Hey team — wishing you a sharp start to the week! ✨ Here’s XAUUSD Daily Outlook based on the current range and supply/demand zones.

🔸 Market Context

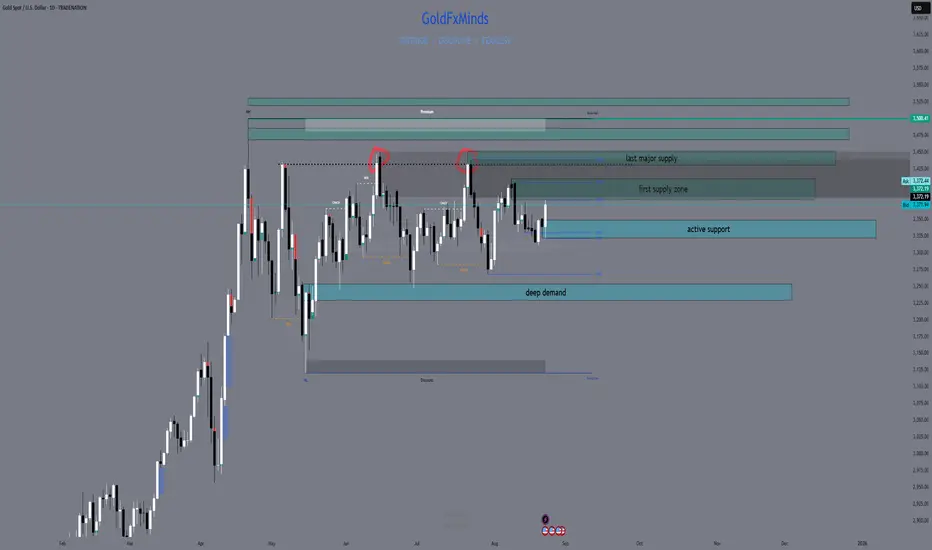

Powell’s speech on Friday gave gold the momentum push, but the market is still trading inside a wide Daily range.

Monday brings no high-impact news, meaning price is likely to respect technical supply and demand zones until Tuesday’s catalysts arrive.

🔸 Structure & Bias (D1)

Current price: ~3372

Trend: HTF bullish, Daily still ranging between 3320 demand and 3439 supply cap.

EMA Flow: Price trades above EMA21/EMA50 → bullish tilt, but capped by multiple overhead supply zones.

Liquidity:

Buy-side rests above 3380–3410 → 3439 → 3470–3485 → 3500.

Sell-side sits under 3320–3340 demand zone.

Bias: Bullish as long as 3320–3340 demand zone holds.

🔸 Key Supply & Demand Zones

Lower Demand Zone: 3320 – 3340 (active support, line in the sand for bulls).

Upper Supply Zone 1: 3380 – 3410 (first resistance band).

Major Supply Zone 2: 3430 – 3439 (weekly wick high, range top).

Supply Zone 3: 3470 – 3485 (Daily supply, OB + liquidity pocket).

Supply Zone 4: 3495 – 3500 (critical ceiling before extensions).

Deep Demand Zone: 3250 – 3230 (only active if 3320 breaks decisively).

🔸 Scenarios

Bullish 🟢

If buyers defend 3320–3340 demand, gold can step up into each supply zone:

3380–3410 → first target

3430–3439 → range cap test

Break above 3439 → continuation to 3470–3485

Final supply before extensions: 3495–3500

Only above 3500 do extensions open:

3520–3530 (1.272 Fibo ext)

3635–3650 (1.618 Fibo ext)

Bearish 🔴

Rejection in any supply zone (3380–3410 / 3439 / 3470–3485 / 3500) → pullback into 3320–3340 demand.

Break below 3320 demand → activates the deeper 3250–3230 HTF demand zone.

🔸 Action Plan

3320–3340 demand = key support zone.

As long as this zone holds, bias is bullish toward step-by-step supply tests.

Watch reactions in each supply zone: rejection = range play, break = continuation.

Above 3500 → bullish extensions activate into 3520–3530 and higher.

✨ Gold remains in range, 3320–3439, with multiple supply zones stacked above. Powell lit the fire, but breakout confirmation hasn’t happened yet. If this gave you clarity, drop a like, share your bias below, and follow GoldFxMinds for more updates. 💛

Disclosure: Analysis built on Trade Nation feed (Gold Spot · TradeNation data).

🔸 Market Context

Powell’s speech on Friday gave gold the momentum push, but the market is still trading inside a wide Daily range.

Monday brings no high-impact news, meaning price is likely to respect technical supply and demand zones until Tuesday’s catalysts arrive.

🔸 Structure & Bias (D1)

Current price: ~3372

Trend: HTF bullish, Daily still ranging between 3320 demand and 3439 supply cap.

EMA Flow: Price trades above EMA21/EMA50 → bullish tilt, but capped by multiple overhead supply zones.

Liquidity:

Buy-side rests above 3380–3410 → 3439 → 3470–3485 → 3500.

Sell-side sits under 3320–3340 demand zone.

Bias: Bullish as long as 3320–3340 demand zone holds.

🔸 Key Supply & Demand Zones

Lower Demand Zone: 3320 – 3340 (active support, line in the sand for bulls).

Upper Supply Zone 1: 3380 – 3410 (first resistance band).

Major Supply Zone 2: 3430 – 3439 (weekly wick high, range top).

Supply Zone 3: 3470 – 3485 (Daily supply, OB + liquidity pocket).

Supply Zone 4: 3495 – 3500 (critical ceiling before extensions).

Deep Demand Zone: 3250 – 3230 (only active if 3320 breaks decisively).

🔸 Scenarios

Bullish 🟢

If buyers defend 3320–3340 demand, gold can step up into each supply zone:

3380–3410 → first target

3430–3439 → range cap test

Break above 3439 → continuation to 3470–3485

Final supply before extensions: 3495–3500

Only above 3500 do extensions open:

3520–3530 (1.272 Fibo ext)

3635–3650 (1.618 Fibo ext)

Bearish 🔴

Rejection in any supply zone (3380–3410 / 3439 / 3470–3485 / 3500) → pullback into 3320–3340 demand.

Break below 3320 demand → activates the deeper 3250–3230 HTF demand zone.

🔸 Action Plan

3320–3340 demand = key support zone.

As long as this zone holds, bias is bullish toward step-by-step supply tests.

Watch reactions in each supply zone: rejection = range play, break = continuation.

Above 3500 → bullish extensions activate into 3520–3530 and higher.

✨ Gold remains in range, 3320–3439, with multiple supply zones stacked above. Powell lit the fire, but breakout confirmation hasn’t happened yet. If this gave you clarity, drop a like, share your bias below, and follow GoldFxMinds for more updates. 💛

Disclosure: Analysis built on Trade Nation feed (Gold Spot · TradeNation data).

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD ⭐

Telegram: t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD ⭐

Telegram: t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD ⭐

Telegram: t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD ⭐

Telegram: t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.