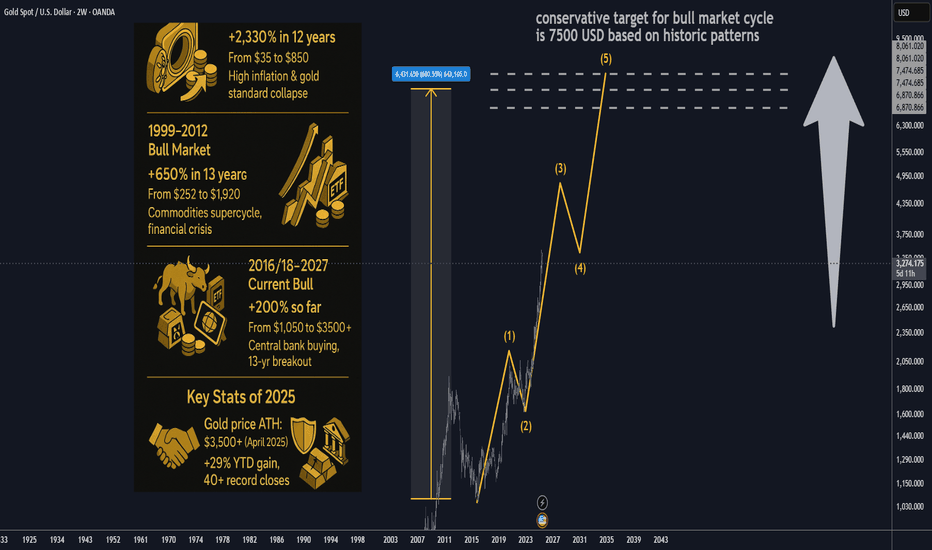

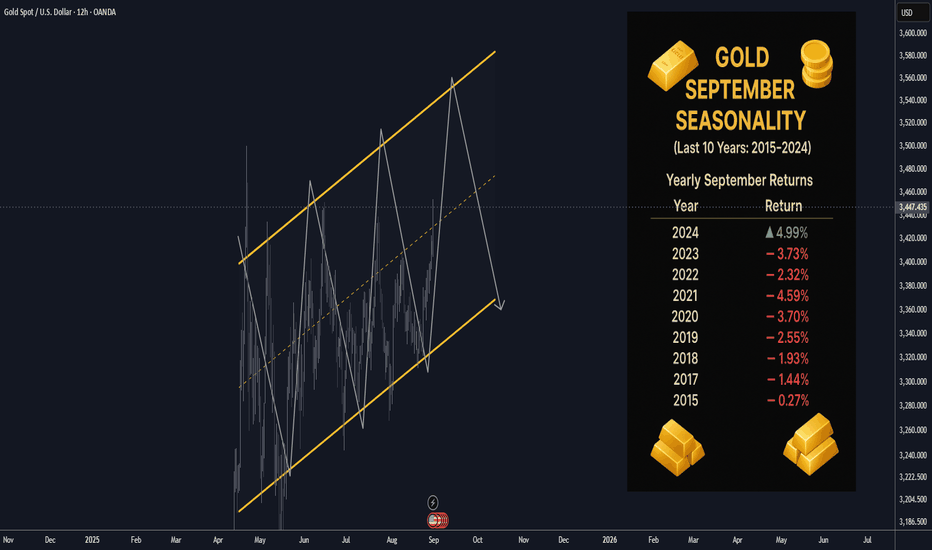

⚡️ Gold: Consolidation Before the Next Move

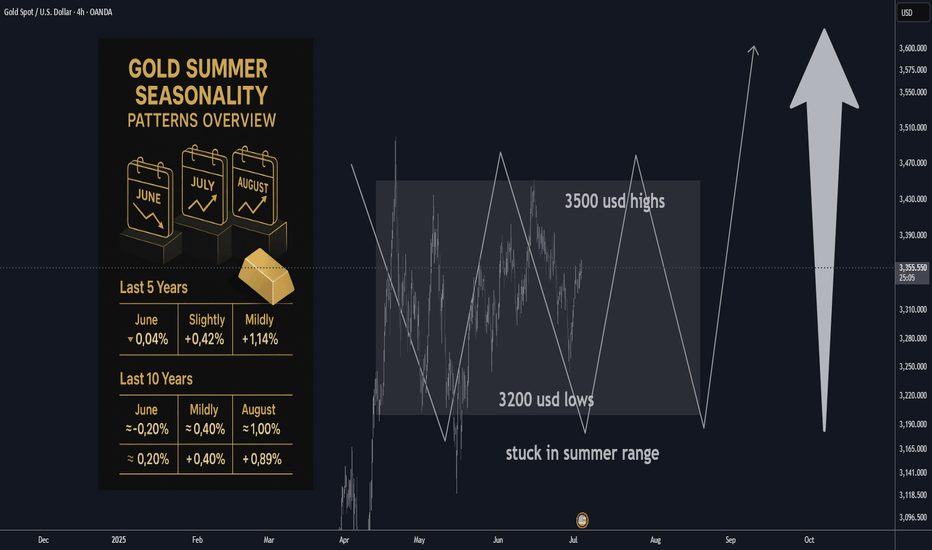

Gold set fresh records earlier this year and now sits in a tight post–Jackson Hole range around $3,360–$3,380/oz as rate-cut odds jumped and the dollar eased back. Spot was ~$3,368 this morning, slightly off Friday’s spike after Powell opened the door to a September cut.

________________________________________

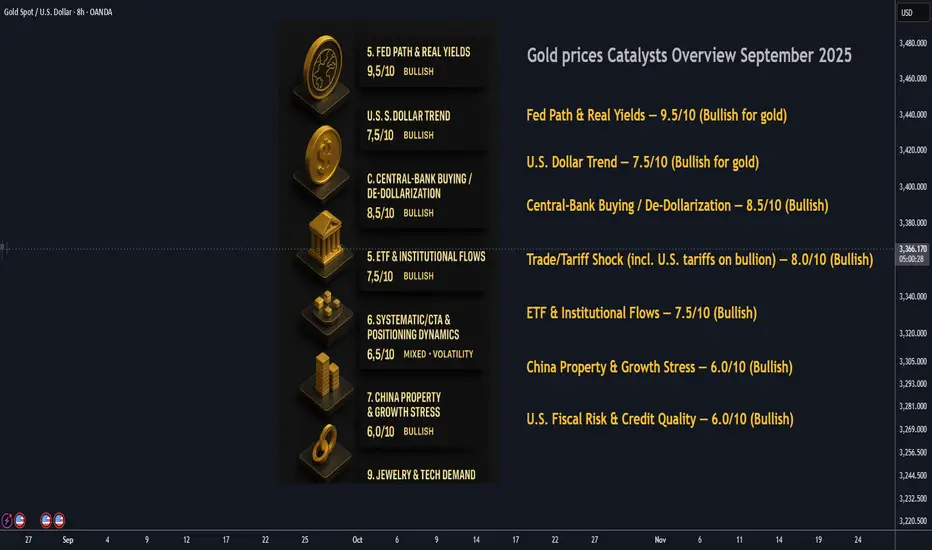

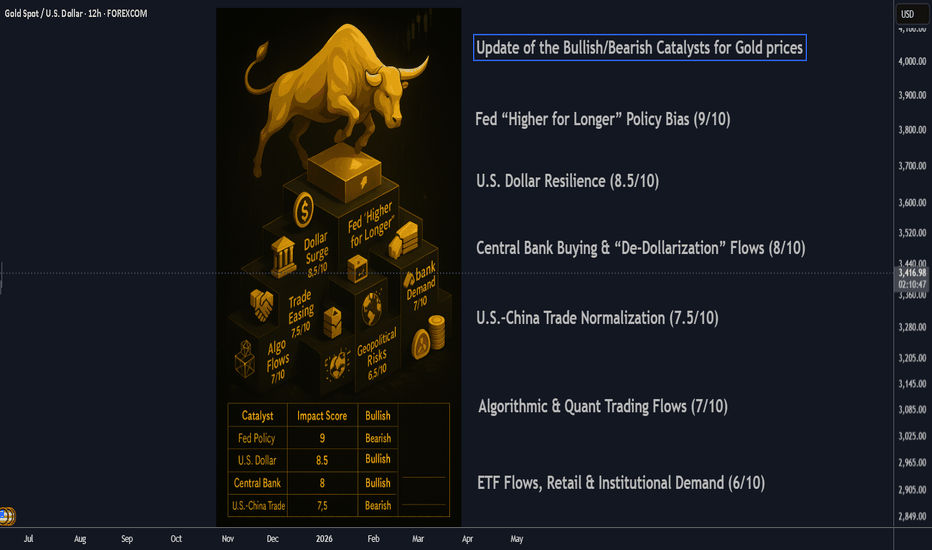

1) Fed Path & Real Yields — 9.5/10 (Bullish for gold)

Powell’s Jackson Hole remarks highlighted rising labor-market risks and explicitly “opened the door” to a September cut. Futures now price a high probability of an initial -25 bps move with more to follow into year-end. Lower policy rates/real yields remain the single strongest tailwind for non-yielding gold.

2) U.S. Dollar Trend — 7.5/10 (Bullish for gold)

The DXY slipped toward the high-97s after Powell’s dovish tilt and remains soft versus recent peaks, reducing a key headwind to non-USD buyers. If the dollar rebound stalls, gold’s upside path stays cleaner.

3) Central-Bank Buying / De-Dollarization — 8.5/10 (Bullish)

Official-sector demand stays structurally strong. Global central banks remain on track for another ~1,000t year, with China’s PBoC extending purchases for a ninth straight month. This “sticky” bid continues to underwrite dips.

4) Trade/Tariff Shock (incl. U.S. tariffs on bullion) — 8.0/10 (Bullish)

The broad U.S. tariff regime (10% baseline, higher on targeted goods) is inflationary at the margin; crucially, imports of 1kg/100oz gold bars were swept into the rules, temporarily snarling Swiss shipments and roiling COMEX/LBMA logistics until guidance is clarified. Result: fatter location/financing premia and periodic price dislocations that tend to support spot.

5) ETF & Institutional Flows — 7.5/10 (Bullish)

After years of outflows, ETF inflows in the first half of 2025 were the strongest in 5 years (~$38B; +397t), with July showing further additions. GLD holdings are back near ~957t. Continued inflows amplify macro moves.

6) Systematic/CTA & Positioning Dynamics — 6.5/10 (Mixed → Volatility)

CTAs and options flow are magnifying swings around key levels ($3,350–$3,420). Upside call demand is persistent, meaning whipsaws remain likely as trend-following systems react to dollar/yield shifts.

7) China Property & Growth Stress — 6.0/10 (Bullish)

The Evergrande delisting and deepening Country Garden losses underscore a property slump that keeps risk appetite in check and supports defensive assets. Weak housing drags on jewelry demand but typically supports investment demand for bullion.

8) U.S. Fiscal Risk & Credit Quality — 6.0/10 (Bullish)

The May downgrade of U.S. sovereign credit and ongoing wide deficits keep a slow-burn bid under gold. Any wobble in auctions or debt-ceiling theatrics would push this higher.

9) Jewelry & Tech Demand — 5.0/10 (Slightly Bearish/neutral short-term)

Record prices hit Q2 jewelry volumes (-14% y/y to 341t), though India shows early signs of seasonal revival into festivals. Tech demand dipped ~2% y/y amid electronics softness. Physical demand is a brake on parabolic rallies.

10) Geopolitics (Ukraine, Middle East, Taiwan risk, etc.) — 5.5/10 (Event-Bullish)

Headlines remain volatile—Israeli strikes on Iran-aligned Houthis and ongoing Ukraine politics keep a latent safe-haven premium. Spikes are event-driven unless escalation persists.

________________________________________

🌐 Other Catalysts to Watch

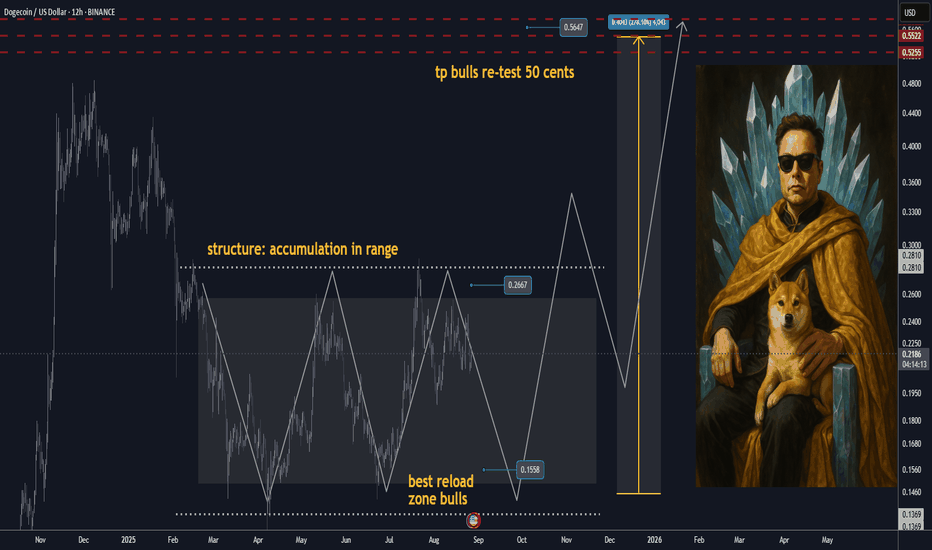

• Crypto Cross-Flows (5/10): Sharp crypto drawdowns can funnel short-term interest into gold, though correlation remains inconsistent.

• Bullion Logistics & Refining (New): U.S. tariff ambiguity on kilobars introduces intermittent premiums and arbitrage opportunities between Zurich–London–NY.

• Physical Supply Disruptions (4/10): Always idiosyncratic; currently secondary to macro.

| Rank | Catalyst | Score/10 | Current Impact | Direction | Notes |

| ---- | ------------------------------------------ | -------: | -------------- | ------------------------------ | ------------------------------------------------------------ |

| 1 | Fed path & real yields | **9.5** | Very High | **Bullish** | Dovish tilt; cuts now live for Sept. |

| 2 | Central-bank buying | **8.5** | High | **Bullish** | Ongoing official demand; PBoC keeps adding. |

| 3 | Trade/tariff shock (incl. bullion tariffs) | **8.0** | High | **Bullish** | Broad tariffs + bullion rules raise premia & inflation risk. |

| 4 | U.S. dollar trend | **7.5** | High | **Bullish** | DXY softer post-Jackson Hole; less drag on gold. |

| 5 | ETF/institutional flows | **7.5** | High | **Bullish** | Biggest inflows in 5 yrs; GLD holdings high. |

| 6 | Systematic/CTA flows | **6.5** | Moderate | **Mixed** | Options/CTA activity driving overshoots both ways. |

| 7 | China property stress | **6.0** | Moderate | **Bullish** | Structural drag supports safe-haven demand. |

| 8 | U.S. fiscal/credit risk | **6.0** | Moderate | **Bullish** | Downgrade + deficits maintain hedge demand. |

| 9 | Jewelry/tech demand | **5.0** | Low | **Neutral → Slightly Bearish** | Jewelry volumes fell 14% y/y; festivals could revive. |

| 10 | Geopolitics (broad) | **5.5** | Low–Mod | **Bullish (event-driven)** | Episodic; not the primary driver now. |

Gold set fresh records earlier this year and now sits in a tight post–Jackson Hole range around $3,360–$3,380/oz as rate-cut odds jumped and the dollar eased back. Spot was ~$3,368 this morning, slightly off Friday’s spike after Powell opened the door to a September cut.

________________________________________

1) Fed Path & Real Yields — 9.5/10 (Bullish for gold)

Powell’s Jackson Hole remarks highlighted rising labor-market risks and explicitly “opened the door” to a September cut. Futures now price a high probability of an initial -25 bps move with more to follow into year-end. Lower policy rates/real yields remain the single strongest tailwind for non-yielding gold.

2) U.S. Dollar Trend — 7.5/10 (Bullish for gold)

The DXY slipped toward the high-97s after Powell’s dovish tilt and remains soft versus recent peaks, reducing a key headwind to non-USD buyers. If the dollar rebound stalls, gold’s upside path stays cleaner.

3) Central-Bank Buying / De-Dollarization — 8.5/10 (Bullish)

Official-sector demand stays structurally strong. Global central banks remain on track for another ~1,000t year, with China’s PBoC extending purchases for a ninth straight month. This “sticky” bid continues to underwrite dips.

4) Trade/Tariff Shock (incl. U.S. tariffs on bullion) — 8.0/10 (Bullish)

The broad U.S. tariff regime (10% baseline, higher on targeted goods) is inflationary at the margin; crucially, imports of 1kg/100oz gold bars were swept into the rules, temporarily snarling Swiss shipments and roiling COMEX/LBMA logistics until guidance is clarified. Result: fatter location/financing premia and periodic price dislocations that tend to support spot.

5) ETF & Institutional Flows — 7.5/10 (Bullish)

After years of outflows, ETF inflows in the first half of 2025 were the strongest in 5 years (~$38B; +397t), with July showing further additions. GLD holdings are back near ~957t. Continued inflows amplify macro moves.

6) Systematic/CTA & Positioning Dynamics — 6.5/10 (Mixed → Volatility)

CTAs and options flow are magnifying swings around key levels ($3,350–$3,420). Upside call demand is persistent, meaning whipsaws remain likely as trend-following systems react to dollar/yield shifts.

7) China Property & Growth Stress — 6.0/10 (Bullish)

The Evergrande delisting and deepening Country Garden losses underscore a property slump that keeps risk appetite in check and supports defensive assets. Weak housing drags on jewelry demand but typically supports investment demand for bullion.

8) U.S. Fiscal Risk & Credit Quality — 6.0/10 (Bullish)

The May downgrade of U.S. sovereign credit and ongoing wide deficits keep a slow-burn bid under gold. Any wobble in auctions or debt-ceiling theatrics would push this higher.

9) Jewelry & Tech Demand — 5.0/10 (Slightly Bearish/neutral short-term)

Record prices hit Q2 jewelry volumes (-14% y/y to 341t), though India shows early signs of seasonal revival into festivals. Tech demand dipped ~2% y/y amid electronics softness. Physical demand is a brake on parabolic rallies.

10) Geopolitics (Ukraine, Middle East, Taiwan risk, etc.) — 5.5/10 (Event-Bullish)

Headlines remain volatile—Israeli strikes on Iran-aligned Houthis and ongoing Ukraine politics keep a latent safe-haven premium. Spikes are event-driven unless escalation persists.

________________________________________

🌐 Other Catalysts to Watch

• Crypto Cross-Flows (5/10): Sharp crypto drawdowns can funnel short-term interest into gold, though correlation remains inconsistent.

• Bullion Logistics & Refining (New): U.S. tariff ambiguity on kilobars introduces intermittent premiums and arbitrage opportunities between Zurich–London–NY.

• Physical Supply Disruptions (4/10): Always idiosyncratic; currently secondary to macro.

| Rank | Catalyst | Score/10 | Current Impact | Direction | Notes |

| ---- | ------------------------------------------ | -------: | -------------- | ------------------------------ | ------------------------------------------------------------ |

| 1 | Fed path & real yields | **9.5** | Very High | **Bullish** | Dovish tilt; cuts now live for Sept. |

| 2 | Central-bank buying | **8.5** | High | **Bullish** | Ongoing official demand; PBoC keeps adding. |

| 3 | Trade/tariff shock (incl. bullion tariffs) | **8.0** | High | **Bullish** | Broad tariffs + bullion rules raise premia & inflation risk. |

| 4 | U.S. dollar trend | **7.5** | High | **Bullish** | DXY softer post-Jackson Hole; less drag on gold. |

| 5 | ETF/institutional flows | **7.5** | High | **Bullish** | Biggest inflows in 5 yrs; GLD holdings high. |

| 6 | Systematic/CTA flows | **6.5** | Moderate | **Mixed** | Options/CTA activity driving overshoots both ways. |

| 7 | China property stress | **6.0** | Moderate | **Bullish** | Structural drag supports safe-haven demand. |

| 8 | U.S. fiscal/credit risk | **6.0** | Moderate | **Bullish** | Downgrade + deficits maintain hedge demand. |

| 9 | Jewelry/tech demand | **5.0** | Low | **Neutral → Slightly Bearish** | Jewelry volumes fell 14% y/y; festivals could revive. |

| 10 | Geopolitics (broad) | **5.5** | Low–Mod | **Bullish (event-driven)** | Episodic; not the primary driver now. |

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.