📉 Fundamental Analysis

Gold remains in a strong bullish structure, supported by multiple macroeconomic and political drivers:

ADP Employment Report Missed Expectations: With a shocking -33K reading, market sentiment shifted firmly against the US Dollar, pushing gold higher.

Fed’s Easing Outlook: Markets are now pricing in a 90% probability of a rate cut in Q3, weakening real yields and supporting demand for gold.

Trump’s “Super Bill” Momentum: Political cohesion among Republicans has re-ignited fiscal stimulus expectations, fuelling concerns over long-term US debt sustainability—another tailwind for gold as a safe haven.

🧠 Smart Money Technical Framework (H1)

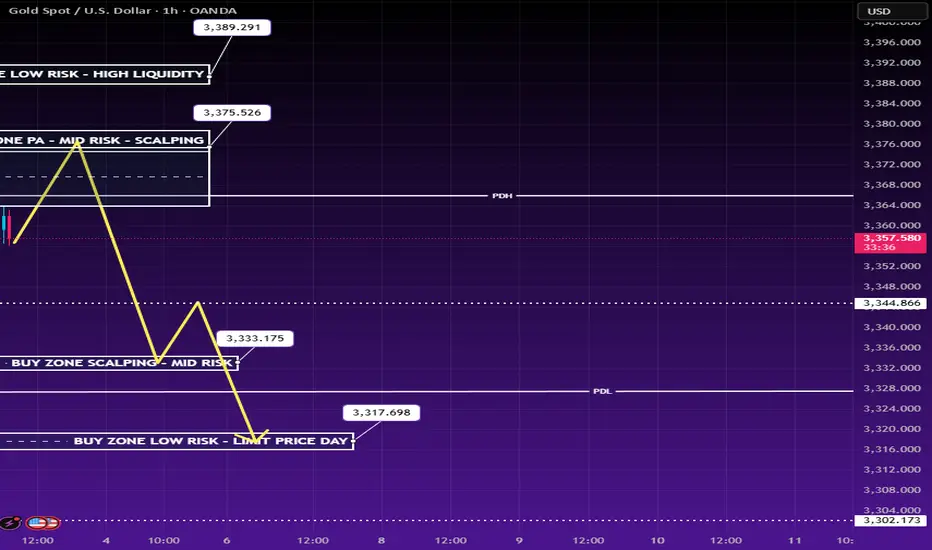

Price has moved into a Premium FVG Zone, showing signs of potential exhaustion after forming a clear CHoCH and bullish BOS. The current zone (3,375 – 3,376) aligns with a mid-risk sell region, where price may experience short-term rejection before revisiting demand zones.

Market structure suggests liquidity sweep potential towards the downside before any continuation of the larger bullish trend.

📊 Trading Strategy – Smart Money Zones & Key Levels

🔵 BUY SCALP: 3,334 – 3,333

🔴 SL: 3,329

✅ TP: 3,340 → 3,344 → 3,350 → 3,360

🔵 BUY ZONE LOW RISK: 3,317 – 3,316

🔴 SL: 3,311

✅ TP: 3,320 → 3,325 → 3,330 → 3,336 → 3,345 → 3,350 → 3,360

🔴 SELL SCALP ZONE: 3,375 – 3,376

🔴 SL: 3,380

✔️ TP: 3,370 → 3,366 → 3,360 → 3,355 → 3,350

🔴 SELL ZONE HIGH PROBABILITY: 3,388 – 3,390

🔴 SL: 3,394

✔️ TP: 3,384 → 3,380 → 3,376 → 3,370 → 3,366 → 3,360

📌 Notes:

Be cautious ahead of NFP data and the upcoming US bank holiday—expect liquidity traps and sudden volatility.

This setup is ideal for intraweek scalping and liquidity-based reversals.

All trades follow Smart Money Concepts logic: premium vs. discount zones, CHoCH + BOS confirmations, and institutional order flow anticipation.

Gold remains in a strong bullish structure, supported by multiple macroeconomic and political drivers:

ADP Employment Report Missed Expectations: With a shocking -33K reading, market sentiment shifted firmly against the US Dollar, pushing gold higher.

Fed’s Easing Outlook: Markets are now pricing in a 90% probability of a rate cut in Q3, weakening real yields and supporting demand for gold.

Trump’s “Super Bill” Momentum: Political cohesion among Republicans has re-ignited fiscal stimulus expectations, fuelling concerns over long-term US debt sustainability—another tailwind for gold as a safe haven.

🧠 Smart Money Technical Framework (H1)

Price has moved into a Premium FVG Zone, showing signs of potential exhaustion after forming a clear CHoCH and bullish BOS. The current zone (3,375 – 3,376) aligns with a mid-risk sell region, where price may experience short-term rejection before revisiting demand zones.

Market structure suggests liquidity sweep potential towards the downside before any continuation of the larger bullish trend.

📊 Trading Strategy – Smart Money Zones & Key Levels

🔵 BUY SCALP: 3,334 – 3,333

🔴 SL: 3,329

✅ TP: 3,340 → 3,344 → 3,350 → 3,360

🔵 BUY ZONE LOW RISK: 3,317 – 3,316

🔴 SL: 3,311

✅ TP: 3,320 → 3,325 → 3,330 → 3,336 → 3,345 → 3,350 → 3,360

🔴 SELL SCALP ZONE: 3,375 – 3,376

🔴 SL: 3,380

✔️ TP: 3,370 → 3,366 → 3,360 → 3,355 → 3,350

🔴 SELL ZONE HIGH PROBABILITY: 3,388 – 3,390

🔴 SL: 3,394

✔️ TP: 3,384 → 3,380 → 3,376 → 3,370 → 3,366 → 3,360

📌 Notes:

Be cautious ahead of NFP data and the upcoming US bank holiday—expect liquidity traps and sudden volatility.

This setup is ideal for intraweek scalping and liquidity-based reversals.

All trades follow Smart Money Concepts logic: premium vs. discount zones, CHoCH + BOS confirmations, and institutional order flow anticipation.

Note

🔵 BUY ZONE LOW RISK: 3,317 – 3,316 +160pips Running🔱 Trade with Smart Money – ICT Concepts & Price Action

🔱 Latest Daily Plan – Updated with 4–6 Free Gold Signals Daily

Join now: t.me/+BT9z8lt4yJ01OGVl

🔱 Latest Daily Plan – Updated with 4–6 Free Gold Signals Daily

Join now: t.me/+BT9z8lt4yJ01OGVl

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔱 Trade with Smart Money – ICT Concepts & Price Action

🔱 Latest Daily Plan – Updated with 4–6 Free Gold Signals Daily

Join now: t.me/+BT9z8lt4yJ01OGVl

🔱 Latest Daily Plan – Updated with 4–6 Free Gold Signals Daily

Join now: t.me/+BT9z8lt4yJ01OGVl

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.