The current short-term focus is still on the Middle East issue. The conflict between Iran and Israel continues to ferment. Trump announced that the US military launched strikes on Iran's three major nuclear facilities, Fordow, Natanz and Isfahan, and dropped 6 bunker-buster bombs. The US's participation in the war means that the Iran-Israel escalation is in the middle of the war. This news instantly ignited the Middle East powder keg. Iran responded quickly, saying that it had completed the evacuation of personnel from relevant nuclear facilities before the attack, and made a strong statement that every American citizen and military personnel in the region were listed as legitimate targets. The Atomic Energy Organization of Iran directly pointed out that the US behavior violated international law and emphasized that the attack could not stop the development of its nuclear industry.

The development of the situation is full of uncertainty and gunpowder. Iran is very likely to launch a retaliatory attack on the US military bases and related interests in the Gulf region, and the Iraqi armed groups allied with Iran are also at risk of being involved in the battle. It is reported that the United States is accelerating the evacuation of diplomats from Iraq, which indirectly reflects the tension of the situation. In Yemen, the Houthi armed forces have made it clear that if Iran is attacked, they will break the brief ceasefire with the United States and start attacking American ships. Although Hezbollah in Lebanon has not taken action yet, it has released a dangerous signal last week, suggesting that it will support Iran in an "appropriate way". Once it intervenes, the conflict with Israel that has caused devastating damage is likely to revive. What is more worthy of attention is that if Iran blocks the Strait of Hormuz, as the throat of about 20% of the world's oil transportation, this move will hit the global economy hard and will also bring a fatal blow to energy exporters in the Gulf region.

Now that the situation in the Middle East has deteriorated sharply, gold, as a traditional safe-haven asset, has quickly activated its safe-haven value in this environment full of uncertainty and risk. Whether it is a direct conflict between the United States and Iran or a possible chain reaction, the market is filled with panic and drives funds to gold. Therefore, driven by the strong demand for safe-haven, gold is expected to have a counterattack opportunity next week.

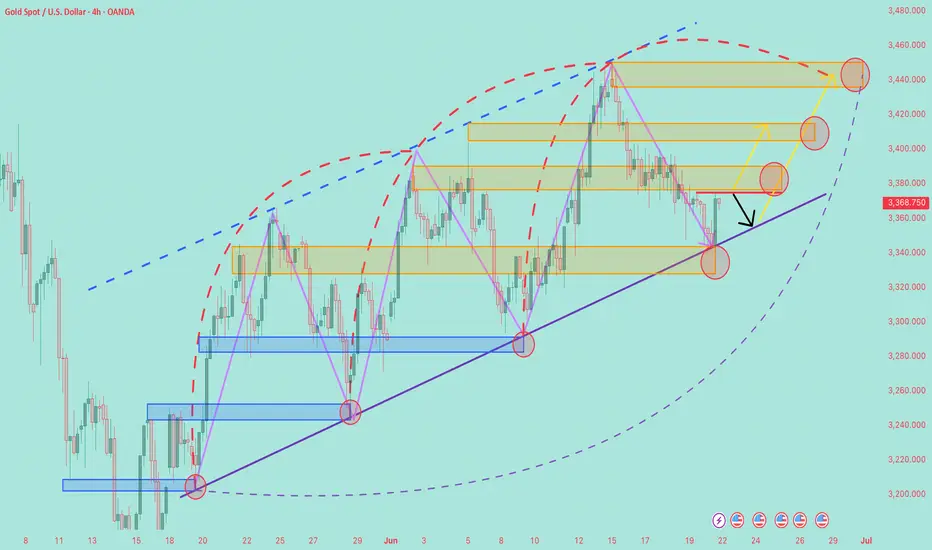

Gold fell first and then rose on Friday. It fluctuated and fell in the Asian session, and the US session fell to around 3340 for the second time and then rose. The US participation in the war means that the conflict between Iran and Israel will escalate. Gold is expected to open higher next Monday. For the operation strategy next week, there is no doubt that it is mainly buying in line with the trend, buying on pullbacks, buying on breakthroughs, and avoiding short orders. Pay attention to the pull-up of the Asian session on Monday. If there is a strong pull-up, you can choose to buy more when there is a pullback in the European and American sessions. The strong pressure above is in the 3400-3410 area, and the upward space will be opened after a breakthrough.

Trade active

I'm glad that many of our strategies this week were correct! What a great week!

I want to know if you come to the market to make money or to gamble? If you want to make money, follow me. Our cooperation will double your profits. As long as you stick to it, you can make a stable profit of at least 200% per week. Don't wait until your account balance is 0 to realize that there is something wrong with your trading method. If you lose money, I will compensate you for your losses! Believe me, our cooperation will win in the end!

You can also contact me:

t.me/+J_l6stZoLjY0Y2Nk

𝐖𝐞𝐥𝐜𝐨𝐦𝐞 𝐓𝐨 𝐉𝐨𝐢𝐧 𝐆𝐨𝐥𝐝 𝐓𝐫𝐚𝐝𝐢𝐧𝐠 𝐂𝐥𝐮𝐛

t.me/+J_l6stZoLjY0Y2Nk

✅𝐃𝐚𝐢𝐥𝐲 𝟐-𝟒 𝐓𝐫𝐚𝐝𝐢𝐧𝐠 𝐒𝐢𝐠𝐧𝐚𝐥𝐬🔥

✅𝐇𝐢𝐠𝐡 𝐀𝐜𝐜𝐮𝐫𝐚𝐜𝐲 𝟗𝟓% 🔥

✅𝐖𝐞𝐞𝐤𝐥𝐲 𝐲𝐢𝐞𝐥𝐝 𝟗𝟎%-𝟗𝟓% 🔥

t.me/+J_l6stZoLjY0Y2Nk

t.me/+J_l6stZoLjY0Y2Nk

✅𝐃𝐚𝐢𝐥𝐲 𝟐-𝟒 𝐓𝐫𝐚𝐝𝐢𝐧𝐠 𝐒𝐢𝐠𝐧𝐚𝐥𝐬🔥

✅𝐇𝐢𝐠𝐡 𝐀𝐜𝐜𝐮𝐫𝐚𝐜𝐲 𝟗𝟓% 🔥

✅𝐖𝐞𝐞𝐤𝐥𝐲 𝐲𝐢𝐞𝐥𝐝 𝟗𝟎%-𝟗𝟓% 🔥

t.me/+J_l6stZoLjY0Y2Nk

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

𝐖𝐞𝐥𝐜𝐨𝐦𝐞 𝐓𝐨 𝐉𝐨𝐢𝐧 𝐆𝐨𝐥𝐝 𝐓𝐫𝐚𝐝𝐢𝐧𝐠 𝐂𝐥𝐮𝐛

t.me/+J_l6stZoLjY0Y2Nk

✅𝐃𝐚𝐢𝐥𝐲 𝟐-𝟒 𝐓𝐫𝐚𝐝𝐢𝐧𝐠 𝐒𝐢𝐠𝐧𝐚𝐥𝐬🔥

✅𝐇𝐢𝐠𝐡 𝐀𝐜𝐜𝐮𝐫𝐚𝐜𝐲 𝟗𝟓% 🔥

✅𝐖𝐞𝐞𝐤𝐥𝐲 𝐲𝐢𝐞𝐥𝐝 𝟗𝟎%-𝟗𝟓% 🔥

t.me/+J_l6stZoLjY0Y2Nk

t.me/+J_l6stZoLjY0Y2Nk

✅𝐃𝐚𝐢𝐥𝐲 𝟐-𝟒 𝐓𝐫𝐚𝐝𝐢𝐧𝐠 𝐒𝐢𝐠𝐧𝐚𝐥𝐬🔥

✅𝐇𝐢𝐠𝐡 𝐀𝐜𝐜𝐮𝐫𝐚𝐜𝐲 𝟗𝟓% 🔥

✅𝐖𝐞𝐞𝐤𝐥𝐲 𝐲𝐢𝐞𝐥𝐝 𝟗𝟎%-𝟗𝟓% 🔥

t.me/+J_l6stZoLjY0Y2Nk

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.