think you’re improving…

But in reality, you’re just getting better at losing slower.

🍹 At Least Vegas Gives You Something Back

Here’s the irony:

In Vegas, the drinks are free.

You get a show. You laugh. You know it’s a gamble.

In trading?

- You pay for your losses

- You pay for your education

- You pay for your psychology coach

- And nobody even gives you a free mojito.

If you're going to lose money without an edge, you might as well enjoy the music.

🎯 So How Do You Actually Get an Edge?

1. Backtest.

Find a setup that repeats. Track it. Chart it. Obsess over it.

2. Track your stats.

Your win rate, average R, time in trade. Know thyself.

3. Simplify.

An edge isn’t 12 indicators. It’s one thing done well.

4. Survive first, thrive later.

If you’re not around after 100 trades, your edge won’t matter anyway.

5. Learn from pain, not just profit.

Your losers have more to teach than your winners.

🧘 Final Thought – Stop Playing Pretend

If you wouldn’t go to a casino and bet $1000 on 25 without knowing the odds…

Why are you doing that in the markets?

Don’t call it trading if it’s actually coping.

Don’t call it strategy if it’s actually guessing.

📈 Forex & XAU/USD Channel:

t.me/intradaytradingsignals

💎 Crypto Channel:

t.me/FanCryptocurrency

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📈 Forex & XAU/USD Channel:

t.me/intradaytradingsignals

💎 Crypto Channel:

t.me/FanCryptocurrency

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.