Mainly due to the strengthening of the  DXY ,

DXY ,  XAUUSD have fallen sharply from a near four-week high, with a one-day drop of nearly $30 on Tuesday and a slight recovery in today's Asian trading session on Wednesday, June 4.

XAUUSD have fallen sharply from a near four-week high, with a one-day drop of nearly $30 on Tuesday and a slight recovery in today's Asian trading session on Wednesday, June 4.

DXY rebounded from its lowest level in more than a month hit earlier in the session on Tuesday and ended the day up 0.6%, which put some minor pressure on gold in yesterday's session. The U.S. Bureau of Labor Statistics' Employment and Labor Turnover Survey (JOLTS) released on Tuesday showed that total job vacancies in the United States reached 7.39 million in April, up from 7.2 million in March. Economists had expected job vacancies in the United States to be 7.1 million in April.

XAUUSD fell on Tuesday as a surprise rise in U.S. job vacancies boosted risk appetite and helped the dollar strengthen, according to Bloomberg. The rise in job vacancies encouraged investors to believe that the U.S. economy remains resilient despite the threat of U.S. President Trump’s tariff agenda.

XAUUSD fell on Tuesday as a surprise rise in U.S. job vacancies boosted risk appetite and helped the dollar strengthen, according to Bloomberg. The rise in job vacancies encouraged investors to believe that the U.S. economy remains resilient despite the threat of U.S. President Trump’s tariff agenda.

Looking ahead, U.S. employment data, including Friday’s May nonfarm payrolls report, could help guide the Federal Reserve’s monetary policy, Bloomberg said. Lower interest rates are generally good for non-interest-bearing gold.

Gold traders will be looking ahead to key employment data, including the ADP and nonfarm payrolls reports, to determine the Fed’s policy path.

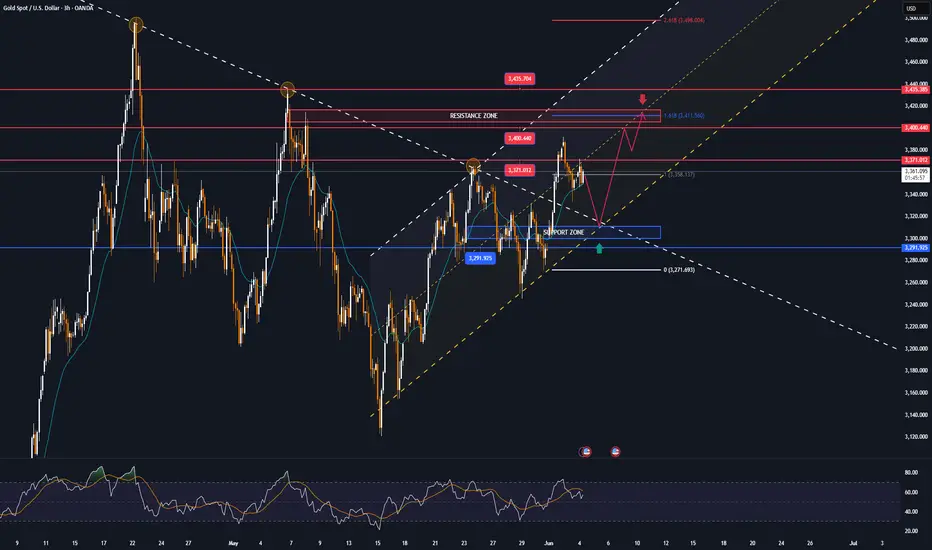

In terms of technical structure, there are no changes to the chart or previous analysis so readers can review it in the previous publication.

SELL XAUUSD PRICE 3412 - 3410⚡️

↠↠ Stop Loss 3416

→Take Profit 1 3404

↨

→Take Profit 2 3398

BUY XAUUSD PRICE 3299 - 3301⚡️

↠↠ Stop Loss 3295

→Take Profit 1 3307

↨

→Take Profit 2 3313

DXY rebounded from its lowest level in more than a month hit earlier in the session on Tuesday and ended the day up 0.6%, which put some minor pressure on gold in yesterday's session. The U.S. Bureau of Labor Statistics' Employment and Labor Turnover Survey (JOLTS) released on Tuesday showed that total job vacancies in the United States reached 7.39 million in April, up from 7.2 million in March. Economists had expected job vacancies in the United States to be 7.1 million in April.

Looking ahead, U.S. employment data, including Friday’s May nonfarm payrolls report, could help guide the Federal Reserve’s monetary policy, Bloomberg said. Lower interest rates are generally good for non-interest-bearing gold.

Gold traders will be looking ahead to key employment data, including the ADP and nonfarm payrolls reports, to determine the Fed’s policy path.

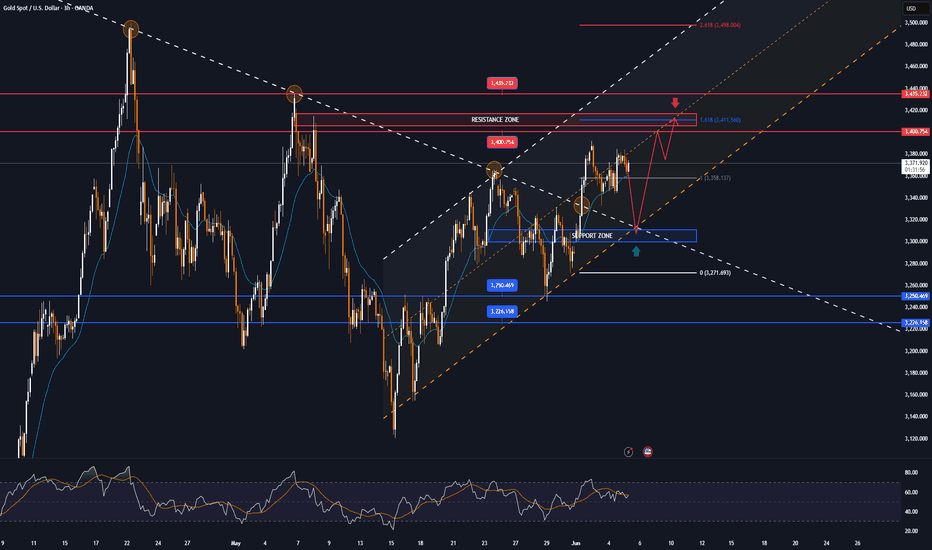

In terms of technical structure, there are no changes to the chart or previous analysis so readers can review it in the previous publication.

SELL XAUUSD PRICE 3412 - 3410⚡️

↠↠ Stop Loss 3416

→Take Profit 1 3404

↨

→Take Profit 2 3398

BUY XAUUSD PRICE 3299 - 3301⚡️

↠↠ Stop Loss 3295

→Take Profit 1 3307

↨

→Take Profit 2 3313

Note

GOLD is reacting negatively to the situation after a positive phone call from TRUMP and XI JINPINGNote

Gold prices fell slightly on June 6 after hitting $3,403 an ounce as signs of cooling from the phone call between Trump and Xi Jinping reduced demand for safe havens.Note

🔴Spot gold prices fell below $3,300/ounce, down 0.35% on the day.Note

▫️Spot gold price reached 3330 USD/ounce, up 0.22% on the day.Note

On June 12, spot gold prices in Asia rose to a weekly high of $3,373.25 an ounce. The increase was supported by lower-than-expected US CPI data in May.Note

Next week is shaping up to be a rollercoaster for markets, with interest rate announcements from central banks, monetary policy updates, and a slew of central bank governors speaking throughout the week.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.