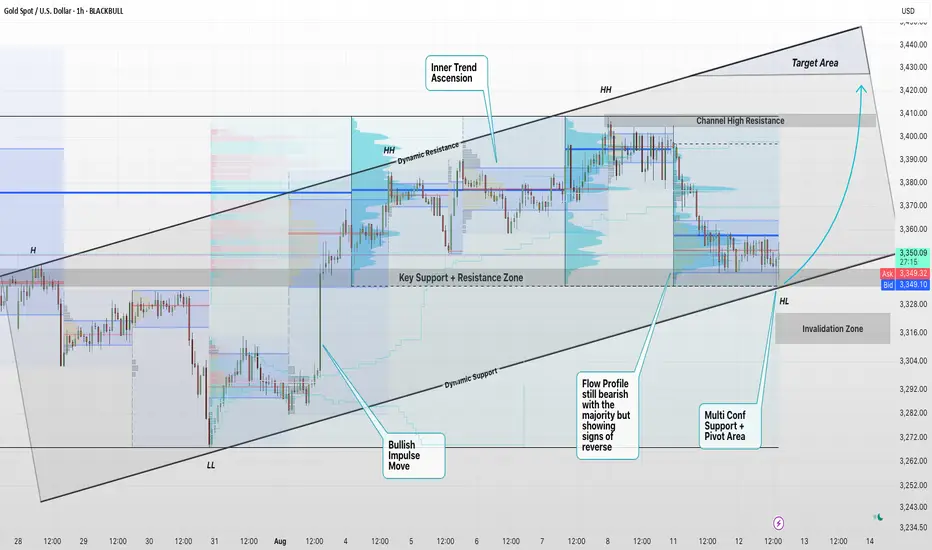

Gold (XAU/USD) – 1H Technical Outlook

Price action on the hourly chart is developing within a well-defined ascending channel, supported by dynamic trendlines that have consistently provided higher highs (HH) and higher lows (HL), confirming the underlying bullish structure.

The Key Support and Resistance Zone around 3,330–3,350 USD has proven to be a pivotal area, acting as both a consolidation base and a springboard for bullish impulses. The most recent Multi-Confluence Support and Pivot Area aligns with dynamic channel support, reinforcing its technical significance.

Volume Profile (Flow Profile) data remains overall bearish, indicating that a majority of trading activity has occurred at lower levels. However, the profile is beginning to exhibit early signs of accumulation, which often precedes directional reversals in market sentiment.

From a structural perspective, maintaining price action above the 3,328–3,350 USD support range would sustain the bullish bias, with upside potential toward Channel High Resistance near 3,400 USD, and an extended target into the Target Area around 3,420 USD.

Conversely, a decisive break below the Invalidation Zone (~3,310 USD) would undermine the bullish channel structure, increasing the probability of a deeper retracement.

Outlook:

Bias: Bullish continuation, contingent on support holding.

Key Support: 3,328–3,350 USD

Immediate Resistance: ~3,400 USD

Primary Target: ~3,420 USD

Invalidation Level: ~3,310 USD

This setup suggests that, while buyers retain structural control, confirmation from price action and volume behavior will be critical in validating the next bullish leg.

Price action on the hourly chart is developing within a well-defined ascending channel, supported by dynamic trendlines that have consistently provided higher highs (HH) and higher lows (HL), confirming the underlying bullish structure.

The Key Support and Resistance Zone around 3,330–3,350 USD has proven to be a pivotal area, acting as both a consolidation base and a springboard for bullish impulses. The most recent Multi-Confluence Support and Pivot Area aligns with dynamic channel support, reinforcing its technical significance.

Volume Profile (Flow Profile) data remains overall bearish, indicating that a majority of trading activity has occurred at lower levels. However, the profile is beginning to exhibit early signs of accumulation, which often precedes directional reversals in market sentiment.

From a structural perspective, maintaining price action above the 3,328–3,350 USD support range would sustain the bullish bias, with upside potential toward Channel High Resistance near 3,400 USD, and an extended target into the Target Area around 3,420 USD.

Conversely, a decisive break below the Invalidation Zone (~3,310 USD) would undermine the bullish channel structure, increasing the probability of a deeper retracement.

Outlook:

Bias: Bullish continuation, contingent on support holding.

Key Support: 3,328–3,350 USD

Immediate Resistance: ~3,400 USD

Primary Target: ~3,420 USD

Invalidation Level: ~3,310 USD

This setup suggests that, while buyers retain structural control, confirmation from price action and volume behavior will be critical in validating the next bullish leg.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.