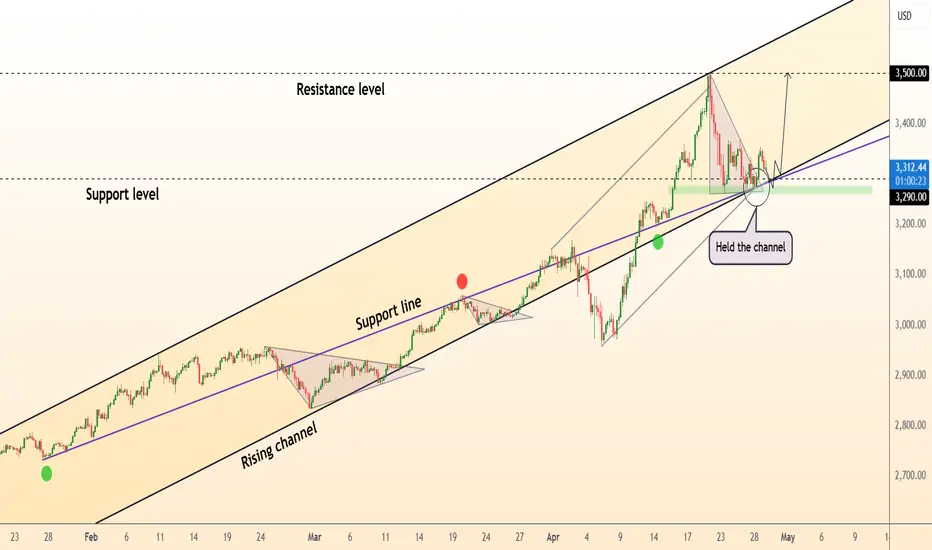

📊 Technical Analysis

● Gold is basing at $3 290; defending this demand band keeps $3 500 – 3 520 viable.

💡 Fundamental Analysis

● Goldman raised its year-end target to $3 700 on robust demand.

✨ Summary

Fundamentals are in line with chart support, favoring a bounce towards $3 500 - $3 520 while maintaining $3 290.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

● Gold is basing at $3 290; defending this demand band keeps $3 500 – 3 520 viable.

💡 Fundamental Analysis

● Goldman raised its year-end target to $3 700 on robust demand.

✨ Summary

Fundamentals are in line with chart support, favoring a bounce towards $3 500 - $3 520 while maintaining $3 290.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Trade active

📊 Technical Analysis

● ~$3,290 support holds; bullish momentum suggests dips are bought.

● Clearing ~$3,330–3,350 resistance would target $3,500.

💡 Fundamental Analysis

● Inflation/Fed: 1-yr US inflation expectations ~3.6% (NY Fed); Fed minutes flag upside inflation risk.

● Demand: record ETF inflows (226t Q1) and heavy China ETF flows (29.1t), with trade-war jitters boosting safe-haven demand.

✨ Summary

XAU/USD in rising channel; support ~$3,290, target ~$3,500.

Drivers: high inflation expectations, Fed caution, robust ETF/central-bank demand.

Watch Fed data (PCE, jobs) and channel support for breakout opportunity.

90% accuracy in telegram

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

90% accuracy in telegram

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.