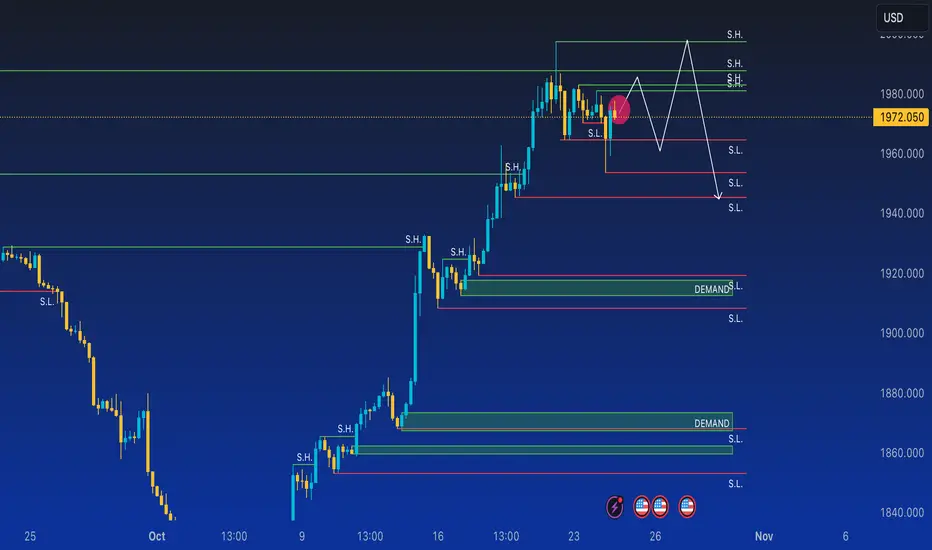

The recent price trend of gold has seen significant volatility. After an initial drop below $1,961 during the American session, gold managed to climb back to around $1,972 per troy ounce, thanks to the retracement of the yield of the ten-year US government bond, previously pushed higher by positive economic data. From a technical perspective, the daily chart suggests a possible exhaustion of the uptrend, with lower lows and highs, but with technical indicators remaining in overbought territory, indicating a potential short-term rally. This picture is confirmed by the 4-hour chart, where technical indicators are showing a positive trend, despite the Momentum being just below the 100 reference point. Key levels to watch are $1,965 and $1,954 as support, and $1,983 and $1,995 as resistance. Renewed demand for the US dollar has influenced the price of gold, bringing it to an intraday low of $1,953.53 during London trading. Geopolitical context, such as the delay of the Israeli incursion into Gaza, has created an optimistic atmosphere in the financial markets, although the prospects for a diplomatic solution remain uncertain. From a broader perspective, the US dollar has gained strength due to positive economic data, with economic activity expanding in October exceeding expectations, including a manufacturing PMI at 50 and a services index at 50.9. During the American session, government bond yields remained stable, allowing XAU/USD to mitigate intraday losses. The price is currently at the 1972 level, and I expect an upward movement followed by a descent and then another rise. This is because I see market conditions of uncertainty, with particularly tricky geopolitical factors, so I prefer to be cautious and will enter the market if it follows my prediction, at which point, I will consider a position at the M15 level. Until then, I will simply observe. Please leave a like and a comment. Have a great day from Nicola, the CEO of Forex48 Trading Academy.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.