Geopolitical tensions have pushed gold prices higher, with the medium- to long-term outlook still pointing to upside potential, and a recovery in Chinese demand could provide potential support.

XAUUSD edged up in early Asian trade on Tuesday. Russia recently launched its largest-ever drone and missile attack on Ukraine, ignoring President Trump’s call to stop the bombing, according to Ukrainian officials.

XAUUSD edged up in early Asian trade on Tuesday. Russia recently launched its largest-ever drone and missile attack on Ukraine, ignoring President Trump’s call to stop the bombing, according to Ukrainian officials.

Gold prices fell nearly 1%

On Monday, international gold prices were under pressure and fell nearly 1%. Affected by US President Trump's decision to postpone the imposition of a 50% tariff on EU goods, the market's risk-off sentiment has cooled significantly, and the appeal of gold as a traditional safe-haven asset has weakened.

The most actively traded June 2025 gold futures closed at $3,342.2/ounce, down $23.6 (-1.45%) on the day, with intraday fluctuations ranging from $3,322.9 to $3,356. Due to the Memorial Day holiday in the United States, COMEX did not announce settlement prices on that day, and the UK and US markets were closed at the same time.

Policy changes affect short-term trends, narrow-range trading is likely to bring big changes

Trump’s extension of the US-EU trade talks deadline from June 1 to July 9 has directly undermined the market’s safe-haven demand for gold. The holiday-induced liquidity crunch has further exacerbated price volatility.

The move is in stark contrast to gold’s performance last Friday, when the XAUUSD price recorded its biggest one-day gain in six weeks as Trump threatened to impose tariffs on EU goods and Apple’s iPhones.

XAUUSD price recorded its biggest one-day gain in six weeks as Trump threatened to impose tariffs on EU goods and Apple’s iPhones.

Geopolitical risks have not disappeared and institutions remain bullish on the outlook

Reasons include the ongoing changes in US tariff policy, the continued escalation of the Ukraine geopolitical crisis and fiscal concerns. Data shows that Russia has launched airstrikes on Ukraine for three consecutive nights, including the largest attack since the conflict began in 2022, and the intensity of the war has not abated.

With what is available in terms of trade, geopolitical and monetary policy risks, gold still has a lot of upside potential in the coming period.

China’s demand is showing signs of recovery, which could be the latest factor

The latest trade data showed that mainland China’s gold imports via Hong Kong in April hit their highest level since March last year. The recovery in physical gold purchases in Asia could support lower gold prices, especially amid increasingly volatile investment demand in the West.

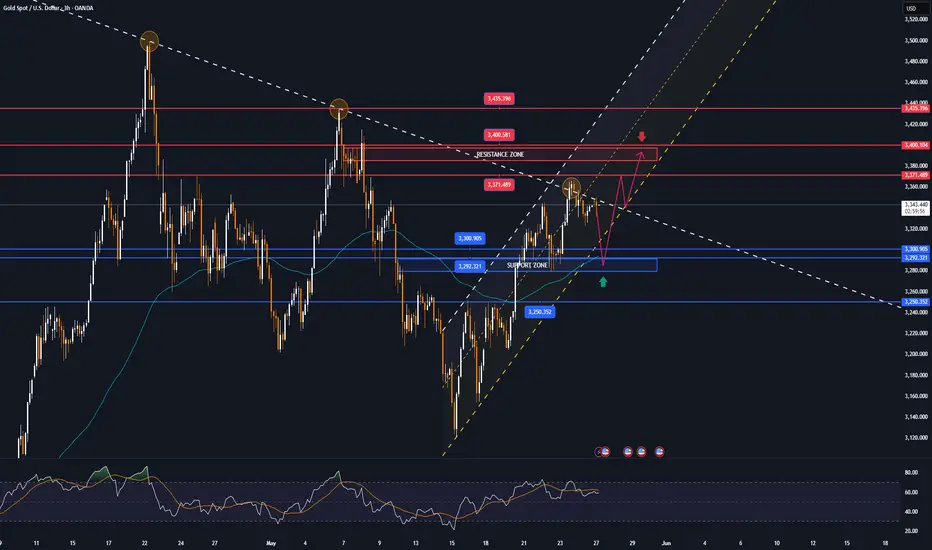

Technical Outlook Analysis XAUUSD

XAUUSD

Gold traded in a fairly narrow range in the early Asian session today, Tuesday (May 27), with technical conditions still leaning towards the upside, with spot gold currently trading around $3,341/oz. After falling from $3,371, the target price point is the price point of the temporary 0.236% Fibonacci retracement. The bullish momentum of gold prices remains unaffected as the nearest support is the confluence of the (EMA21 with the 0.382% Fibonacci retracement).

On the other hand, the Relative Strength Index (RSI) remaining above 50 should be considered a positive signal as the RSI is still quite far from the overbought zone indicating that there is still room for upside ahead.

Next, if gold breaks above $3,371 it will be in a position to continue its rally towards the short-term target of $3,400, more so $3,435 and then the all-time high of $3,500.

As long as gold remains above the EMA21, it still has a short-term bullish outlook, and the long-term trend continues to be noticed by the price channel.

During the day, the gold price's bullish trend will be interested by the following technical positions.

Support: 3,300 – 3,292 – 3,250 USD

Resistance: 3,371 – 3,400 – 3,435 USD

SELL XAUUSD PRICE 3391 - 3389⚡️

↠↠ Stop Loss 3395

→Take Profit 1 3383

↨

→Take Profit 2 3377

BUY XAUUSD PRICE 3283 - 3285⚡️

↠↠ Stop Loss 3279

→Take Profit 1 3291

↨

→Take Profit 2 3297

Gold prices fell nearly 1%

On Monday, international gold prices were under pressure and fell nearly 1%. Affected by US President Trump's decision to postpone the imposition of a 50% tariff on EU goods, the market's risk-off sentiment has cooled significantly, and the appeal of gold as a traditional safe-haven asset has weakened.

The most actively traded June 2025 gold futures closed at $3,342.2/ounce, down $23.6 (-1.45%) on the day, with intraday fluctuations ranging from $3,322.9 to $3,356. Due to the Memorial Day holiday in the United States, COMEX did not announce settlement prices on that day, and the UK and US markets were closed at the same time.

Policy changes affect short-term trends, narrow-range trading is likely to bring big changes

Trump’s extension of the US-EU trade talks deadline from June 1 to July 9 has directly undermined the market’s safe-haven demand for gold. The holiday-induced liquidity crunch has further exacerbated price volatility.

The move is in stark contrast to gold’s performance last Friday, when the

Geopolitical risks have not disappeared and institutions remain bullish on the outlook

Reasons include the ongoing changes in US tariff policy, the continued escalation of the Ukraine geopolitical crisis and fiscal concerns. Data shows that Russia has launched airstrikes on Ukraine for three consecutive nights, including the largest attack since the conflict began in 2022, and the intensity of the war has not abated.

With what is available in terms of trade, geopolitical and monetary policy risks, gold still has a lot of upside potential in the coming period.

China’s demand is showing signs of recovery, which could be the latest factor

The latest trade data showed that mainland China’s gold imports via Hong Kong in April hit their highest level since March last year. The recovery in physical gold purchases in Asia could support lower gold prices, especially amid increasingly volatile investment demand in the West.

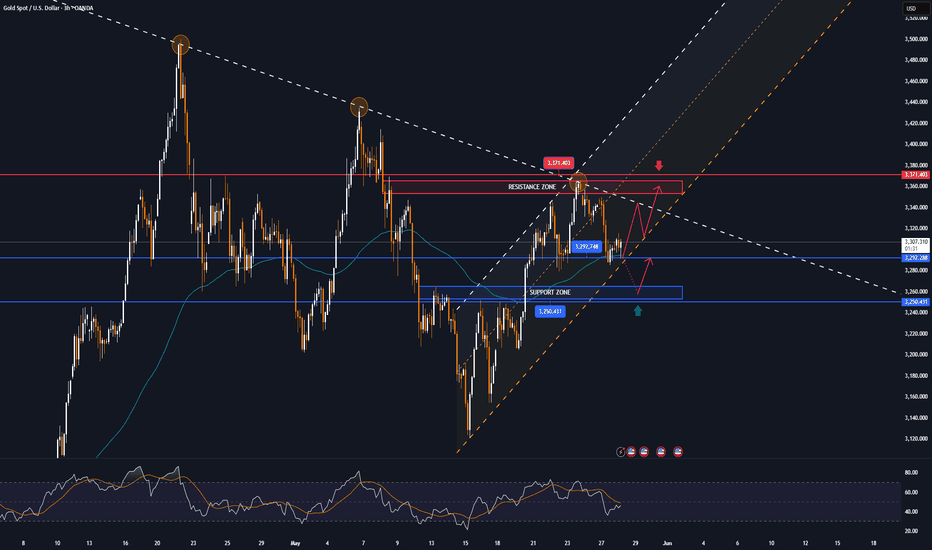

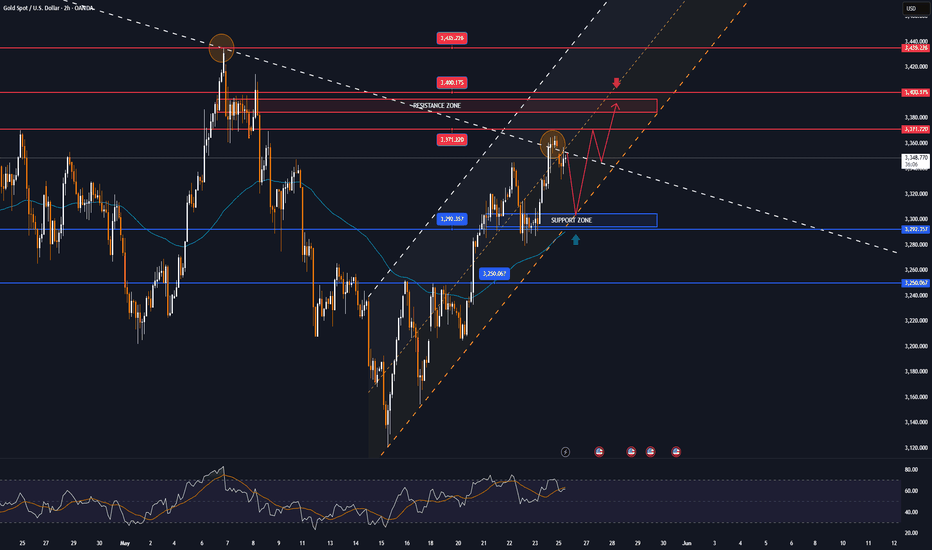

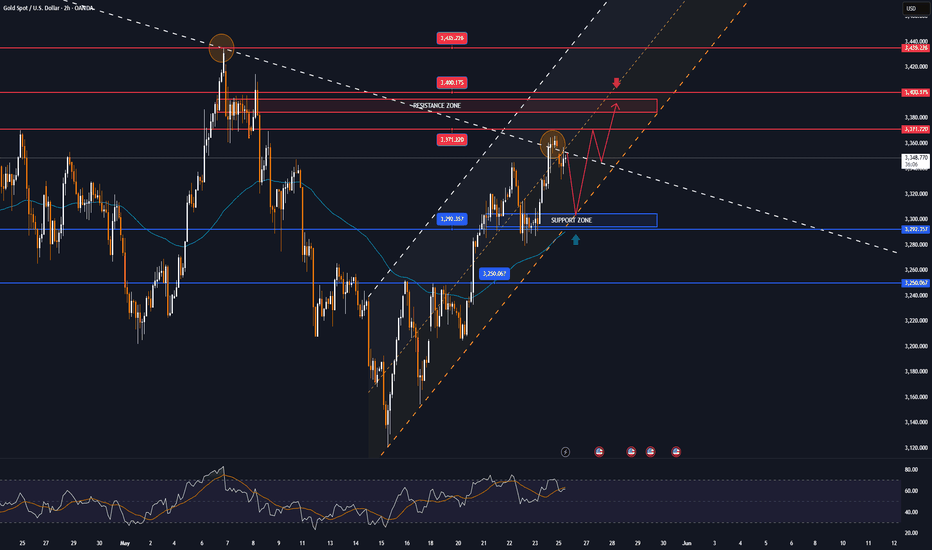

Technical Outlook Analysis

Gold traded in a fairly narrow range in the early Asian session today, Tuesday (May 27), with technical conditions still leaning towards the upside, with spot gold currently trading around $3,341/oz. After falling from $3,371, the target price point is the price point of the temporary 0.236% Fibonacci retracement. The bullish momentum of gold prices remains unaffected as the nearest support is the confluence of the (EMA21 with the 0.382% Fibonacci retracement).

On the other hand, the Relative Strength Index (RSI) remaining above 50 should be considered a positive signal as the RSI is still quite far from the overbought zone indicating that there is still room for upside ahead.

Next, if gold breaks above $3,371 it will be in a position to continue its rally towards the short-term target of $3,400, more so $3,435 and then the all-time high of $3,500.

As long as gold remains above the EMA21, it still has a short-term bullish outlook, and the long-term trend continues to be noticed by the price channel.

During the day, the gold price's bullish trend will be interested by the following technical positions.

Support: 3,300 – 3,292 – 3,250 USD

Resistance: 3,371 – 3,400 – 3,435 USD

SELL XAUUSD PRICE 3391 - 3389⚡️

↠↠ Stop Loss 3395

→Take Profit 1 3383

↨

→Take Profit 2 3377

BUY XAUUSD PRICE 3283 - 3285⚡️

↠↠ Stop Loss 3279

→Take Profit 1 3291

↨

→Take Profit 2 3297

Trade active

Plan BUY HIT TP1 +70pips. Heading to TP2 😵😵😵Trade closed: target reached

Plan BUY Hit Full TP2 + 125pips🤕🤕🤕. Congratulations everyoneNote

Gold continues to weaken to 3,285 USD/ozNote

Gold prices suddenly plummeted early on May 28, falling to $3,285.25/ounce due to the temporary easing of US-EU trade tensions after Trump delayed imposing a 50% tax, causing demand for safe havens to decline.Note

🔴Spot gold prices fell below $3,290/ounce, down 0.30% on the day.Note

Gold price recovers slightly to above 3,270 USD/ozNote

Dollar rally stalls as traders assess next step on Trump tariffsNote

🔴Spot gold prices fell below $3,300/ounce, down 0.53% on the day.Note

Gold accumulates around $3,295/oz🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.